Answered step by step

Verified Expert Solution

Question

1 Approved Answer

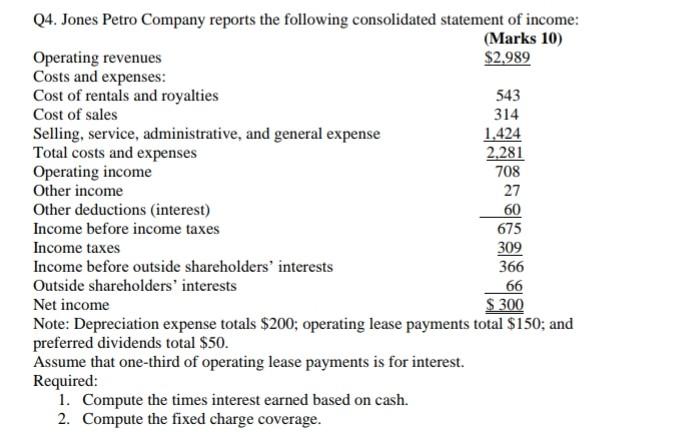

708 27 Q4. Jones Petro Company reports the following consolidated statement of income: (Marks 10) Operating revenues $2.989 Costs and expenses: Cost of rentals and

708 27 Q4. Jones Petro Company reports the following consolidated statement of income: (Marks 10) Operating revenues $2.989 Costs and expenses: Cost of rentals and royalties 543 Cost of sales 314 Selling, service, administrative, and general expense 1.424 Total costs and expenses 2.281 Operating income Other income Other deductions (interest) 60 Income before income taxes 675 Income taxes 309 Income before outside shareholders' interests 366 Outside shareholders' interests 66 Net income $ 300 Note: Depreciation expense totals $200; operating lease payments total $150; and preferred dividends total $50. Assume that one-third of operating lease payments is for interest. Required: 1. Compute the times interest earned based on cash. 2. Compute the fixed charge coverage. 708 27 Q4. Jones Petro Company reports the following consolidated statement of income: (Marks 10) Operating revenues $2.989 Costs and expenses: Cost of rentals and royalties 543 Cost of sales 314 Selling, service, administrative, and general expense 1.424 Total costs and expenses 2.281 Operating income Other income Other deductions (interest) 60 Income before income taxes 675 Income taxes 309 Income before outside shareholders' interests 366 Outside shareholders' interests 66 Net income $ 300 Note: Depreciation expense totals $200; operating lease payments total $150; and preferred dividends total $50. Assume that one-third of operating lease payments is for interest. Required: 1. Compute the times interest earned based on cash. 2. Compute the fixed charge coverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started