Question

7. You are working in the treasury department of a bank. Turkish Treasury announced that it would issue discounted bond. Nominal value is 100

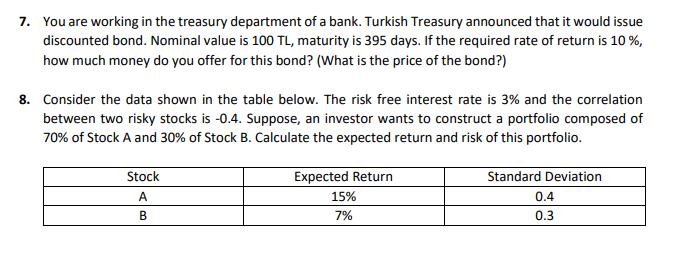

7. You are working in the treasury department of a bank. Turkish Treasury announced that it would issue discounted bond. Nominal value is 100 TL, maturity is 395 days. If the required rate of return is 10%, how much money do you offer for this bond? (What is the price of the bond?) 8. Consider the data shown in the table below. The risk free interest rate is 3% and the correlation between two risky stocks is -0.4. Suppose, an investor wants to construct a portfolio composed of 70% of Stock A and 30% of Stock B. Calculate the expected return and risk of this portfolio. Stock A B Expected Return 15% 7% Standard Deviation 0.4 0.3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

7 To calculate the price of the bond we need to discount the future cash flows the nominal value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Business Ethics

Authors: Peter A. Stanwick, Sarah D. Stanwick

3rd Edition

1506303234, 9781506303239

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App