Answered step by step

Verified Expert Solution

Question

1 Approved Answer

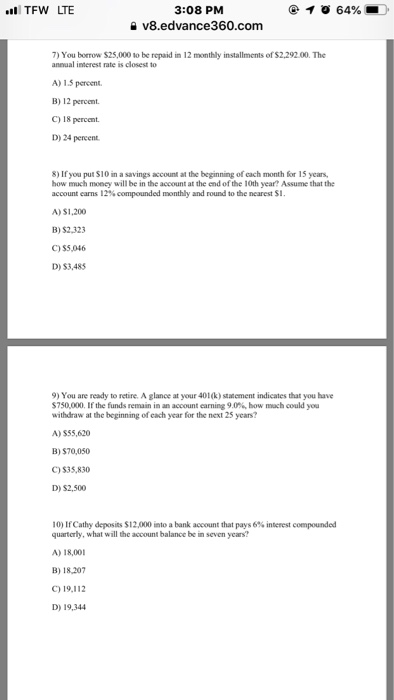

7-15 3:08 PM a v8.edvance360.com @ l TFW LTE 64%- 7) You borroW $25,000 to be repaid in 12 monthly installments of $2,292.00. The anevual

7-15

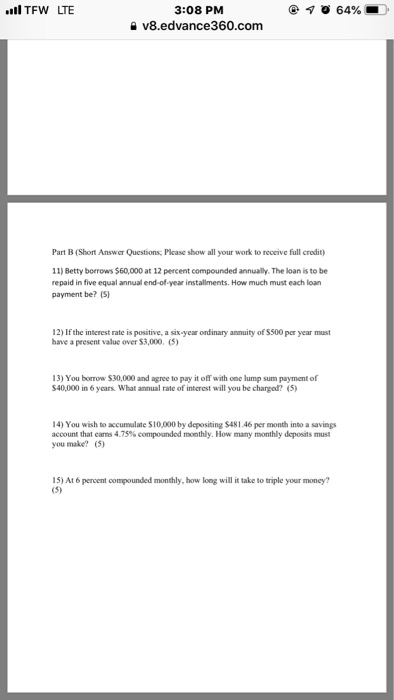

3:08 PM a v8.edvance360.com @ l TFW LTE 64%- 7) You borroW $25,000 to be repaid in 12 monthly installments of $2,292.00. The anevual interest rate is closest to A) 1.5 percent. B) 12 percent C) 18 percent D) 24 percent 8) If you put $10 in a savings account at the beginning of each month for 15 years, how much moncy will be in the account at the end of the 10th year? Assume that the account cams 12% compounded monthly and round to the nearest $1 A) $1,200 B) $2,323 C) $5,046 D) $3,485 9) You are ready to retire. A glance at your 401(k) staement indicates that you have $750,000. If the funds remain in an account earning 9.0%, bow much could you withdraw at the beginning of cach year for the next 25 years? A) $55,620 B) $70,050 C) 535,830 D) $2,500 10) If Cathy deposits $12,000 into a bank account that pays 6% interest compounded quarterly, what will the account balance be in seven years? A) 18,001 B) 18,207 C) 19.112 D) 19,344 @ l TFW LTE 3:08 PM a v8.edvance360.com 64% Part B (Short Answer Questions; Please show all your work to receive full crodit) 11) Betty borrows $60,000 at 12 percent compounded annually. The loan is to be repaid in five equal annual end-of-year installments. How much must each loan payment be? (S) 12) If the interest rate is positive, a six-year ordinary annuity of S500 per year must have a present value over $3,000. (S) 13) You borrow $30,000 and agree to pay it off with one lump sum payment of $40,000 in 6 years. What amnual rate of interest will you be charged? 5) 14) You wish to accumalate $10,000 by depositing $481.46 per month into a savings account that earns 4.75% compounded monthly. How mamy monthly d posits must you make? (5) 15) At 6 percent compounded monthly, how long will it take to triple your money

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started