Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record journal entries for transactions 1-9. (Credit account titles are automatically indented when amount is entered.n Bramble Corp. prepares quarterly financial statements. The post-closing trial

Record journal entries for transactions 1-9. (Credit account titles are automatically indented when amount is entered.n

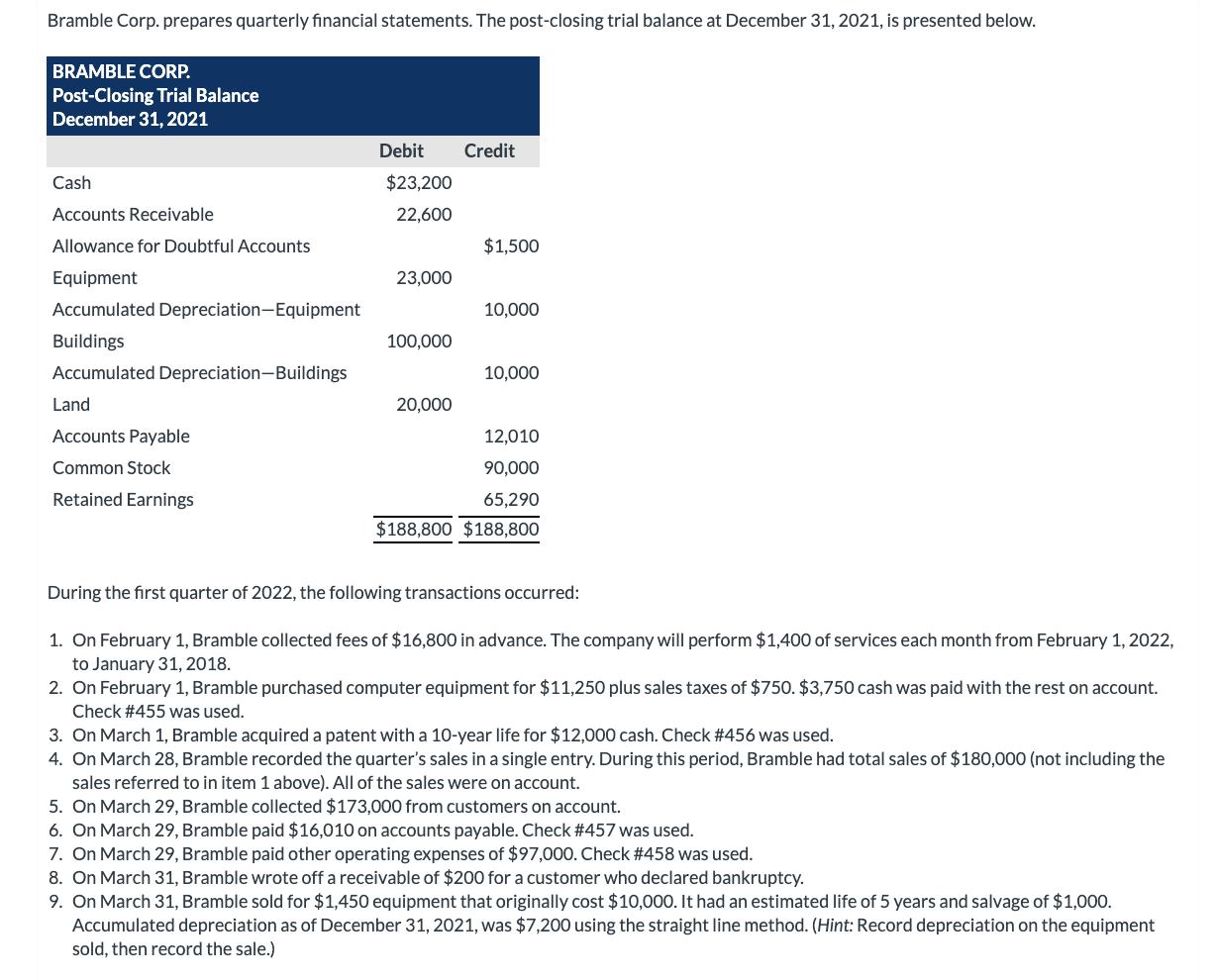

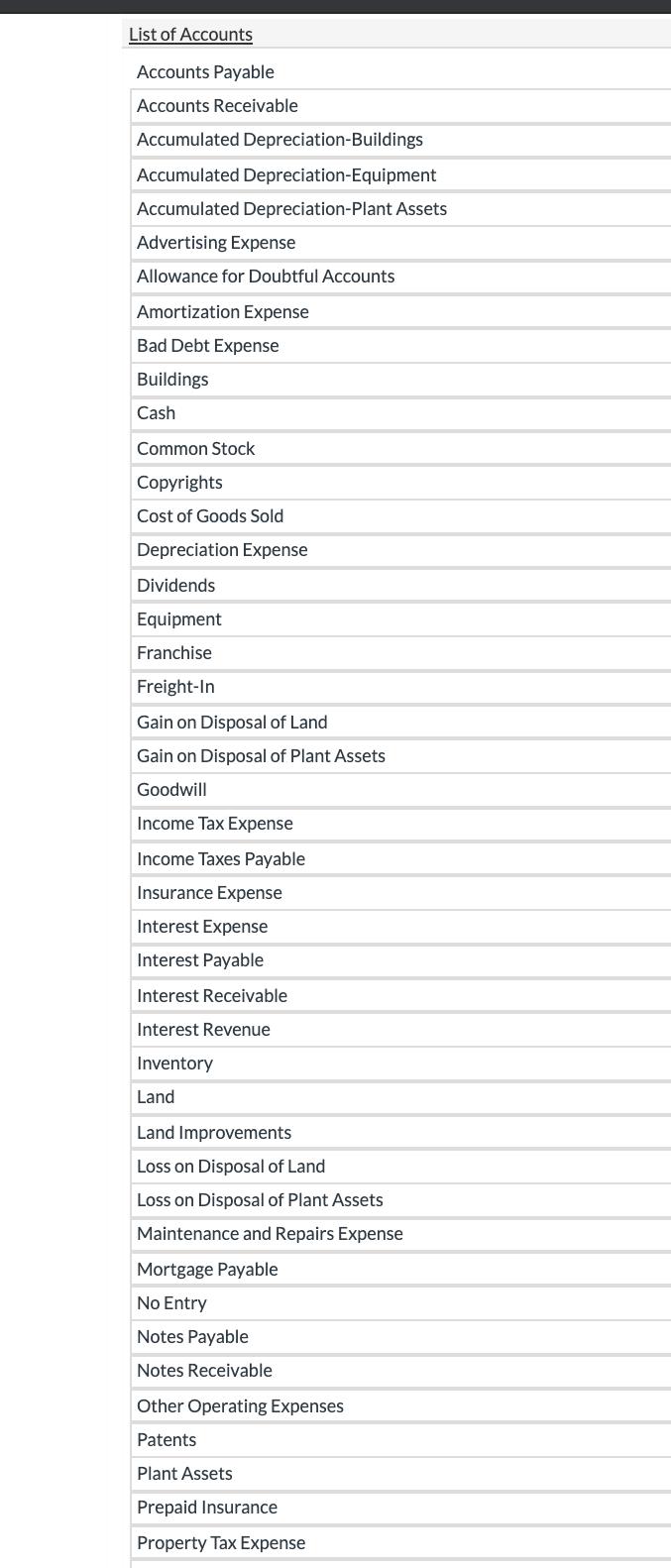

Bramble Corp. prepares quarterly financial statements. The post-closing trial balance at December 31, 2021, is presented below. BRAMBLE CORP. Post-Closing Trial Balance December 31, 2021 Debit Credit Cash $23,200 Accounts Receivable 22,600 Allowance for Doubtful Accounts $1,500 Equipment 23,000 Accumulated Depreciation-Equipment 10,000 Buildings 100,000 Accumulated Depreciation-Buildings 10,000 Land 20,000 Accounts Payable 12,010 Common Stock 90,000 Retained Earnings 65,290 $188,800 $188,800 During the first quarter of 2022, the following transactions occurred: 1. On February 1, Bramble collected fees of $16,800 in advance. The company will perform $1,400 of services each month from February 1, 2022, to January 31, 2018. 2. On February 1, Bramble purchased computer equipment for $11,250 plus sales taxes of $750. $3,750 cash was paid with the rest on account. Check #455 was used. 3. On March 1, Bramble acquired a patent with a 10-year life for $12,000 cash. Check #456 was used. 4. On March 28, Bramble recorded the quarter's sales in a single entry. During this period, Bramble had total sales of $180,000 (not including the sales referred to in item 1 above). All of the sales were on account. 5. On March 29, Bramble collected $173,000 from customers on account. 6. On March 29, Bramble paid $16,010 on accounts payable. Check #457 was used. 7. On March 29, Bramble paid other operating expenses of $97,000. Check # 458 was used. 8. On March 31, Bramble wrote off a receivable of $200 for a customer who declared bankruptcy. 9. On March 31, Bramble sold for $1,450 equipment that originally cost $10,000. It had an estimated life of 5 years and salvage of $1,000. Accumulated depreciation as of December 31, 2021, was $7,200 using the straight line method. (Hint: Record depreciation on the equipment sold, then record the sale.)

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started