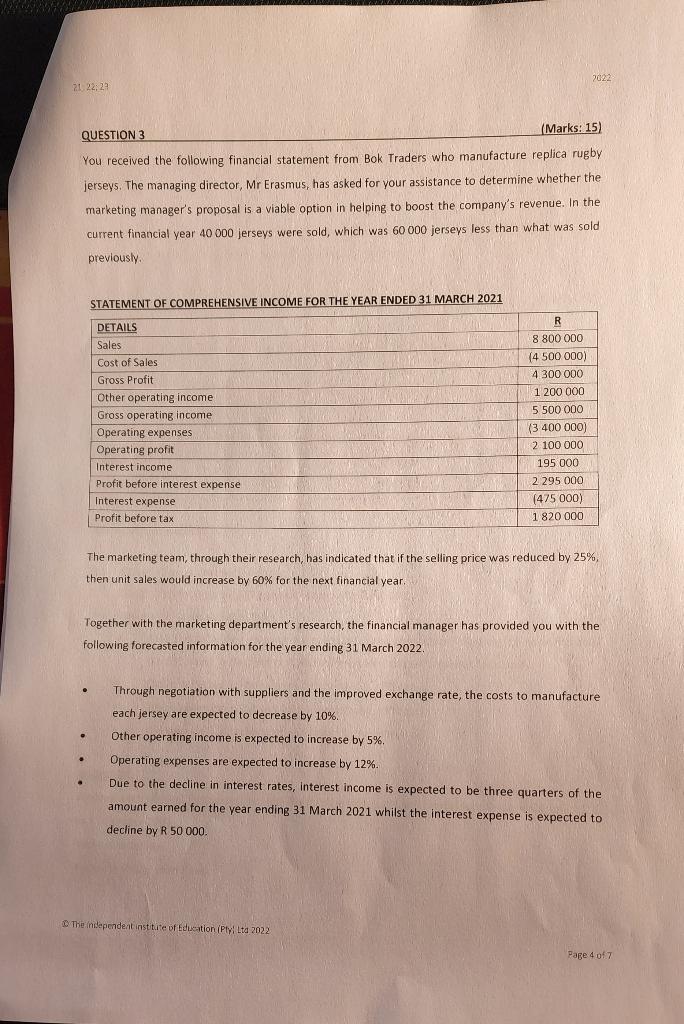

7022 21. 22:22 QUESTION 3 (Marks: 15) You received the following financial statement from Bok Traders who manufacture replica rugby jerseys. The managing director, Mr Erasmus, has asked for your assistance to determine whether the marketing manager's proposal is a viable option in helping to boost the company's revenue. In the current financial year 40 000 jerseys were sold, which was 60 000 jerseys less than what was sold previously STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 MARCH 2021 DETAILS Sales Cost of Sales Gross Profit Other operating income Gross operating income Operating expenses Operating profit Interest income Profit before interest expense Interest expense Profit before tax R 8 800 000 (4 500 000) 4 300 000 1 200 000 5 500 000 (3 400 000) 2 100 000 195 000 2 295 000 1475 000) 1820 000 The marketing team, through their research has indicated that if the selling price was reduced by 25%, then unit sales would increase by 60% for the next financial year. Together with the marketing department's research, the financial manager has provided you with the following forecasted information for the year ending 31 March 2022 . Through negotiation with suppliers and the improved exchange rate, the costs to manufacture each jersey are expected to decrease by 10%. Other operating income is expected to increase by 5%. Operating expenses are expected to increase by 12%. Due to the decline in interest rates, interest income is expected to be three quarters of the amount earned for the year ending 31 March 2021 whilst the interest expense is expected to decline by R 50 000 The Independent institute of Education (Pty Lta 2022 Page 4 of 7 2022 21; 22; 23 Mr Erasmus has indicated that the proposal will only be implemented if the forecasted net profit before tax percentage exceeds the industry average of 15%. REQUIRED: Prepare a budgeted statement of comprehensive income using the information above to determine whether the marketing manager's proposal should be implemented. 7022 21. 22:22 QUESTION 3 (Marks: 15) You received the following financial statement from Bok Traders who manufacture replica rugby jerseys. The managing director, Mr Erasmus, has asked for your assistance to determine whether the marketing manager's proposal is a viable option in helping to boost the company's revenue. In the current financial year 40 000 jerseys were sold, which was 60 000 jerseys less than what was sold previously STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 MARCH 2021 DETAILS Sales Cost of Sales Gross Profit Other operating income Gross operating income Operating expenses Operating profit Interest income Profit before interest expense Interest expense Profit before tax R 8 800 000 (4 500 000) 4 300 000 1 200 000 5 500 000 (3 400 000) 2 100 000 195 000 2 295 000 1475 000) 1820 000 The marketing team, through their research has indicated that if the selling price was reduced by 25%, then unit sales would increase by 60% for the next financial year. Together with the marketing department's research, the financial manager has provided you with the following forecasted information for the year ending 31 March 2022 . Through negotiation with suppliers and the improved exchange rate, the costs to manufacture each jersey are expected to decrease by 10%. Other operating income is expected to increase by 5%. Operating expenses are expected to increase by 12%. Due to the decline in interest rates, interest income is expected to be three quarters of the amount earned for the year ending 31 March 2021 whilst the interest expense is expected to decline by R 50 000 The Independent institute of Education (Pty Lta 2022 Page 4 of 7 2022 21; 22; 23 Mr Erasmus has indicated that the proposal will only be implemented if the forecasted net profit before tax percentage exceeds the industry average of 15%. REQUIRED: Prepare a budgeted statement of comprehensive income using the information above to determine whether the marketing manager's proposal should be implemented