Question

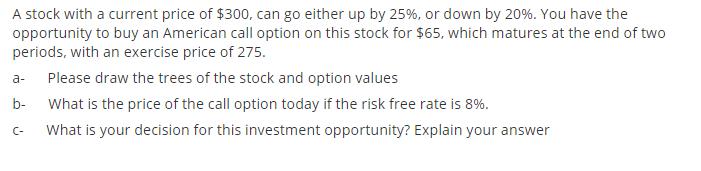

A stock with a current price of $300, can go either up by 25%, or down by 20%. You have the opportunity to buy

A stock with a current price of $300, can go either up by 25%, or down by 20%. You have the opportunity to buy an American call option on this stock for $65, which matures at the end of two periods, with an exercise price of 275. Please draw the trees of the stock and option values What is the price of the call option today if the risk free rate is 8%. What is your decision for this investment opportunity? Explain your answer a- b- C-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Here is the tree diagram representing the stock and option values S 300 S 375 S 240 S 468 S 300 S 288 S 192 C 65 C C C C C C b To calculate the pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

6th edition

1305637100, 978-1305637108

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App