Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7103AFE Corporate Accounting Workshop questions Associates and joint ventures Question 1 Sarah Ltd acquired a 30% interest in Madison Ltd for $50 000 on 1

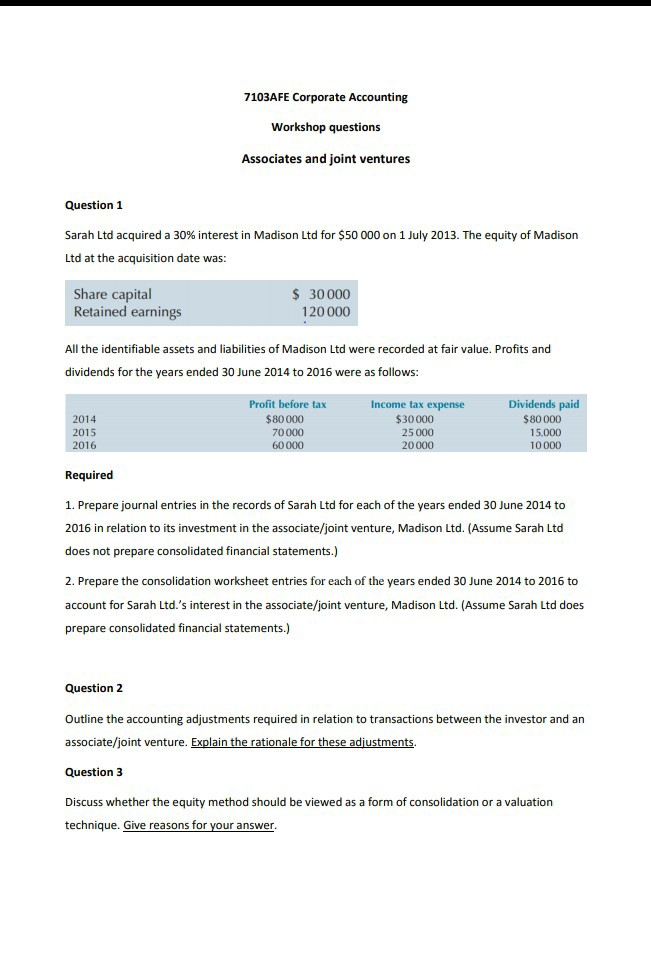

7103AFE Corporate Accounting Workshop questions Associates and joint ventures Question 1 Sarah Ltd acquired a 30% interest in Madison Ltd for $50 000 on 1 July 2013. The equity of Madison Ltd at the acquisition date was: Share capital Retained earnings $ 30 000 120 000 All the identifiable assets and liabilities of Madison Ltd were recorded at fair value. Profits and dividends for the years ended 30 June 2014 to 2016 were as follows: 2014 2015 2016 Profit before tax $80 000 70000 60000 Income tax expense $30 000 25 000 20000 Dividends paid $80 000 15.000 10000 Required 1. Prepare journal entries in the records of Sarah Ltd for each of the years ended 30 June 2014 to 2016 in relation to its investment in the associate/joint venture, Madison Ltd. (Assume Sarah Ltd does not prepare consolidated financial statements.) 2. Prepare the consolidation worksheet entries for each of the years ended 30 June 2014 to 2016 to account for Sarah Ltd.'s interest in the associate/joint venture, Madison Ltd. (Assume Sarah Ltd does prepare consolidated financial statements.) Question 2 Outline the accounting adjustments required in relation to transactions between the investor and an associate/joint venture. Explain the rationale for these adjustments. Question 3 Discuss whether the equity method should be viewed as a form of consolidation or a valuation technique. Give reasons for your answer Question 4 The accountant of Cornett Chocolates Ltd, Ms Fraulein, has been advised by her auditors that the entity's investment in Concertina's Milk Ltd should be accounted for using the equity method of accounting. Cornett Chocolates Ltd holds only 20.2% of the voting shares currently issued by Concertina's Milk Ltd. Since the investment was undertaken purely for cash flow reasons based on the potential dividend stream from the investment, Ms Fraulein does not believe that Cornett Chocolates Ltd exerts significant influence over the investee. Required Discuss the factors that Ms Fraulein should investigate in determining whether an investor-associate relationship exists, and what avenues are available so that the equity method of accounting does not have to be applied. 7103AFE Corporate Accounting Workshop questions Associates and joint ventures Question 1 Sarah Ltd acquired a 30% interest in Madison Ltd for $50 000 on 1 July 2013. The equity of Madison Ltd at the acquisition date was: Share capital Retained earnings $ 30 000 120 000 All the identifiable assets and liabilities of Madison Ltd were recorded at fair value. Profits and dividends for the years ended 30 June 2014 to 2016 were as follows: 2014 2015 2016 Profit before tax $80 000 70000 60000 Income tax expense $30 000 25 000 20000 Dividends paid $80 000 15.000 10000 Required 1. Prepare journal entries in the records of Sarah Ltd for each of the years ended 30 June 2014 to 2016 in relation to its investment in the associate/joint venture, Madison Ltd. (Assume Sarah Ltd does not prepare consolidated financial statements.) 2. Prepare the consolidation worksheet entries for each of the years ended 30 June 2014 to 2016 to account for Sarah Ltd.'s interest in the associate/joint venture, Madison Ltd. (Assume Sarah Ltd does prepare consolidated financial statements.) Question 2 Outline the accounting adjustments required in relation to transactions between the investor and an associate/joint venture. Explain the rationale for these adjustments. Question 3 Discuss whether the equity method should be viewed as a form of consolidation or a valuation technique. Give reasons for your answer Question 4 The accountant of Cornett Chocolates Ltd, Ms Fraulein, has been advised by her auditors that the entity's investment in Concertina's Milk Ltd should be accounted for using the equity method of accounting. Cornett Chocolates Ltd holds only 20.2% of the voting shares currently issued by Concertina's Milk Ltd. Since the investment was undertaken purely for cash flow reasons based on the potential dividend stream from the investment, Ms Fraulein does not believe that Cornett Chocolates Ltd exerts significant influence over the investee. Required Discuss the factors that Ms Fraulein should investigate in determining whether an investor-associate relationship exists, and what avenues are available so that the equity method of accounting does not have to be applied

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started