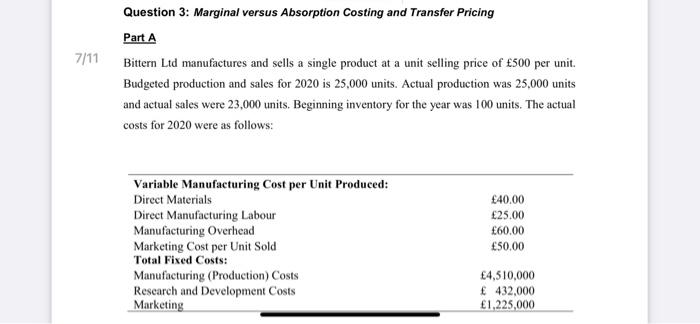

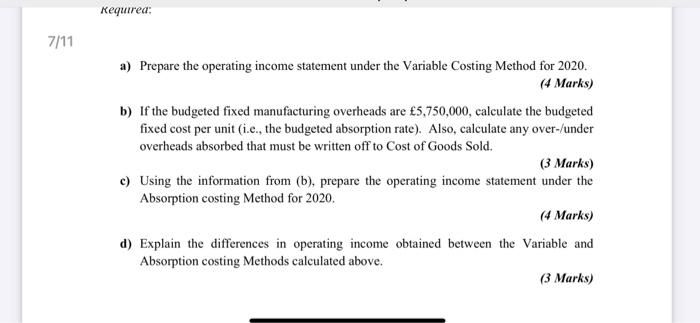

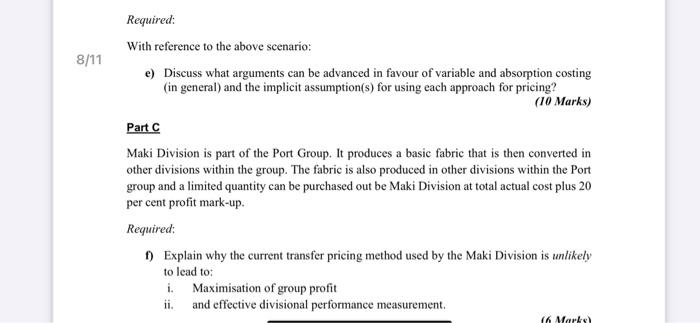

7/11 Question 3: Marginal versus Absorption Costing and Transfer Pricing Part A Bittern Ltd manufactures and sells a single product at a unit selling price of 500 per unit. Budgeted production and sales for 2020 is 25,000 units. Actual production was 25,000 units and actual sales were 23,000 units. Beginning inventory for the year was 100 units. The actual costs for 2020 were as follows: Variable Manufacturing Cost per Unit Produced: Direct Materials Direct Manufacturing Labour Manufacturing Overhead Marketing Cost per Unit Sold Total Fixed Costs: Manufacturing (Production) Costs Research and Development Costs Marketing 40.00 25.00 60,00 50.00 4,510,000 432,000 1,225,000 Required: 7/11 a) Prepare the operating income statement under the Variable Costing Method for 2020. (4 Marks) b) If the budgeted fixed manufacturing overheads are 5,750,000, calculate the budgeted fixed cost per unit (i.e., the budgeted absorption rate). Also, calculate any over-/under overheads absorbed that must be written off to Cost of Goods Sold. (3 Marks) c) Using the information from (b), prepare the operating income statement under the Absorption costing Method for 2020. (4 Marks) d) Explain the differences in operating income obtained between the Variable and Absorption costing Methods calculated above. (3 Marks) 8/11 Required: With reference to the above scenario: e) Discuss what arguments can be advanced in favour of variable and absorption costing (in general) and the implicit assumption(s) for using each approach for pricing? (10 Marks) Part C Maki Division is part of the Port Group. It produces a basic fabric that is then converted in other divisions within the group. The fabric is also produced in other divisions within the Port group and a limited quantity can be purchased out be Maki Division at total actual cost plus 20 per cent profit mark-up. Required: f) Explain why the current transfer pricing method used by the Maki Division is unlikely to lead to: i. Maximisation of group profit ii. and effective divisional performance measurement. 16 Marks 8/11 Required: With reference to the above scenario: e) Discuss what arguments can be advanced in favour of variable and absorption costing (in general) and the implicit assumption(s) for using each approach for pricing? (10 Marks) Part C Maki Division is part of the Port Group. It produces a basic fabric that is then converted in other divisions within the group. The fabric is also produced in other divisions within the Port group and a limited quantity can be purchased out be Maki Division at total actual cost plus 20 per cent profit mark-up. Required: 1) Explain why the current transfer pricing method used by the Maki Division is unlikely to lead to: i. Maximisation of group profit ii. and effective divisional performance measurement. 16 Marks 7/11 Question 3: Marginal versus Absorption Costing and Transfer Pricing Part A Bittern Ltd manufactures and sells a single product at a unit selling price of 500 per unit. Budgeted production and sales for 2020 is 25,000 units. Actual production was 25,000 units and actual sales were 23,000 units. Beginning inventory for the year was 100 units. The actual costs for 2020 were as follows: Variable Manufacturing Cost per Unit Produced: Direct Materials Direct Manufacturing Labour Manufacturing Overhead Marketing Cost per Unit Sold Total Fixed Costs: Manufacturing (Production) Costs Research and Development Costs Marketing 40.00 25.00 60,00 50.00 4,510,000 432,000 1,225,000 Required: 7/11 a) Prepare the operating income statement under the Variable Costing Method for 2020. (4 Marks) b) If the budgeted fixed manufacturing overheads are 5,750,000, calculate the budgeted fixed cost per unit (i.e., the budgeted absorption rate). Also, calculate any over-/under overheads absorbed that must be written off to Cost of Goods Sold. (3 Marks) c) Using the information from (b), prepare the operating income statement under the Absorption costing Method for 2020. (4 Marks) d) Explain the differences in operating income obtained between the Variable and Absorption costing Methods calculated above. (3 Marks) 8/11 Required: With reference to the above scenario: e) Discuss what arguments can be advanced in favour of variable and absorption costing (in general) and the implicit assumption(s) for using each approach for pricing? (10 Marks) Part C Maki Division is part of the Port Group. It produces a basic fabric that is then converted in other divisions within the group. The fabric is also produced in other divisions within the Port group and a limited quantity can be purchased out be Maki Division at total actual cost plus 20 per cent profit mark-up. Required: f) Explain why the current transfer pricing method used by the Maki Division is unlikely to lead to: i. Maximisation of group profit ii. and effective divisional performance measurement. 16 Marks 8/11 Required: With reference to the above scenario: e) Discuss what arguments can be advanced in favour of variable and absorption costing (in general) and the implicit assumption(s) for using each approach for pricing? (10 Marks) Part C Maki Division is part of the Port Group. It produces a basic fabric that is then converted in other divisions within the group. The fabric is also produced in other divisions within the Port group and a limited quantity can be purchased out be Maki Division at total actual cost plus 20 per cent profit mark-up. Required: 1) Explain why the current transfer pricing method used by the Maki Division is unlikely to lead to: i. Maximisation of group profit ii. and effective divisional performance measurement. 16 Marks