Having just returned from serving with the U.S. Marines in Afghanistan, Nick has managed to save most of his earnings. He has enrolled in

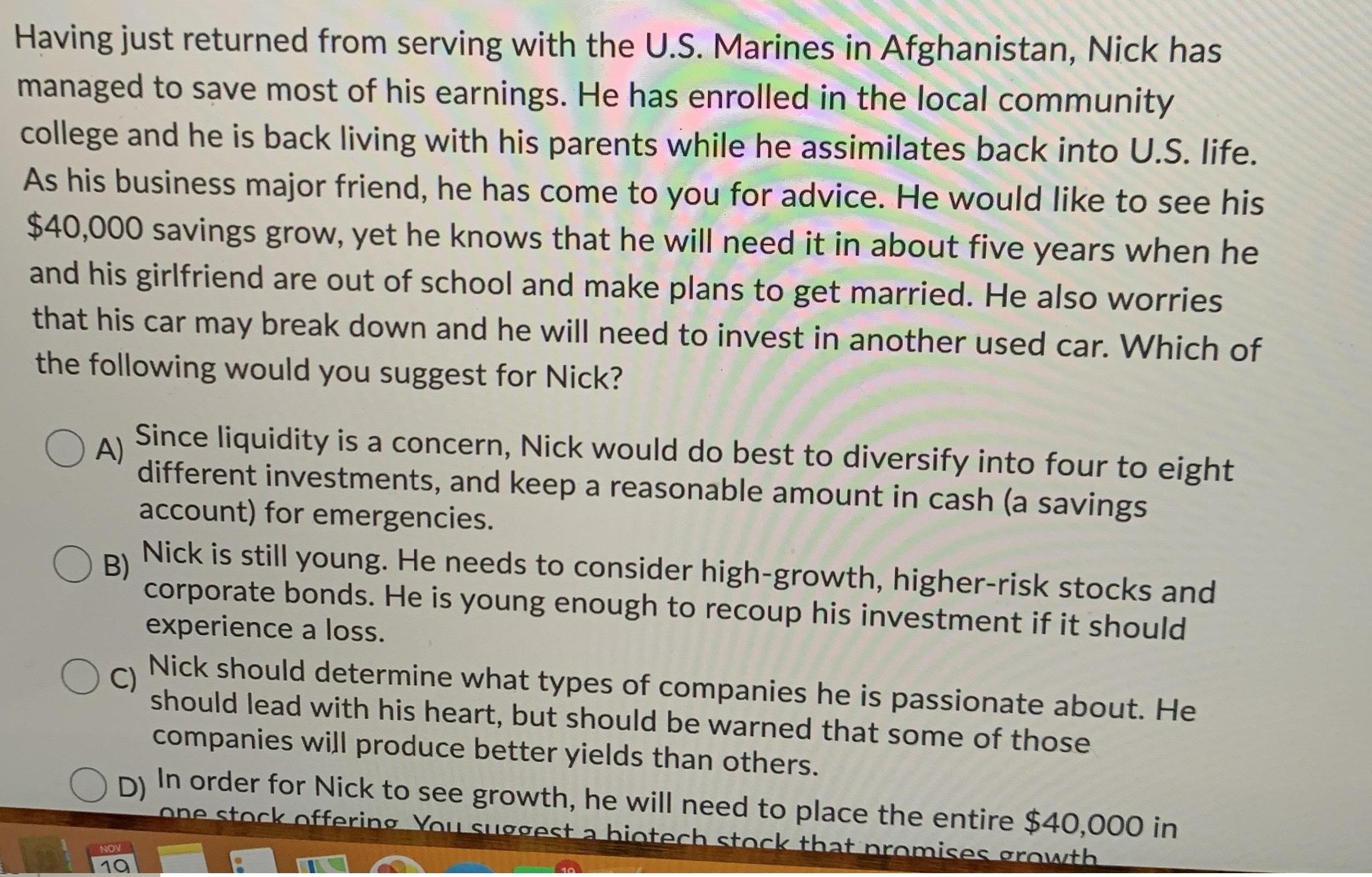

Having just returned from serving with the U.S. Marines in Afghanistan, Nick has managed to save most of his earnings. He has enrolled in the local community college and he is back living with his parents while he assimilates back into U.S. life. As his business major friend, he has come to you for advice. He would like to see his $40,000 savings grow, yet he knows that he will need it in about five years when he and his girlfriend are out of school and make plans to get married. He also worries that his car may break down and he will need to invest in another used car. Which of the following would you suggest for Nick? Since liquidity is a concern, Nick would do best to diversify into four to eight A) different investments, and keep a reasonable amount in cash (a savings account) for emergencies. Nick is still young. He needs to consider high-growth, higher-risk stocks and B) corporate bonds. He is young enough to recoup his investment if it should experience a loss. C) Nick should determine what types of companies he is passionate about. He should lead with his heart, but should be warned that some of those companies will produce better yields than others. In order for Nick to see growth, he will need to place the entire $40,000 in D) one stock offering You suggest a hiotech stock that promises growth NOV 10

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

option A is correct Since liquidity is a concern Nick would be best to divers...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started