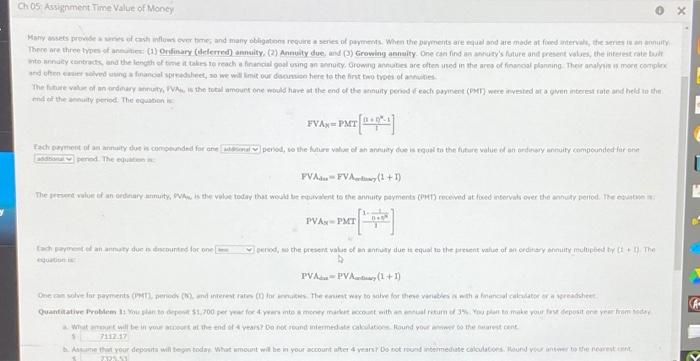

7325.53 Quantitative Problem 21 You and your wife are making plans for retirement. You planning 30 years offer you retire and would like to have $10,000 any on which to love your first withdrawal will be made one year after your retire and you anticipate that your retirement account will earn 12 ay What amount do you need in your retirement account the day you retire? Do not round mediste calculations. Round your answer to the nearest cent b. Assume that your first withdrawal will be made the day you retire. Under this assumption, what amount do you now need in your retirement account the day you are do not found intermediate calculations, Round your answer to the nearest cont Ch 05 Assignment Time Value of Money OX Maryse proof cases over time, and many obligations requires of payments. When the payments are equal and are made for the There are three types of (1) Ordinary (deferred) annuity (2) Annuity due, and (3) Growing annuity One can find an annuty's future and present the interest rate bult to annutyunds, and the length of time to reach financial goal using an anotty. Growing retened in the area of financial planning. There more complex and then eve nga finance, so we will limit our de here to the first two types of us The inte vad of ordinary PVA the total amount one would have the end of the menuity period each vinent (MI) were invested air a ghen interest rate and held on the end of the nuty period. The equations FVAN=Paer[4*** Tache permetton any do schoended for one we were to the future Valve el an ander de sequal to the future value of an ordinary annuity compounded for inn pred The FVAPV Atay (1+1) The present vuit te an orderwy unimuity, PVA is the vabae today that would be obuvakenk to the annuity payments (PHT) received at lowed intervals over the annuity penod. Ne contenu PVA PMT tapetent de counted for one ed, so the present value of an annuly due to equal to the value of an ordinaryoniy multiplied by + D) The PVA-PVA(1+1) Deccan save our payments per and interest rate for the way to solve for these newth financial color area sheet Quantitative Problem solltest 51.700 per year for money marcat with an itu make your depository We will be at the end of years and intermediate Round you the recent At your depute will begin to what wmount will be in your account wit years? Do not found intermediate calculation od v to the norton