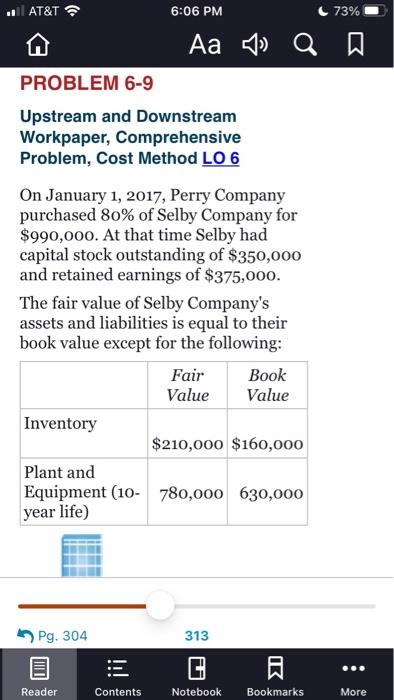

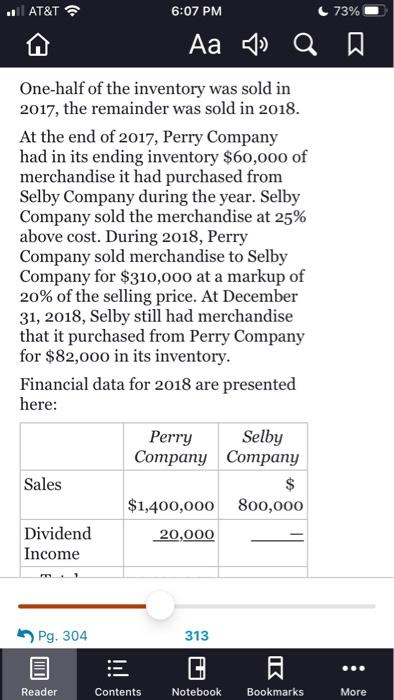

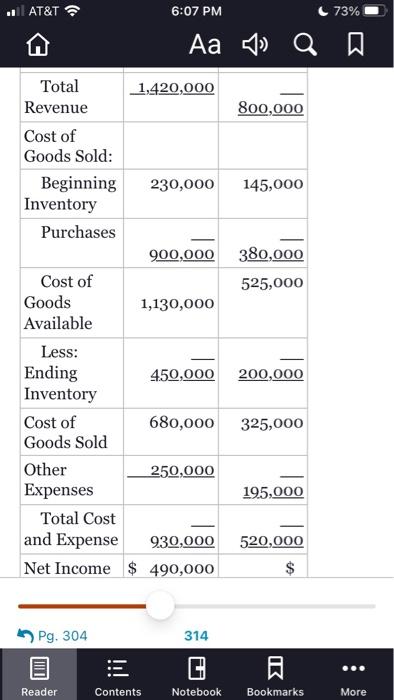

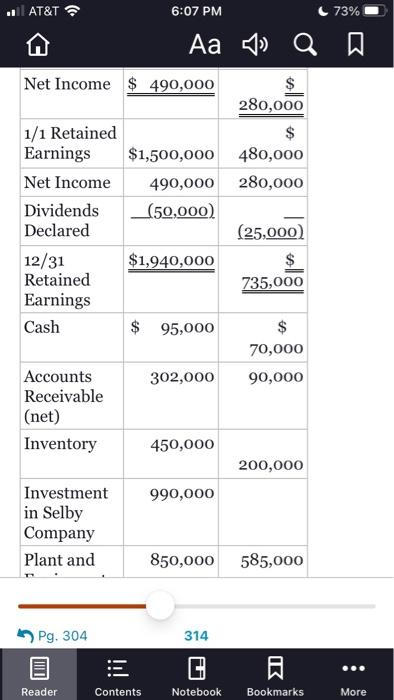

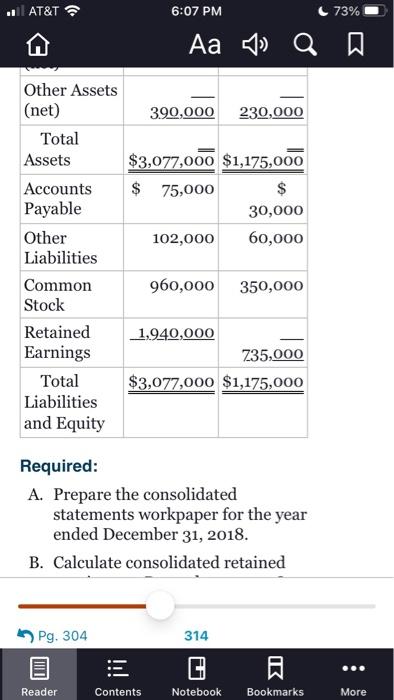

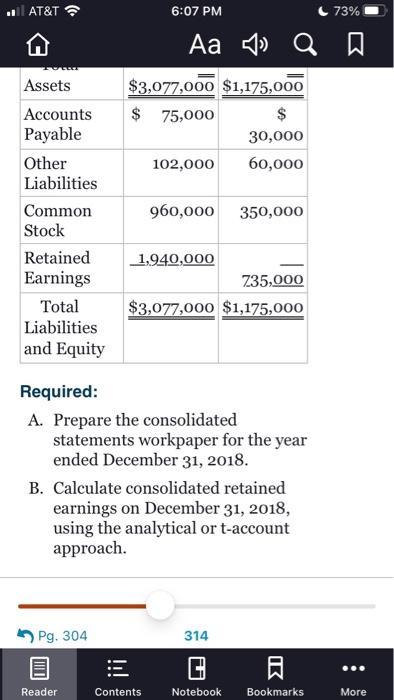

73% . AT&T 6:06 PM Aa ^ a D PROBLEM 6-9 Upstream and Downstream Workpaper, Comprehensive Problem, Cost Method LO 6 On January 1, 2017, Perry Company purchased 80% of Selby Company for $990,000. At that time Selby had capital stock outstanding of $350,000 and retained earnings of $375,000. The fair value of Selby Company's assets and liabilities is equal to their book value except for the following: Fair Book Value Value Inventory $210,000 $160,000 Plant and Equipment (10- 780,000 630,000 year life) Pg. 304 313 .. Reader Contents Notebook Bookmarks More . AT&T 6:07 PM 73% One-half of the inventory was sold in 2017, the remainder was sold in 2018. At the end of 2017, Perry Company had in its ending inventory $60,000 of merchandise it had purchased from Selby Company during the year. Selby Company sold the merchandise at 25% above cost. During 2018, Perry Company sold merchandise to Selby Company for $310,000 at a markup of 20% of the selling price. At December 31, 2018, Selby still had merchandise that it purchased from Perry Company for $82,000 in its inventory. Financial data for 2018 are presented here: Sales Perry Selby Company Company $ $1,400,000 800,000 20,000 Dividend Income Pg. 304 313 .. Reader Contents Notebook Bookmarks More AT&T 6:07 PM 73% Aa A A A 800,000 145,000 380,000 525,000 Total 1,420,000 Revenue Cost of Goods Sold: Beginning 230,000 Inventory Purchases 900,000 Cost of Goods 1,130,000 Available Less: Ending 450,000 Inventory Cost of 680,000 Goods Sold Other 250,000 Expenses Total Cost and Expense 930,000 Net Income $ 490,000 200,000 325,000 195,000 520,000 Pg. 304 314 .. Reader Contents Notebook Bookmarks More AT&T 6:07 PM 73% Aa QD Net Income $ 490,000 $ 280,000 1/1 Retained Earnings $1,500,000 480,000 Net Income 490,000 280,000 Dividends (50,000) Declared (25,000) 12/31 $1,940,000 $ Retained 735,000 Earnings Cash $ 95,000 $ 70,000 Accounts 302,000 90,000 Receivable (net) Inventory 450,000 200,000 Investment 990,000 in Selby Company Plant and 850,000 585,000 Pg. 304 314 .. Reader Contents Notebook Bookmarks More AT&T 6:07 PM 73% Aa 1 aD 390,000 230,000 $3,077,000 $1,175,000 $ 75,000 $ 30,000 102,000 60,000 Other Assets (net) Total Assets Accounts Payable Other Liabilities Common Stock Retained Earnings Total Liabilities and Equity 960,000 350,000 1,940,000 735,000 $3,077,000 $1,175,000 Required: A. Prepare the consolidated statements workpaper for the year ended December 31, 2018. B. Calculate consolidated retained Pg. 304 314 .. Reader Contents Notebook Bookmarks More AT&T 6:07 PM 73% Aa 1 a $3,077,000 $1,175,000 $ 75,000 $ 30,000 102,000 60,000 Assets Accounts Payable Other Liabilities Common Stock Retained Earnings Total Liabilities and Equity 960,000 350,000 1,940,000 735,000 $3,077,000 $1,175,000 Required: A. Prepare the consolidated statements workpaper for the year ended December 31, 2018. B. Calculate consolidated retained earnings on December 31, 2018, using the analytical or t-account approach. Pg. 304 314 .. Reader Contents Notebook Bookmarks More