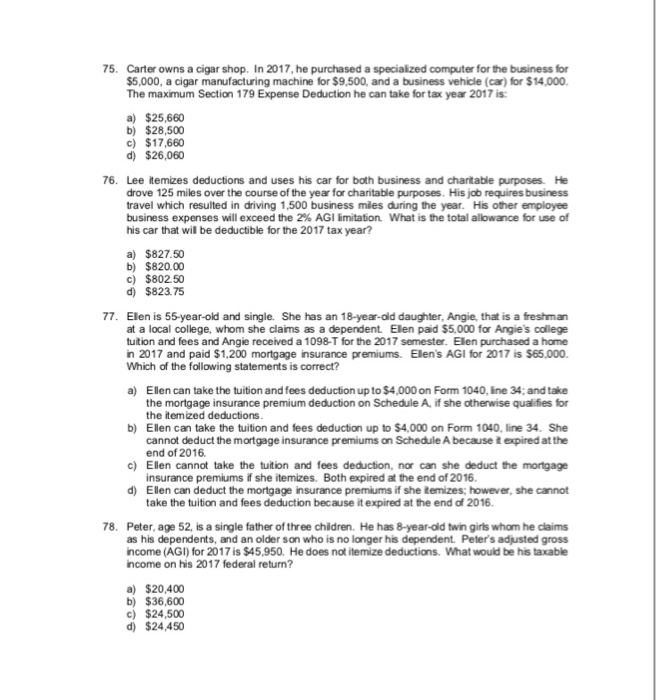

75. Carter owns a cigar shop. In 2017, he purchased a specialized computer for the business for $5,000, a cigar manufacturing machine for $9,500, and a business vehicle (car) for $14,000 The maximum Section 179 Expense Deduction he can take for tax year 2017 is: a) $25,660 b) $28,500 c) $17,660 d) $26,060 76. Lee itemizes deductions and uses his car for both business and charitable purposes. He drove 125 miles over the course of the year for charitable purposes. His job requires business travel which resulted in driving 1,500 business mles during the year. His other employee business expenses will exceed the 2% AGI limitation. What is the total allowance for use of his car that wil be deductible for the 2017 tax year? a) $827.50 b) $820.00 c) $802 50 d) $823.75 77. Elen is 55-year-old and single. She has an 18-year-old daughter, Angie, that is a freshman at a local college, whom she claims as a dependent Elen paid $5,000 for Angie's college tuition and fees and Angie received a 1098-T for the 2017 semester. Elen purchased a home in 2017 and paid $1,200 mortgage insurance premiums. Elen's AGI for 2017 is $65,000. Which of the following statements is correct? a) Ellen can take the tuition and fees deduction up to $4,000 on Form 1040, ine 34; and take the mortgage insurance premium deduction on Schedule A, if she otherwise qualifies for the itemized deductions b) Ellen can take the tuition and fees deduction up to $4,000 on Form 1040, line 34. She cannot deduct the mortgage insurance premiums on Schedule A because t expired at the end of 2016 c) Ellen cannot take the tuition and fees deduction, nor can she deduct the mortgage insurance premiums if she itemizes. Both expired at the end of 2016 d) Ellen can deduct the mortgage insurance premiums if she temizes; however, she cannot take the tuition and fees deduction because it expired at the end of 2016 78. Peter, age 52, is a single father of three children. He has 8-year-old twin girls whom he claims as his dependents, and an older son who is no longer his dependent Peters adjusted gross ncome (AGI) for 2017 is $45,950. He does not itemize deductions. What would be his taxable ncome on his 2017 federal return? a) $20,400 b) $36,600 c) $24,500 d) $24,450