Answered step by step

Verified Expert Solution

Question

1 Approved Answer

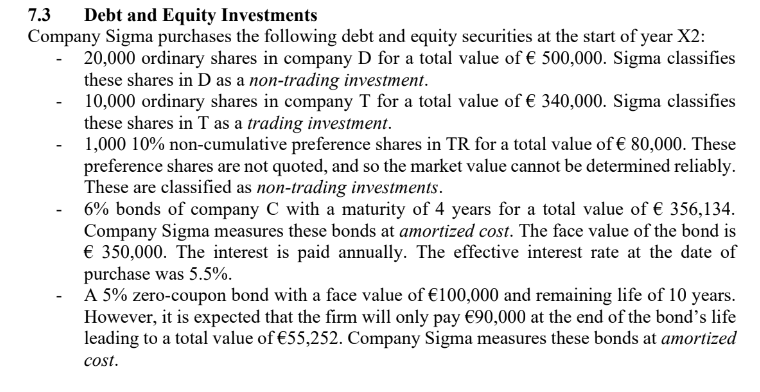

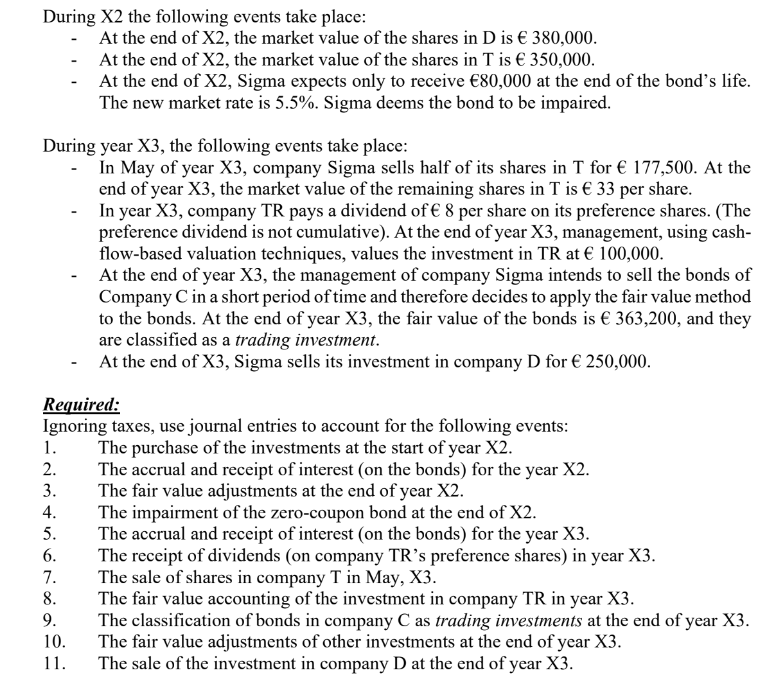

7.3 Debt and Equity Investments Company Sigma purchases the following debt and equity securities at the start of year X2: - 20,000 ordinary shares in

7.3 Debt and Equity Investments Company Sigma purchases the following debt and equity securities at the start of year X2: - 20,000 ordinary shares in company D for a total value of 500,000. Sigma classifies these shares in D as a non-trading investment. - 10,000 ordinary shares in company T for a total value of 340,000. Sigma classifies these shares in T as a trading investment. - 1,00010% non-cumulative preference shares in TR for a total value of 80,000. These preference shares are not quoted, and so the market value cannot be determined reliably. These are classified as non-trading investments. - 6% bonds of company C with a maturity of 4 years for a total value of 356,134. Company Sigma measures these bonds at amortized cost. The face value of the bond is 350,000. The interest is paid annually. The effective interest rate at the date of purchase was 5.5%. - A 5% zero-coupon bond with a face value of 100,000 and remaining life of 10 years. However, it is expected that the firm will only pay 90,000 at the end of the bond's life leading to a total value of 55,252. Company Sigma measures these bonds at amortized cost. During X2 the following events take place: - At the end of X2, the market value of the shares in D is 380,000. - At the end of X2, the market value of the shares in T is 350,000. - At the end of X2, Sigma expects only to receive 80,000 at the end of the bond's life. The new market rate is 5.5%. Sigma deems the bond to be impaired. During year X3, the following events take place: - In May of year X3, company Sigma sells half of its shares in T for 177,500. At the end of year X3, the market value of the remaining shares in T is 33 per share. - In year X3, company TR pays a dividend of 8 per share on its preference shares. (The preference dividend is not cumulative). At the end of year X3, management, using cashflow-based valuation techniques, values the investment in TR at 100,000. - At the end of year X3, the management of company Sigma intends to sell the bonds of Company C in a short period of time and therefore decides to apply the fair value method to the bonds. At the end of year X3, the fair value of the bonds is 363,200, and they are classified as a trading investment. - At the end of X3, Sigma sells its investment in company D for 250,000. Required: Ignoring taxes, use journal entries to account for the following events: 1. The purchase of the investments at the start of year X2. 2. The accrual and receipt of interest (on the bonds) for the year X2. 3. The fair value adjustments at the end of year X2. 4. The impairment of the zero-coupon bond at the end of X2. 5. The accrual and receipt of interest (on the bonds) for the year X3. 6. The receipt of dividends (on company TR's preference shares) in year X3. 7. The sale of shares in company T in May, X3. 8. The fair value accounting of the investment in company TR in year X3. 9. The classification of bonds in company C as trading investments at the end of year X3. 10. The fair value adjustments of other investments at the end of year X3. 11. The sale of the investment in company D at the end of year X3. 7.3 Debt and Equity Investments Company Sigma purchases the following debt and equity securities at the start of year X2: - 20,000 ordinary shares in company D for a total value of 500,000. Sigma classifies these shares in D as a non-trading investment. - 10,000 ordinary shares in company T for a total value of 340,000. Sigma classifies these shares in T as a trading investment. - 1,00010% non-cumulative preference shares in TR for a total value of 80,000. These preference shares are not quoted, and so the market value cannot be determined reliably. These are classified as non-trading investments. - 6% bonds of company C with a maturity of 4 years for a total value of 356,134. Company Sigma measures these bonds at amortized cost. The face value of the bond is 350,000. The interest is paid annually. The effective interest rate at the date of purchase was 5.5%. - A 5% zero-coupon bond with a face value of 100,000 and remaining life of 10 years. However, it is expected that the firm will only pay 90,000 at the end of the bond's life leading to a total value of 55,252. Company Sigma measures these bonds at amortized cost. During X2 the following events take place: - At the end of X2, the market value of the shares in D is 380,000. - At the end of X2, the market value of the shares in T is 350,000. - At the end of X2, Sigma expects only to receive 80,000 at the end of the bond's life. The new market rate is 5.5%. Sigma deems the bond to be impaired. During year X3, the following events take place: - In May of year X3, company Sigma sells half of its shares in T for 177,500. At the end of year X3, the market value of the remaining shares in T is 33 per share. - In year X3, company TR pays a dividend of 8 per share on its preference shares. (The preference dividend is not cumulative). At the end of year X3, management, using cashflow-based valuation techniques, values the investment in TR at 100,000. - At the end of year X3, the management of company Sigma intends to sell the bonds of Company C in a short period of time and therefore decides to apply the fair value method to the bonds. At the end of year X3, the fair value of the bonds is 363,200, and they are classified as a trading investment. - At the end of X3, Sigma sells its investment in company D for 250,000. Required: Ignoring taxes, use journal entries to account for the following events: 1. The purchase of the investments at the start of year X2. 2. The accrual and receipt of interest (on the bonds) for the year X2. 3. The fair value adjustments at the end of year X2. 4. The impairment of the zero-coupon bond at the end of X2. 5. The accrual and receipt of interest (on the bonds) for the year X3. 6. The receipt of dividends (on company TR's preference shares) in year X3. 7. The sale of shares in company T in May, X3. 8. The fair value accounting of the investment in company TR in year X3. 9. The classification of bonds in company C as trading investments at the end of year X3. 10. The fair value adjustments of other investments at the end of year X3. 11. The sale of the investment in company D at the end of year X3

7.3 Debt and Equity Investments Company Sigma purchases the following debt and equity securities at the start of year X2: - 20,000 ordinary shares in company D for a total value of 500,000. Sigma classifies these shares in D as a non-trading investment. - 10,000 ordinary shares in company T for a total value of 340,000. Sigma classifies these shares in T as a trading investment. - 1,00010% non-cumulative preference shares in TR for a total value of 80,000. These preference shares are not quoted, and so the market value cannot be determined reliably. These are classified as non-trading investments. - 6% bonds of company C with a maturity of 4 years for a total value of 356,134. Company Sigma measures these bonds at amortized cost. The face value of the bond is 350,000. The interest is paid annually. The effective interest rate at the date of purchase was 5.5%. - A 5% zero-coupon bond with a face value of 100,000 and remaining life of 10 years. However, it is expected that the firm will only pay 90,000 at the end of the bond's life leading to a total value of 55,252. Company Sigma measures these bonds at amortized cost. During X2 the following events take place: - At the end of X2, the market value of the shares in D is 380,000. - At the end of X2, the market value of the shares in T is 350,000. - At the end of X2, Sigma expects only to receive 80,000 at the end of the bond's life. The new market rate is 5.5%. Sigma deems the bond to be impaired. During year X3, the following events take place: - In May of year X3, company Sigma sells half of its shares in T for 177,500. At the end of year X3, the market value of the remaining shares in T is 33 per share. - In year X3, company TR pays a dividend of 8 per share on its preference shares. (The preference dividend is not cumulative). At the end of year X3, management, using cashflow-based valuation techniques, values the investment in TR at 100,000. - At the end of year X3, the management of company Sigma intends to sell the bonds of Company C in a short period of time and therefore decides to apply the fair value method to the bonds. At the end of year X3, the fair value of the bonds is 363,200, and they are classified as a trading investment. - At the end of X3, Sigma sells its investment in company D for 250,000. Required: Ignoring taxes, use journal entries to account for the following events: 1. The purchase of the investments at the start of year X2. 2. The accrual and receipt of interest (on the bonds) for the year X2. 3. The fair value adjustments at the end of year X2. 4. The impairment of the zero-coupon bond at the end of X2. 5. The accrual and receipt of interest (on the bonds) for the year X3. 6. The receipt of dividends (on company TR's preference shares) in year X3. 7. The sale of shares in company T in May, X3. 8. The fair value accounting of the investment in company TR in year X3. 9. The classification of bonds in company C as trading investments at the end of year X3. 10. The fair value adjustments of other investments at the end of year X3. 11. The sale of the investment in company D at the end of year X3. 7.3 Debt and Equity Investments Company Sigma purchases the following debt and equity securities at the start of year X2: - 20,000 ordinary shares in company D for a total value of 500,000. Sigma classifies these shares in D as a non-trading investment. - 10,000 ordinary shares in company T for a total value of 340,000. Sigma classifies these shares in T as a trading investment. - 1,00010% non-cumulative preference shares in TR for a total value of 80,000. These preference shares are not quoted, and so the market value cannot be determined reliably. These are classified as non-trading investments. - 6% bonds of company C with a maturity of 4 years for a total value of 356,134. Company Sigma measures these bonds at amortized cost. The face value of the bond is 350,000. The interest is paid annually. The effective interest rate at the date of purchase was 5.5%. - A 5% zero-coupon bond with a face value of 100,000 and remaining life of 10 years. However, it is expected that the firm will only pay 90,000 at the end of the bond's life leading to a total value of 55,252. Company Sigma measures these bonds at amortized cost. During X2 the following events take place: - At the end of X2, the market value of the shares in D is 380,000. - At the end of X2, the market value of the shares in T is 350,000. - At the end of X2, Sigma expects only to receive 80,000 at the end of the bond's life. The new market rate is 5.5%. Sigma deems the bond to be impaired. During year X3, the following events take place: - In May of year X3, company Sigma sells half of its shares in T for 177,500. At the end of year X3, the market value of the remaining shares in T is 33 per share. - In year X3, company TR pays a dividend of 8 per share on its preference shares. (The preference dividend is not cumulative). At the end of year X3, management, using cashflow-based valuation techniques, values the investment in TR at 100,000. - At the end of year X3, the management of company Sigma intends to sell the bonds of Company C in a short period of time and therefore decides to apply the fair value method to the bonds. At the end of year X3, the fair value of the bonds is 363,200, and they are classified as a trading investment. - At the end of X3, Sigma sells its investment in company D for 250,000. Required: Ignoring taxes, use journal entries to account for the following events: 1. The purchase of the investments at the start of year X2. 2. The accrual and receipt of interest (on the bonds) for the year X2. 3. The fair value adjustments at the end of year X2. 4. The impairment of the zero-coupon bond at the end of X2. 5. The accrual and receipt of interest (on the bonds) for the year X3. 6. The receipt of dividends (on company TR's preference shares) in year X3. 7. The sale of shares in company T in May, X3. 8. The fair value accounting of the investment in company TR in year X3. 9. The classification of bonds in company C as trading investments at the end of year X3. 10. The fair value adjustments of other investments at the end of year X3. 11. The sale of the investment in company D at the end of year X3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started