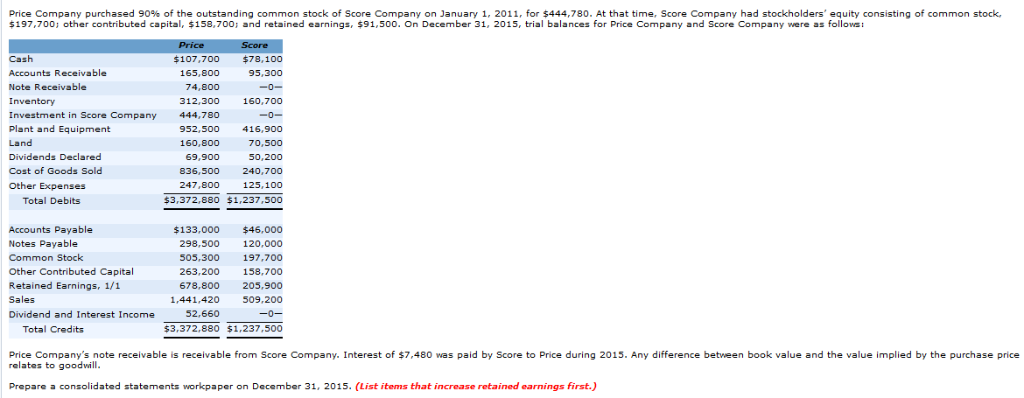

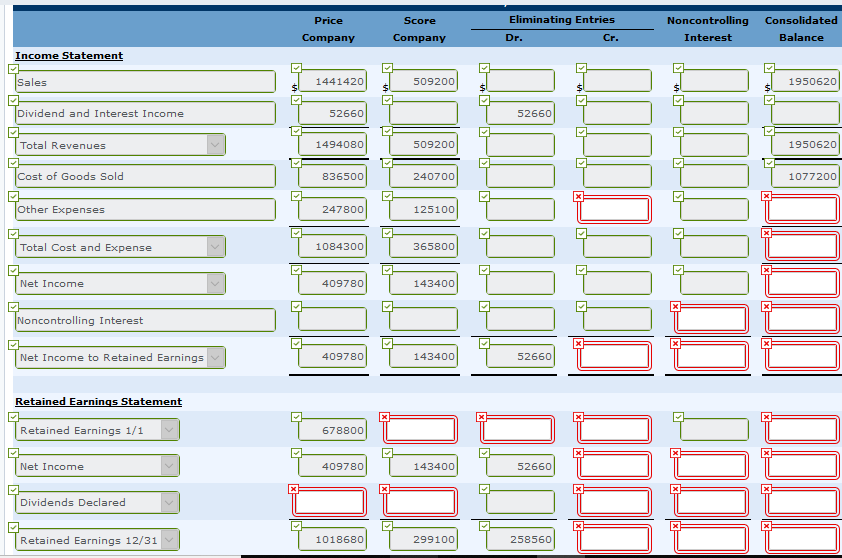

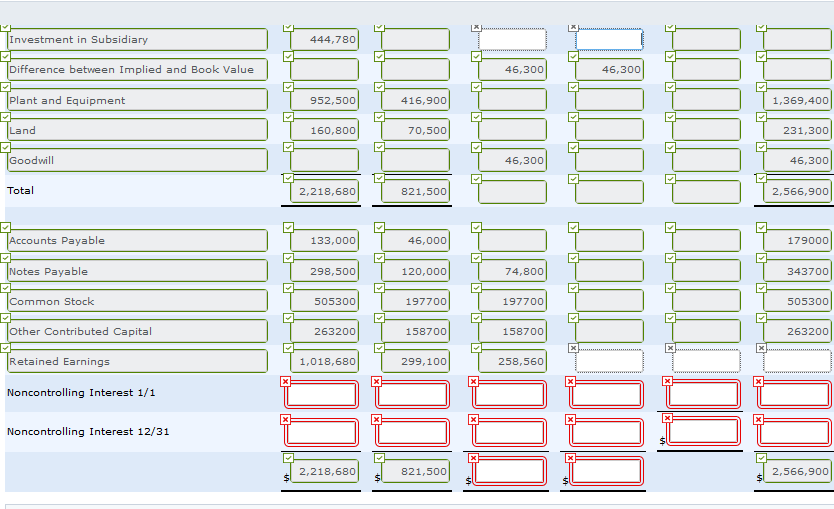

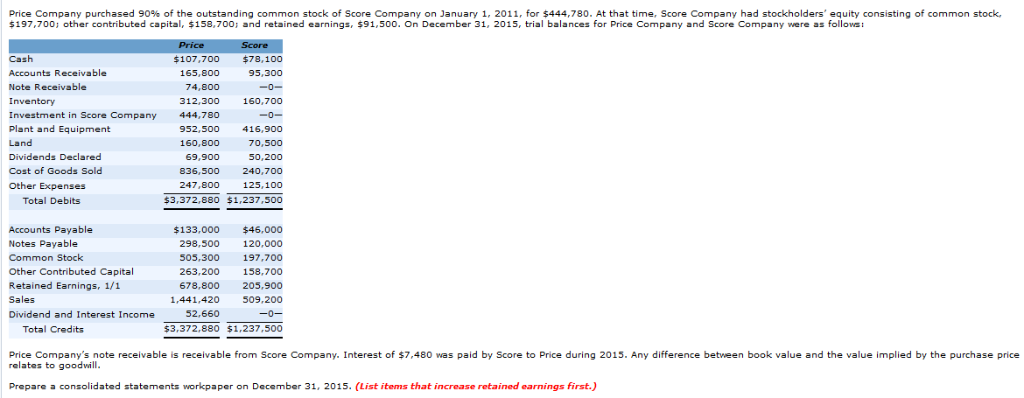

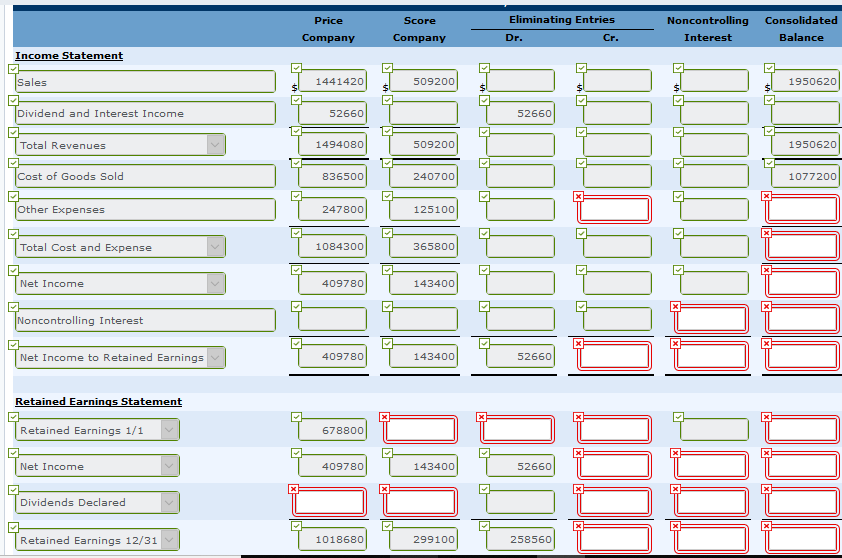

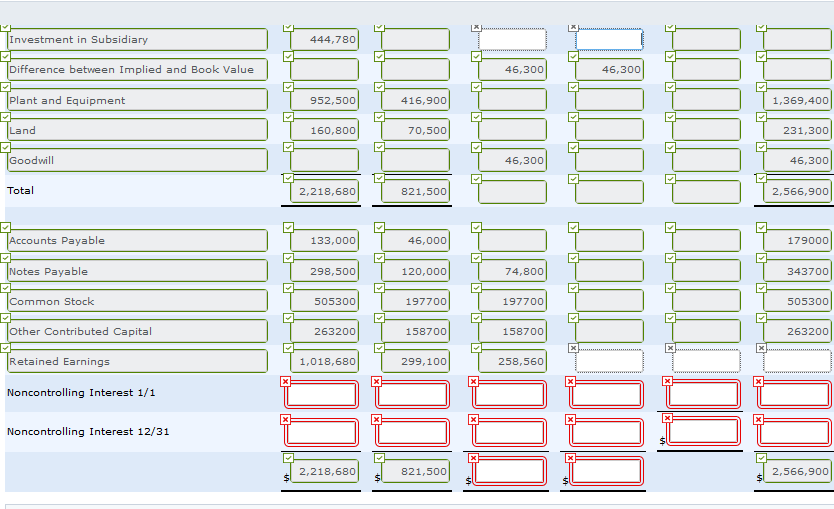

700 other contributed capital, $158.700: and retained a 50o, On December 21 2015, trial balances for Price Compuy and Scoe Cos follove iting of common stock. Price Score Cash $107,700 nts Receivable Note Receivable 74,800 -0- Inventory 312,300 160,700 Investment in Score Company 444.780 -0- Plant and Equipment 952.500 416.900 Land 160.800 70,500 Dividends Declared 69,900 50,200 Cost of Goods Sold Oth 47 800 3.372.880 $1.237.50 Total Debits Accounts Payable $133,000 $46,000 Notes Pavable 298,500 120,000 Common Stock 505.300 197.700 Other Contributed Capital 263,200 158,700 Retained Earnings, 1/1 678.800 205,900 Sales 1.441.420 509,200 Dividend and Interest Income 52.660 -0- $3,372,880 $1,237,500 Total Credits Score to Price during 2015. Any difference between book value and the value implied by the purchase price Price Company's note receivable is receivable from Score Company. Interest of $7,480 was paid relates to qoodwill. Prepare a consolidated state ments workpaper on December 31, 2015. (List items that increase retained earnings first.) Eliminating Entries Noncontrolling Consolidated Price Score Balance Company Company Dr. Cr. Interest Income Statement 509200 1441420 Sales 1950620 Dividend and Interest Income 52660 52660 509200 Total Revenues 1494080 1950620 Cost of Goods Sold 836500 240700 1077200 247800 Other Expenses 125100 Total Cost and Expense 1084300 365800 409780 143400 Net Income Noncontrolling Interest Net Income to Retained Earnings 409780 52660 143400 Retained Earnings Statement Retained Earnings 1/1 678800 409780 143400 52660 Net Income Dividends Declared 299100 258560 Retained Earnings 12/31 1018680 | Investment in Subsidiary 444,780 Difference between Implied and Book Value 46,300 46,300 Plant and Equipment 1,369,400 952,500 416,900 Land 160,800 70,500 231,300 Goodwill 46,300 46,300 Total 2,218,680 821,500 2,566,900 Accounts Payable 133,000 46,000 179000 Notes Payable 298,500 120,000 74,800 343700 Common Stock 505300 197700 197700 505300 Other Contributed Capital 158700 263200 158700 263200 Retained Earnings 1,018,680 299,100 258,560 Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 2,218,680 821,500 2,566,900 xB 700 other contributed capital, $158.700: and retained a 50o, On December 21 2015, trial balances for Price Compuy and Scoe Cos follove iting of common stock. Price Score Cash $107,700 nts Receivable Note Receivable 74,800 -0- Inventory 312,300 160,700 Investment in Score Company 444.780 -0- Plant and Equipment 952.500 416.900 Land 160.800 70,500 Dividends Declared 69,900 50,200 Cost of Goods Sold Oth 47 800 3.372.880 $1.237.50 Total Debits Accounts Payable $133,000 $46,000 Notes Pavable 298,500 120,000 Common Stock 505.300 197.700 Other Contributed Capital 263,200 158,700 Retained Earnings, 1/1 678.800 205,900 Sales 1.441.420 509,200 Dividend and Interest Income 52.660 -0- $3,372,880 $1,237,500 Total Credits Score to Price during 2015. Any difference between book value and the value implied by the purchase price Price Company's note receivable is receivable from Score Company. Interest of $7,480 was paid relates to qoodwill. Prepare a consolidated state ments workpaper on December 31, 2015. (List items that increase retained earnings first.) Eliminating Entries Noncontrolling Consolidated Price Score Balance Company Company Dr. Cr. Interest Income Statement 509200 1441420 Sales 1950620 Dividend and Interest Income 52660 52660 509200 Total Revenues 1494080 1950620 Cost of Goods Sold 836500 240700 1077200 247800 Other Expenses 125100 Total Cost and Expense 1084300 365800 409780 143400 Net Income Noncontrolling Interest Net Income to Retained Earnings 409780 52660 143400 Retained Earnings Statement Retained Earnings 1/1 678800 409780 143400 52660 Net Income Dividends Declared 299100 258560 Retained Earnings 12/31 1018680 | Investment in Subsidiary 444,780 Difference between Implied and Book Value 46,300 46,300 Plant and Equipment 1,369,400 952,500 416,900 Land 160,800 70,500 231,300 Goodwill 46,300 46,300 Total 2,218,680 821,500 2,566,900 Accounts Payable 133,000 46,000 179000 Notes Payable 298,500 120,000 74,800 343700 Common Stock 505300 197700 197700 505300 Other Contributed Capital 158700 263200 158700 263200 Retained Earnings 1,018,680 299,100 258,560 Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 2,218,680 821,500 2,566,900 xB