Answered step by step

Verified Expert Solution

Question

1 Approved Answer

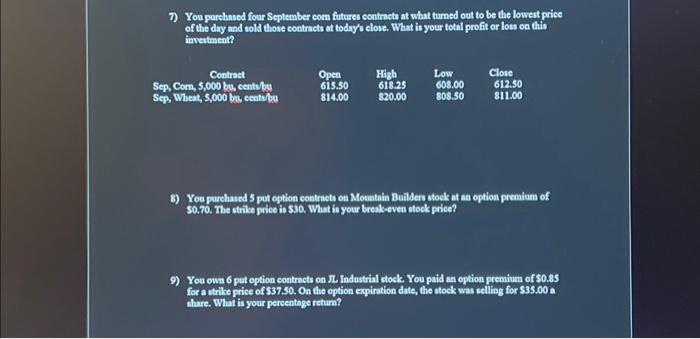

7) You purchased four September corn futures contracts at what turned out to be the lowest price of the day and sold those contracts at

7) You purchased four September corn futures contracts at what turned out to be the lowest price of the day and sold those contracts at today's close. What is your total profit or loss on this investment? Contract Sep, Corn, 5,000 bu, cents/bu Sep, Wheat, 5,000 bu, cents/bu Open 615.50 814.00 High 618.25 820.00 Low 608.00 808.50 Close 612.50 811.00 8) You purchased 5 put option contracts on Mountain Builders stock at an option premium of $0.70. The strike price is $30. What is your break-even stock price? 9) You own 6 put option contracts on JL Industrial stock. You paid an option premium of $0.85 for a strike price of $37.50. On the option expiration date, the stock was selling for $35.00 a share. What is your percentage return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started