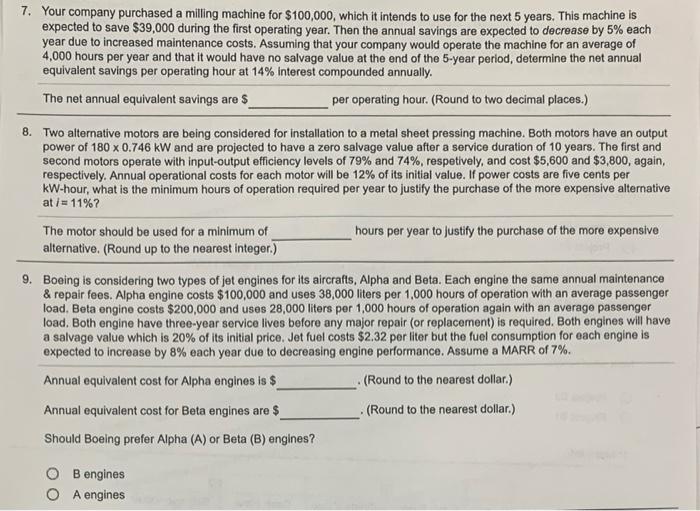

7. Your company purchased a milling machine for $100,000, which it intends to use for the next 5 years. This machine is expected to save $39,000 during the first operating year. Then the annual savings are expected to decrease by 5% each year due to increased maintenance costs. Assuming that your company would operate the machine for an average of 4,000 hours per year and that it would have no salvage value at the end of the 5-year period, determine the net annual equivalent savings per operating hour at 14% interest compounded annually. The net annual equivalent savings are $ per operating hour. (Round to two decimal places.) 8. Two alternative motors are being considered for installation to a metal sheet pressing machine. Both motors have an output power of 180 x 0.746 kW and are projected to have a zero salvage value after a service duration of 10 years. The first and second motors operate with input-output efficiency levels of 79% and 74%, respetively, and cost $5,600 and $3,800, again, respectively. Annual operational costs for each motor will be 12% of its initial value. If power costs are five cents per kW-hour, what is the minimum hours of operation required per year to justify the purchase of the more expensive alternative at / -11%? The motor should be used for a minimum of hours per year to justify the purchase of the more expensive alternative. (Round up to the nearest Integer.) 9. Boeing is considering two types of jet engines for its aircrafts, Alpha and Beta. Each engine the same annual maintenance & repair fees. Alpha engine costs $100,000 and uses 38,000 liters per 1.000 hours of operation with an average passenger load. Beta engine costs $200,000 and uses 28,000 liters per 1,000 hours of operation again with an average passenger load. Both engine have three-year service lives before any major repair (or replacement) is required. Both engines will have a salvage value which is 20% of its initial price. Jet fuel costs $2.32 per liter but the fuel consumption for each engine is expected to increase by 8% each year due to decreasing engine performance. Assume a MARR of 7%. Annual equivalent cost for Alpha engines is $ (Round to the nearest dollar.) Annual equivalent cost for Beta engines are $ (Round to the nearest dollar.) Should Boeing prefer Alpha (A) or Beta (B) engines? O B engines O A engines