Question

7. You have the following information about two stocks: . Expected return Standard deviation Jon, Inc. 12.7% Daenerys, Ltd. 17.4% 9% 12% Beta 1.2

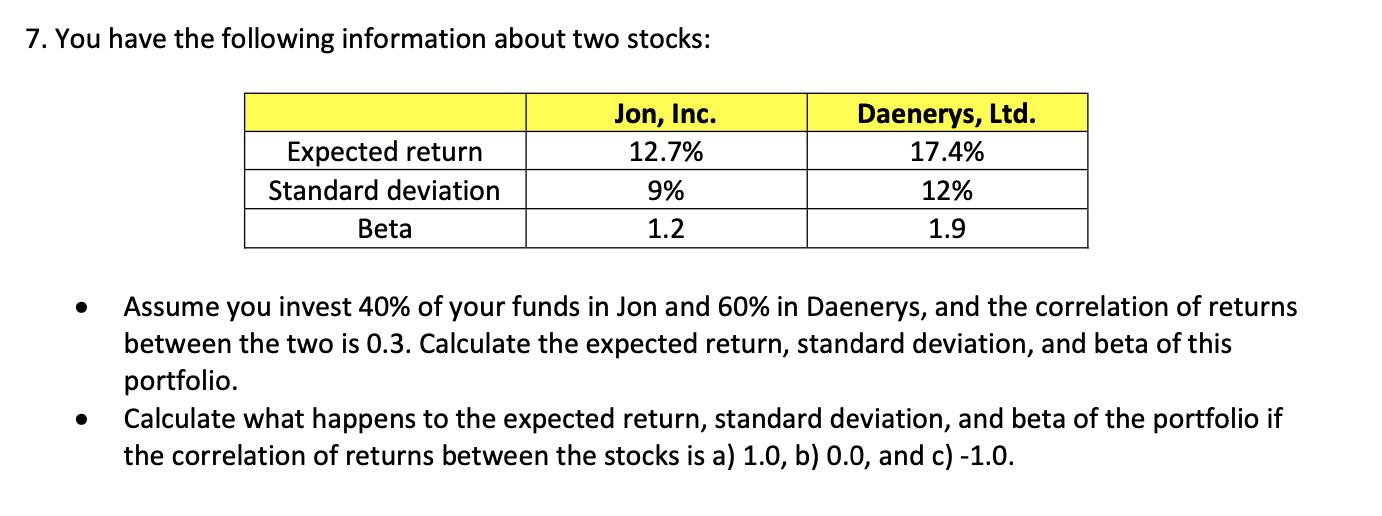

7. You have the following information about two stocks: . Expected return Standard deviation Jon, Inc. 12.7% Daenerys, Ltd. 17.4% 9% 12% Beta 1.2 1.9 Assume you invest 40% of your funds in Jon and 60% in Daenerys, and the correlation of returns between the two is 0.3. Calculate the expected return, standard deviation, and beta of this portfolio. Calculate what happens to the expected return, standard deviation, and beta of the portfolio if the correlation of returns between the stocks is a) 1.0, b) 0.0, and c) -1.0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected return standard deviation and beta of the portfolio we can use the followi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial management theory and practice

Authors: Eugene F. Brigham and Michael C. Ehrhardt

13th edition

1439078106, 111197375X, 9781439078105, 9781111973759, 978-1439078099

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App