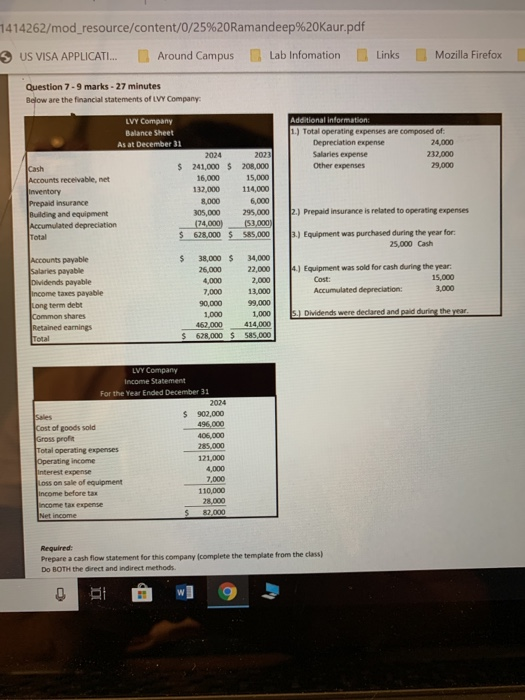

7414262/mod_resource/content/0/25%20Ramandeep%20Kaur.pdf 3 US VISA APPLICATI... Around Campus Lab Infomation Links Mozilla Firefox Question 7 - 9 marks - 27 minutes Below are the financial statements of LVY Company Additional information: 1.) Total operating expenses are composed of: Depreciation expense 24,000 Salaries expense 232,000 Other expenses 29,000 Cash LVY Company Balance Sheet As at December 31 2024 2023 $ 241,000 $ 208,000 Accounts receivable, net 16.000 15,000 inventory 132,000 114,000 Prepaid insurance 8,000 6,000 Building and equipment 305,000 295.000 Accumulated depreciation (74000) 153 000) Total $ 628,000 $585,000 2.) Prepaid insurance is related to operating expenses 3.) Equipment was purchased during the year for: 25,000 Cash Accounts payable Salaries payable Dividends payable income taxes payable Long term debt Common shares Retained earnings 4.) Equipment was sold for cash during the year: Cost: 15,000 Accumulated depreciation: 3.000 $ 38,000 $ 34,000 26.000 22,000 4,000 2.000 7,000 13,000 90,000 99.000 1,000 462,000 414,000 $ 628.000 $ 585,000 1.000 5.) Dividends were declared and paid during the year Total LVY Company Income Statement For the Year Ended December 31 2024 Sales $ 902.000 Cost of goods sold 496,000 Gross profit 406,000 Total operating expenses 285.000 Operating income 121,000 Interest expense 4,000 Loss on sale of equipment 7,000 income before tax 110,000 income tax expense 28.000 Net income $ 82.000 Required: Prepare a cash flow statement for this company complete the template from the class) Do BOTH the direct and indirect methods RE 7414262/mod_resource/content/0/25%20Ramandeep%20Kaur.pdf 3 US VISA APPLICATI... Around Campus Lab Infomation Links Mozilla Firefox Question 7 - 9 marks - 27 minutes Below are the financial statements of LVY Company Additional information: 1.) Total operating expenses are composed of: Depreciation expense 24,000 Salaries expense 232,000 Other expenses 29,000 Cash LVY Company Balance Sheet As at December 31 2024 2023 $ 241,000 $ 208,000 Accounts receivable, net 16.000 15,000 inventory 132,000 114,000 Prepaid insurance 8,000 6,000 Building and equipment 305,000 295.000 Accumulated depreciation (74000) 153 000) Total $ 628,000 $585,000 2.) Prepaid insurance is related to operating expenses 3.) Equipment was purchased during the year for: 25,000 Cash Accounts payable Salaries payable Dividends payable income taxes payable Long term debt Common shares Retained earnings 4.) Equipment was sold for cash during the year: Cost: 15,000 Accumulated depreciation: 3.000 $ 38,000 $ 34,000 26.000 22,000 4,000 2.000 7,000 13,000 90,000 99.000 1,000 462,000 414,000 $ 628.000 $ 585,000 1.000 5.) Dividends were declared and paid during the year Total LVY Company Income Statement For the Year Ended December 31 2024 Sales $ 902.000 Cost of goods sold 496,000 Gross profit 406,000 Total operating expenses 285.000 Operating income 121,000 Interest expense 4,000 Loss on sale of equipment 7,000 income before tax 110,000 income tax expense 28.000 Net income $ 82.000 Required: Prepare a cash flow statement for this company complete the template from the class) Do BOTH the direct and indirect methods RE