Answered step by step

Verified Expert Solution

Question

1 Approved Answer

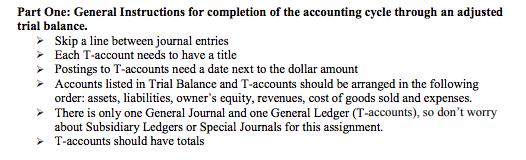

Part One: General Instructions for completion of the accounting cycle through an adjusted trial balance. Skip a line between journal entries > Each T-account

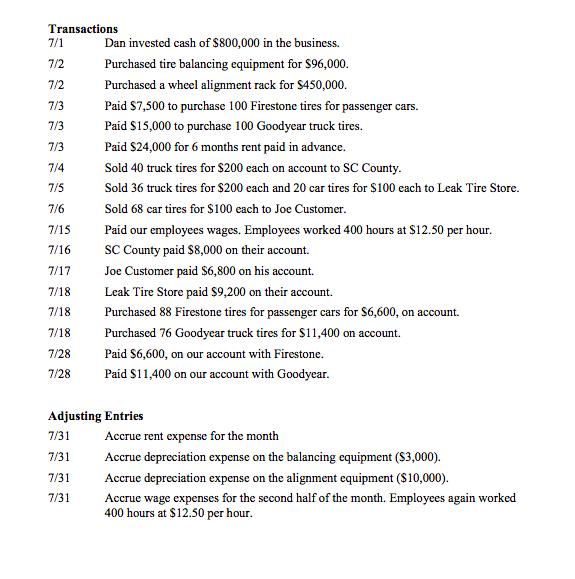

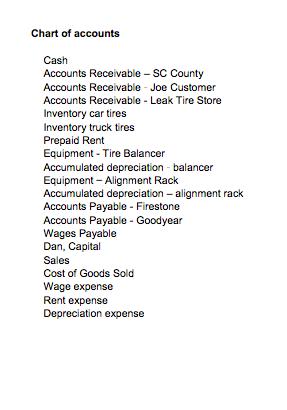

Part One: General Instructions for completion of the accounting cycle through an adjusted trial balance. Skip a line between journal entries > Each T-account needs to have a title Postings to T-accounts need a date next to the dollar amount > Accounts listed in Trial Balance and T-accounts should be arranged in the following order: assets, liabilities, owner's equity, revenues, cost of goods sold and expenses. - There is only one General Journal and one General Ledger (T-accounts), so don't worry about Subsidiary Ledgers or Special Journals for this assignment. > T-accounts should have totals Transactions 7/1 Dan invested cash of $800,000 in the business. 7/2 Purchased tire balancing equipment for $96,000. 7/2 Purchased a wheel alignment rack for $450,000. 7/3 Paid S7,500 to purchase 100 Firestone tires for passenger cars. 7/3 Paid S15,000 to purchase 100 Goodyear truck tires. 7/3 Paid S24,000 for 6 months rent paid in advance. Sold 40 truck tires for $200 each on account to SC County. 7/4 7/5 Sold 36 truck tires for $200 each and 20 car tires for $100 each to Leak Tire Store. 7/6 Sold 68 car tires for s100 each to Joe Customer. 7/15 Paid our employees wages. Employees worked 400 hours at $12.50 per hour. SC County paid $8,000 on their account. 7/16 7/17 Joe Customer paid S6,800 on his account. 7/18 Leak Tire Store paid $9,200 on their account. 7/18 Purchased 88 Firestone tires for passenger cars for $6,600, on account. 7/18 Purchased 76 Goodyear truck tires for $11,400 on account. 7/28 Paid S6,600, on our account with Firestone. 7/28 Paid S11,400 on our account with Goodyear. Adjusting Entries 7/31 Accrue rent expense for the month 7/31 Accrue depreciation expense on the balancing equipment ($3,000). 7/31 Accrue depreciation expense on the alignment equipment (S10,000). 7/31 Accrue wage expenses for the second half of the month. Employees again worked 400 hours at $12.50 per hour. Chart of accounts Cash Accounts Receivable SC County Accounts Receivable - Joe Customer Accounts Receivable - Leak Tire Store Inventory car tires Inventory truck tires Prepaid Rent Equipment - Tire Balancer Accumulated depreciation - balancer Equipment - Alignment Rack Accumulated depreciation alignment rack Accounts Payabie - Firestone Accounts Payable - Goodyear Wages Payable Dan, Capital Sales Cost of Goods Sold Wage expense Rent expense Depreciation expense

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting entries 31Jul Rent expense Prepaid Rent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started