Answered step by step

Verified Expert Solution

Question

1 Approved Answer

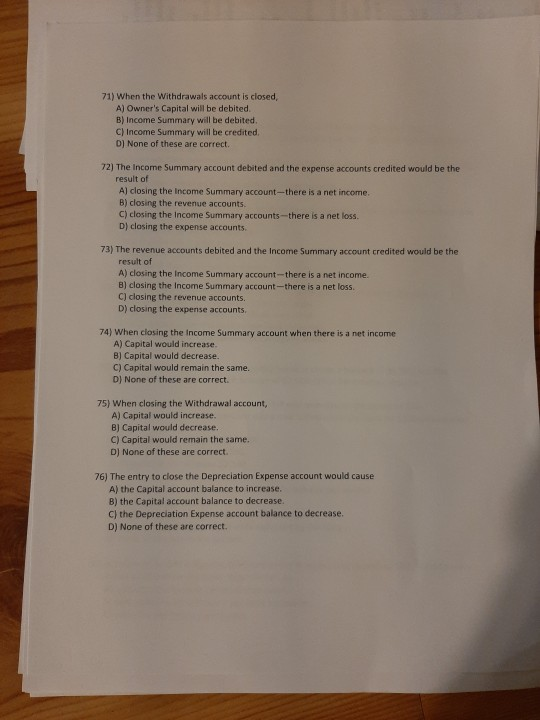

71) When the Withdrawals account is closed, A) Owner's Capital will be debited. B) Income Summary will be debited. C) Income Summary will be credited

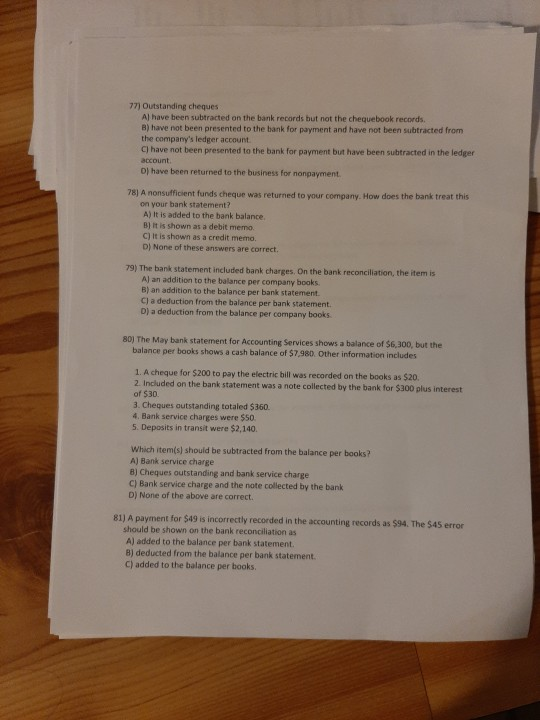

71) When the Withdrawals account is closed, A) Owner's Capital will be debited. B) Income Summary will be debited. C) Income Summary will be credited Dj None of these are correct. 72) The Income Summary account debited and the expense accounts credited would be the result of Al closing the income Summary account--there is a net income. B) closing the revenue accounts c) closing the income Summary accounts - there is a net loss. D) closing the expense accounts 73) The revenue accounts debited and the Income Summary account credited would be the result of A) closing the income Summary account--there is a net income. B) closing the Income Summary account there is a net loss. C) closing the revenue accounts D) closing the expense accounts 74) When closing the income Summary account when there is a net income A) Capital would increase B) Capital would decrease. C) Capital would remain the same. D) None of these are correct. 75) When closing the Withdrawal account, A) Capital would increase. B) Capital would decrease. C) Capital would remain the same. D) None of these are correct. 76) The entry to close the Depreciation Expense account would cause A) the Capital account balance to increase. B) the Capital account balance to decrease. C) the Depreciation Expense account balance to decrease. D) None of these are correct. 771 Outstanding cheques Al have been subtracted on the bank records but not the chequebook records B) have not been presented to the bank for payment and have not been subtracted from the company's ledger account C) have not been presented to the bank for payment but have been subtracted in the lediger account D) have been returned to the business for nonpayment. 78) A nonsufficient funds cheque was returned to your company. How does the bank treat this on your bank statement? A) It is added to the bank balance B) it is shown as a debit memo C) It is shown as a credit mema. D) None of these answers are correct. 79) The bank statement included bank charges. On the bank reconciliation, the item is A) an addition to the balance per company books B) an addition to the balance per bank statement C) a deduction from the balance per bank statement. D) a deduction from the balance per company books 80) The May bank statement for Accounting Services shows a balance of 56,300, but the balance per books shows a cash balance of $7.980. Other information includes 1. A cheque for $200 to pay the electric bill was recorded on the books as $20. 2. Included on the bank statement was a note collected by the bank for $300 plus interest of 530 3. Cheques outstanding totaled $360 4. Bank service charges were $50 5. Deposits in transit were $2,140 Which item(s) should be subtracted from the balance per books? A) Bank service charge B) Cheques outstanding and bank service charge C) Bank service charge and the note collected by the bank D) None of the above are correct 81) A payment for $49 is incorrectly recorded in the accounting records as $94. The $45 error should be shown on the bank reconciliation as A) added to the balance per bank statement B) deducted from the balance per bank statement. C) added to the balance per books

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started