Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7,172.77 5,389.01 6520.70 8,965.96 Which of the following statements about annuities are true? Check all that apply. Ordinary annuities make fixed payments at the beginning

7,172.77

5,389.01

6520.70

8,965.96

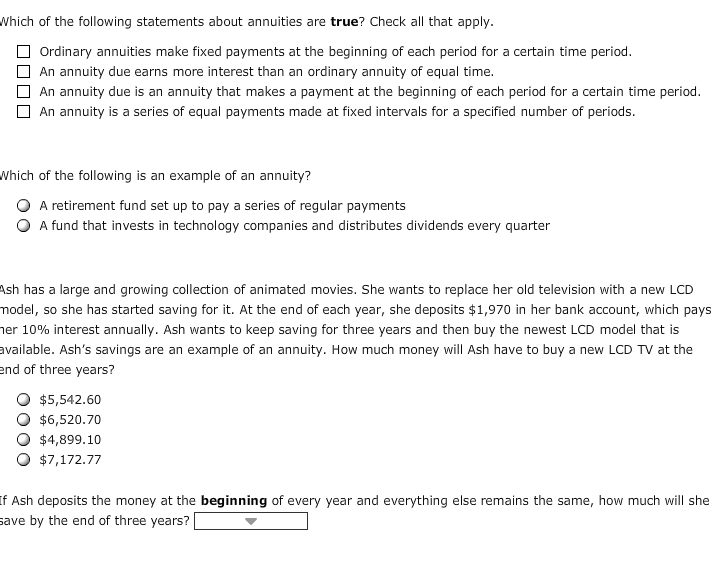

Which of the following statements about annuities are true? Check all that apply. Ordinary annuities make fixed payments at the beginning of each period for a certain time period. An annuity due earns more interest than an ordinary annuity of equal time. An annuity due is an annuity that makes a payment at the beginning of each period for a certain time period. An annuity is a series of equal payments made at fixed intervals for a specified number of periods. Which of the following is an example of an annuity? A retirement fund set up to pay a series of regular payments A fund that invests in technology companies and distributes dividends every quarter has a large and growing collection of animated movies. She wants to replace her old television with a new LCD nodal, so she has started saving for it. At the end of each year, she deposits $1, 970 in her bank account, which pays leer 10% interest annually. Ash wants to keep saving for three years and then buy the newest LCD model that is available. Ash's savings are an example of an annuity. How much money will Ash have to buy a new LCD TV at the 2nd of three years? $5, 542.60 $6, 520.70 $4, 899.10 $7, 172.77 if Ash deposits the money at the beginning of every year and everything else remains the same, how much will she save by the end of three yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started