Answered step by step

Verified Expert Solution

Question

1 Approved Answer

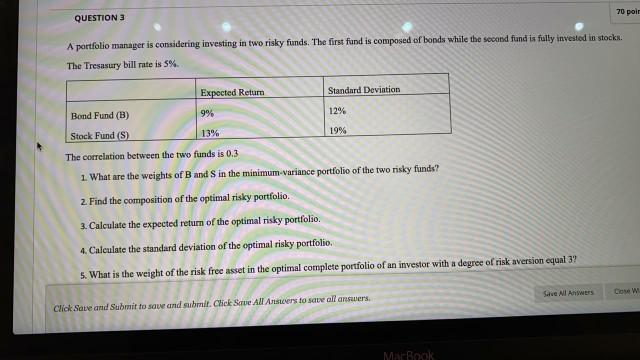

70 poir QUESTION 3 A portfolio manager is considering investing in two risky funds. The first fund is composed of bonds while the second fund

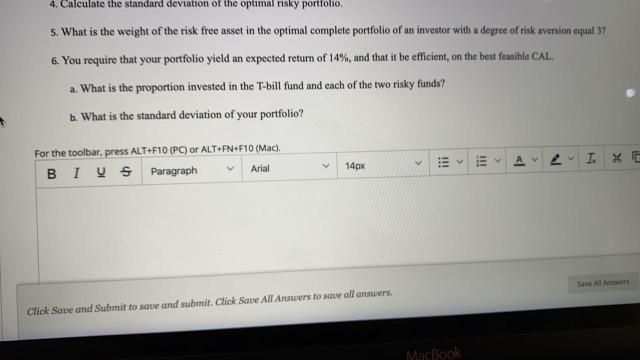

70 poir QUESTION 3 A portfolio manager is considering investing in two risky funds. The first fund is composed of bonds while the second fund is fully invested in stocks The Tresasury bill rate is 5% Expected Return Standard Deviation 9% 12% Bond Fund (B) 13% 19% Stock Fund (S) The correlation between the two funds is 0.3 1. What are the weights of B and in the minimum variance portfolio of the two risky funds? 2. Find the composition of the optimal risky portfolio 3. Calculate the expected return of the optimal risky portfolio 4. Calculate the standard deviation of the optimal risky portfolio 5. What is the weight of the risk free asset in the optimal complete portfolio of an investor with a degree of risk aversion equal 3? Save Nl Answers Close Click Save and Submit to save and submit Choke Se All Alsters to save all answers MACBOOK 4. Calculate the standard deviation of the optimal risky portfolio. 5. What is the weight of the risk free asset in the optimal complete portfolio of an investor with a degree of risk version equal 3 6. You require that your portfolio yield an expected return of 14%, and that it be efficient, on the best feasible CAL. a. What is the proportion invested in the T-bill fund and each of the two risky funds? b. What is the standard deviation of your portfolio? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI y $ Paragraph Arial 14px 11! !!! 1 All Am Click Save and Submit to save and submit. Click Save All Answers to see all answers, MacBook

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started