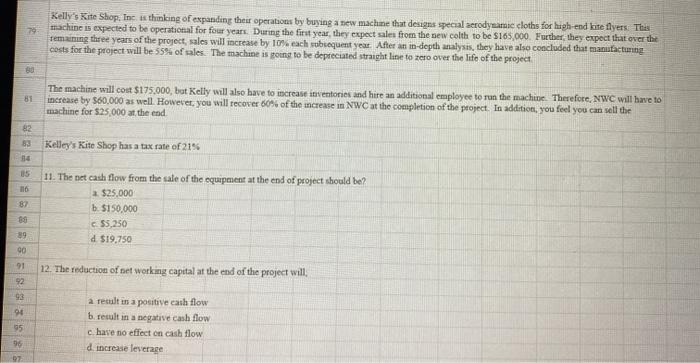

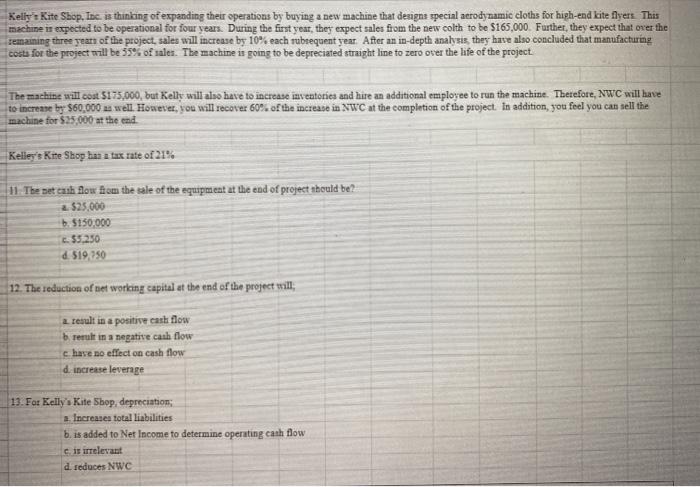

70 Kelly's Kite Shop, Inc. is thinking of expanding their operations by buying a new machine that designs special aerodyname cloths for high-end kite flyers. This machine is expected to be operational for four years. During the first year, they expect sales from the new colth to be $165.000. Further, they expect that over the remaining three years of the project, sales will increase by 10% each absequent year. After an in-depth analysis, they have also concluded that manufacturing costs for the project will be 55% of tales. The machine is poing to be deprecated straight line to zero over the life of the project B0 81 The machine will cost $175.000, but Kelly will also have to increase inventories and hire an additional employee to run the machine. Therefore, NWC will have to increase by $60,000 as well. However, you will recover 60% of the increase in NWC at the completion of the project. In addition, you feel you can sell the machine for $25,000 at the end 82 Kelley's Kite Shop has a tax rate of 21% 116 87 63 89 90 11. The net cash flow from the sale of the equipment at the end of project should be? a $25.000 b. $150,000 c55.250 d $19.750 91 92 12. The reduction of net working capital at the end of the project will 93 90 a retult in a positive cash flow b. result in a negative cash flow c. have no effect on cash flow d increase leverage 95 96 Kelly : Kite Shop, Inc. is thinking of expanding the operations by buying a new machine that designs special aerodynamic cloths for high-end kite flyer This machine is expected to be operational for four years. During the first year, the expect sales from the new colth to be $165,000. Further, they expect that over the remaining three years of the project, sales will increase by 10% each subsequent year. After an in-depth analysis they have also concluded that manufacturing costs for the project will be 55% of sales. The machine is going to be depreciated straight line to zero over the life of the project The machine will cost $175,000, but Kelly will also have to increase inventories and hire an additional employee to run the machine. Therefore, NWC will have to increase by $60.000 well. However, you will recover 60% of the increase in NWC at the completion of the project. In addition, you feel you can sell the machine for $25,000 at the end Kelley's Kite Shop has a tax rate of 21% 11 The set cash flow hom the sale of the equipment at the end of project should be? 2 $25.000 b. $150,000 33.250 d. 519.750 12. The reduction of net working capital at the end of the project will a result in a positive cash flow b Terult in a negative cash flow chave no effect on cash flow d increase leverage 13. Fa: Kelly's Kite Shop, depreciation 2. Increases total liabilities b. is added to Net Income to determine operating cash flow is irrelevant d. seduces NWC