Answered step by step

Verified Expert Solution

Question

1 Approved Answer

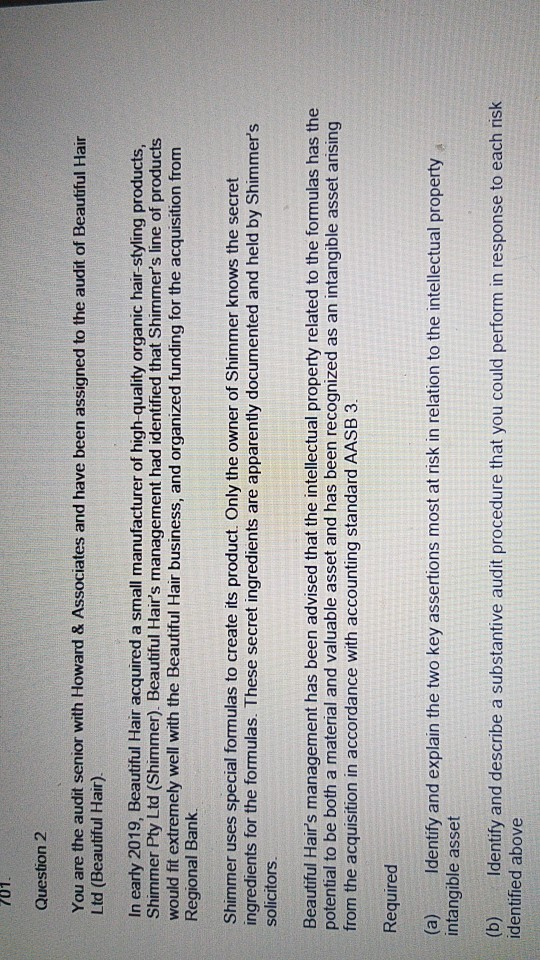

701. Question 2 You are the audit senior with Howard & Associates and have been assigned to the audit of Beautiful Hair Ltd (Beautiful Hair).

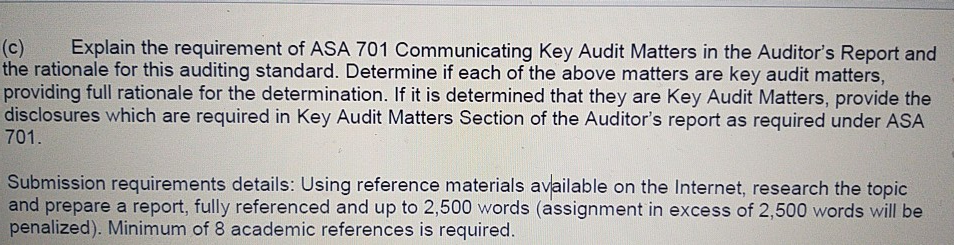

701. Question 2 You are the audit senior with Howard & Associates and have been assigned to the audit of Beautiful Hair Ltd (Beautiful Hair). In early 2019, Beautiful Hair acquired a small manufacturer of high-quality organic hair-styling products, Shimmer Pty Ltd (Shimmer). Beautiful Hair's management had identified that Shimmer's line of products would fit extremely well with the Beautiful Hair business, and organized funding for the acquisition from Regional Bank Shimmer uses special formulas to create its product. Only the owner of Shimmer knows the secret ingredients for the formulas. These secret ingredients are apparently documented and held by Shimmer's solicitors. Beautiful Hair's management has been advised that the intellectual property related to the formulas has the potential to be both a material and valuable asset and has been recognized as an intangible asset arising from the acquisition in accordance with accounting standard AASB 3. Required (a) Identify and explain the two key assertions most at risk in relation to the intellectual property intangible asset (b) Identify and describe a substantive audit procedure that you could perform in response to each risk identified above (c) Explain the requirement of ASA 701 Communicating Key Audit Matters in the Auditor's Report and the rationale for this auditing standard. Determine if each of the above matters are key audit matters, providing full rationale for the determination. If it is determined that they are key Audit Matters, provide the disclosures which are required in Key Audit Matters Section of the Auditor's report as required under ASA 701. Submission requirements details: Using reference materials available on the Internet, research the topic and prepare a report, fully referenced and up to 2,500 words (assignment in excess of 2,500 words will be penalized). Minimum of 8 academic references is required. 701. Question 2 You are the audit senior with Howard & Associates and have been assigned to the audit of Beautiful Hair Ltd (Beautiful Hair). In early 2019, Beautiful Hair acquired a small manufacturer of high-quality organic hair-styling products, Shimmer Pty Ltd (Shimmer). Beautiful Hair's management had identified that Shimmer's line of products would fit extremely well with the Beautiful Hair business, and organized funding for the acquisition from Regional Bank Shimmer uses special formulas to create its product. Only the owner of Shimmer knows the secret ingredients for the formulas. These secret ingredients are apparently documented and held by Shimmer's solicitors. Beautiful Hair's management has been advised that the intellectual property related to the formulas has the potential to be both a material and valuable asset and has been recognized as an intangible asset arising from the acquisition in accordance with accounting standard AASB 3. Required (a) Identify and explain the two key assertions most at risk in relation to the intellectual property intangible asset (b) Identify and describe a substantive audit procedure that you could perform in response to each risk identified above (c) Explain the requirement of ASA 701 Communicating Key Audit Matters in the Auditor's Report and the rationale for this auditing standard. Determine if each of the above matters are key audit matters, providing full rationale for the determination. If it is determined that they are key Audit Matters, provide the disclosures which are required in Key Audit Matters Section of the Auditor's report as required under ASA 701. Submission requirements details: Using reference materials available on the Internet, research the topic and prepare a report, fully referenced and up to 2,500 words (assignment in excess of 2,500 words will be penalized). Minimum of 8 academic references is required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started