Answered step by step

Verified Expert Solution

Question

1 Approved Answer

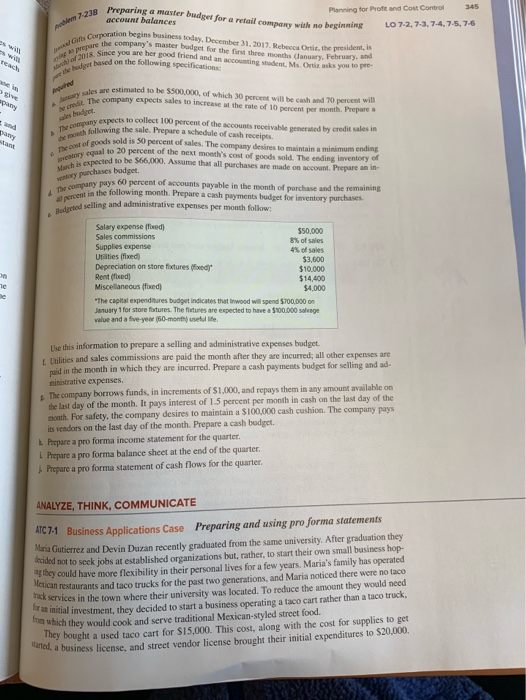

7-23B 345 poblem 7-23B Preparing a master budget for a retail company with no beginning Gtts Corporation begins business today, December 31. 2017. Rebecca Ortir,

7-23B

345 poblem 7-23B Preparing a master budget for a retail company with no beginning Gtts Corporation begins business today, December 31. 2017. Rebecca Ortir, the president, is aning An prepaure the company's master budget for the firt three months (Janoary, February, and Ah od 2018, Since you are her good friend and an accounting student, Ms. Ortiz asks you to pee Planning for Proft and Cost Control account balances LO 7-2, 7-3, 7-4,7-5,7-6 s wi s will reach he bdget hased on the following specifications: ase in Janary sales are estimated to be $500,,000, of which 30 percent will be cash and 70 percent will e cit The company expects sales to increase at the rate of 10 percent per month. Prepare a oared give apany The company expects to collect 100 percent of the accounts receivable generated by credit sales in the moeth following the sale. Prepare a schedule of cash receints e he cost of goods sold is 50 percent of sales. The company desires to maintain a minimum ending vearory equal to 20 percent of the next month's cost of goods sold. The ending inventory of March as expected to be S66.000, Assume that all purchases are made cn acpount Prepare an in ales badget and pany stam d he company pays 60 percent of accounts payable in the month of purchase and the remaining al percent in the following month. Prepare a cash payments budget for inventory purchases entory purchases badget &Budgeted selling and administrative expenses per month follow: Salary expense (fixed) $50,000 8% of sales Sales commissions Supplies expense Utilities (fixed) Depreciation on store fixtures (fixed Rent (fxed) Miscellaneous (fxed) 4% of salesa $3,600 $10.000 $14,400 $4,000 e The capital expenditures budget indicates that Inwood will spend $700,000 on January 1 for store foxtures. The fixtunes are expected to have a $100.000 salvage value and a five-year (60-month) usetul life, e The this information to prepare a selling and administrative expenses budget t Thilities and sales commissions are paid the month after they are incurred; all other expenses are naid in the month in which they are incurred. Prepare a cash payments budget for selling and ad- ministrative expenses. The company borrows funds, in increments of $1,000, and repays them in any amount available on the last day of the month. It pays interest of 1.5 percent per month in cash on the last day of the month. For safety, the company desires to maintain a $100,000 cash cushion. The company pays its vendors on the last day of the month. Prepare a cash budget h Prepare a pro forma income statement for the quarter. L Prepare a pro forma balance sheet at the end of the quarter Prepare a pro forma statement of cash flows for the quarter ANALYZE, THINK, COMMUNICATE ATC 7-1 Business Applications Case Preparing and using pro forma statements Maria Gutierrez and Devin Duzan recently graduated from the same university. After graduation they decided not to seck jobs at established organizations but, rather, to start their own small business hop- g they could have more flexibility in their personal lives for a few years. Maria's family has operated Mexican restaurants and taco trucks for the past two generations, and Maria noticed there were no taco track services in the town where their university was located. To reduce the amount they would need for an initial investment, they decided to start a business operating a taco cart rather than a taco truck, fo which they would cook and serve traditional Mexican-styled street food. They bought a used taco cart for $15,000. This cost, along with the cost for supplies to get tarted, a business license, and street vendor license brought their initial expenditures to $20,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started