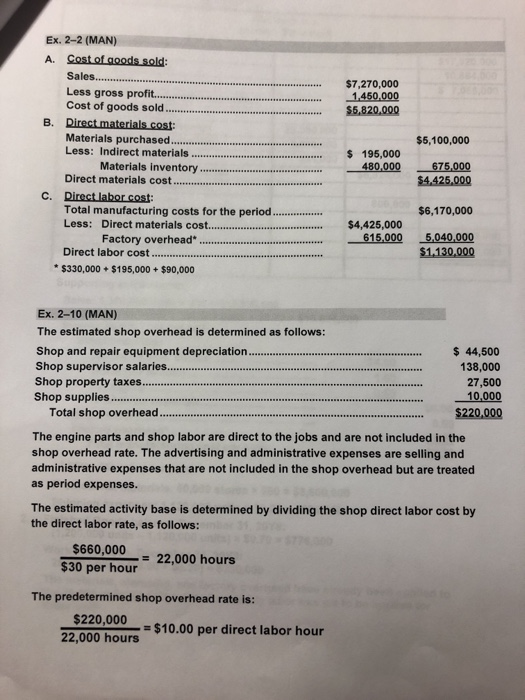

$7,270,000 1,450,000 $5,820.000 $5,100,000 Ex. 2-2 (MAN) A. Cost of goods sold: Sales........ Less gross profit.. Cost of goods sold B. Direct materials cost: Materials purchased Less: Indirect materials Materials inventory Direct materials cost. C. Direct labor cost: Total manufacturing costs for the period...... Less: Direct materials cost......... Factory overhead Direct labor cost. *$330,000+ $195,000 + $90,000 $ 195,000 480,000 675,000 $4,425,000 $6,170,000 $4,425,000 615,000 5,040,000 $1,130,000 Ex. 2-10 (MAN) The estimated shop overhead is determined as follows: Shop and repair equipment depreciation.... $ 44,500 Shop supervisor salaries... 138,000 Shop property taxes.. 27,500 Shop supplies... 10.000 Total shop overhead. $220,000 The engine parts and shop labor are direct the jobs and are not included in the shop overhead rate. The advertising and administrative expenses are selling and administrative expenses that are not included in the shop overhead but are treated as period expenses. The estimated activity base is determined by dividing the shop direct labor cost by the direct labor rate, as follows: $660,000 = 22,000 hours $30 per hour The predetermined shop overhead rate is: $220,000 = $10.00 per direct labor hour 22,000 hours $7,270,000 1,450,000 $5,820.000 $5,100,000 Ex. 2-2 (MAN) A. Cost of goods sold: Sales........ Less gross profit.. Cost of goods sold B. Direct materials cost: Materials purchased Less: Indirect materials Materials inventory Direct materials cost. C. Direct labor cost: Total manufacturing costs for the period...... Less: Direct materials cost......... Factory overhead Direct labor cost. *$330,000+ $195,000 + $90,000 $ 195,000 480,000 675,000 $4,425,000 $6,170,000 $4,425,000 615,000 5,040,000 $1,130,000 Ex. 2-10 (MAN) The estimated shop overhead is determined as follows: Shop and repair equipment depreciation.... $ 44,500 Shop supervisor salaries... 138,000 Shop property taxes.. 27,500 Shop supplies... 10.000 Total shop overhead. $220,000 The engine parts and shop labor are direct the jobs and are not included in the shop overhead rate. The advertising and administrative expenses are selling and administrative expenses that are not included in the shop overhead but are treated as period expenses. The estimated activity base is determined by dividing the shop direct labor cost by the direct labor rate, as follows: $660,000 = 22,000 hours $30 per hour The predetermined shop overhead rate is: $220,000 = $10.00 per direct labor hour 22,000 hours