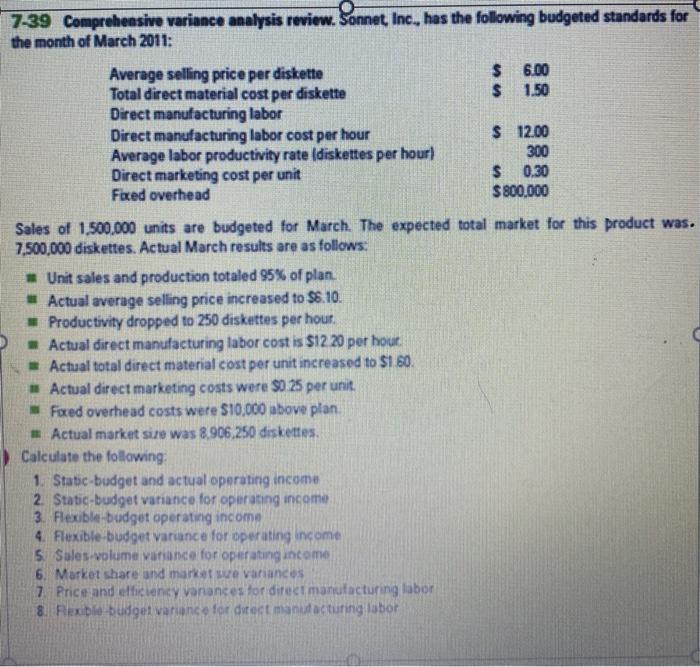

7-39 Comprehensive variance analysis review. Sonnet, Inc., has the following budgeted standards for the month of March 2011: Average selling price per diskette $ 6.00 Total direct material cost per diskette $ 1.50 Direct manufacturing labor Direct manufacturing labor cost per hour $ 12.00 Average labor productivity rate (diskettes per hour) 300 Direct marketing cost per unit $ 0.30 Faced overhead $800,000 Sales of 1,500,000 units are budgeted for March. The expected total market for this product was. 7,500,000 diskettes. Actual March results are as follows: * Unit sales and production totaled 95% of plan. Actual average selling price increased to $6.10. Productivity dropped to 250 diskettes per hour Actual direct manufacturing labor cost is $12 20 per hour. Actual total direct material cost per unit increased to $1.60. Actual direct marketing costs were $0 25 per unit. Foxed overhead costs were $10,000 above plan Actual market sure was 8,906,250 diskettes. Calculate the following: 1. Static-budget and actual operating income 2. Static-budget variance for operating income 3. Flexible-budget operating income 4. Flexible-budget variance for operating income 5. Sales volume variance for operating income 6. Market share and marketse variances 7 Price and efficiency vanances for direct manufacturing labor 8. Rexible-budget variance for detect manufacturing ibor 7-39 Comprehensive variance analysis review. Sonnet, Inc., has the following budgeted standards for the month of March 2011: Average selling price per diskette $ 6.00 Total direct material cost per diskette $ 1.50 Direct manufacturing labor Direct manufacturing labor cost per hour $ 12.00 Average labor productivity rate (diskettes per hour) 300 Direct marketing cost per unit $ 0.30 Faced overhead $800,000 Sales of 1,500,000 units are budgeted for March. The expected total market for this product was. 7,500,000 diskettes. Actual March results are as follows: * Unit sales and production totaled 95% of plan. Actual average selling price increased to $6.10. Productivity dropped to 250 diskettes per hour Actual direct manufacturing labor cost is $12 20 per hour. Actual total direct material cost per unit increased to $1.60. Actual direct marketing costs were $0 25 per unit. Foxed overhead costs were $10,000 above plan Actual market sure was 8,906,250 diskettes. Calculate the following: 1. Static-budget and actual operating income 2. Static-budget variance for operating income 3. Flexible-budget operating income 4. Flexible-budget variance for operating income 5. Sales volume variance for operating income 6. Market share and marketse variances 7 Price and efficiency vanances for direct manufacturing labor 8. Rexible-budget variance for detect manufacturing ibor