Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7.5- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. 1. 2. 3. A-E TRUE OR FALSE 4. 5. 'ear 1 and Year 2, respectively?

7.5-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

1.

2.

3. A-E TRUE OR FALSE

4.

5.

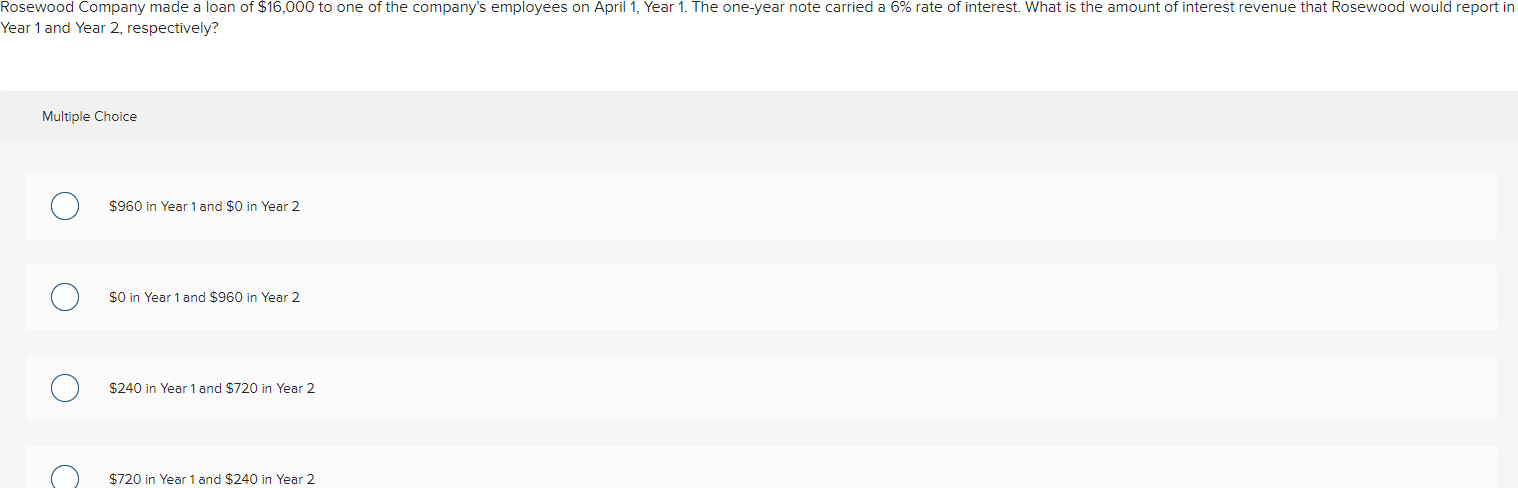

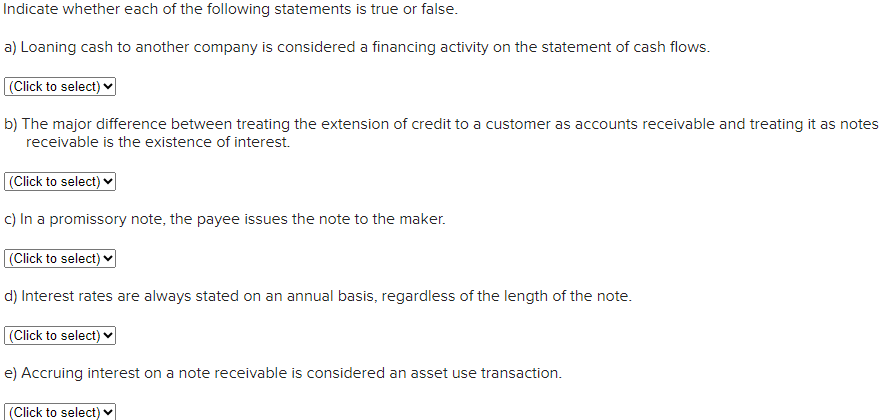

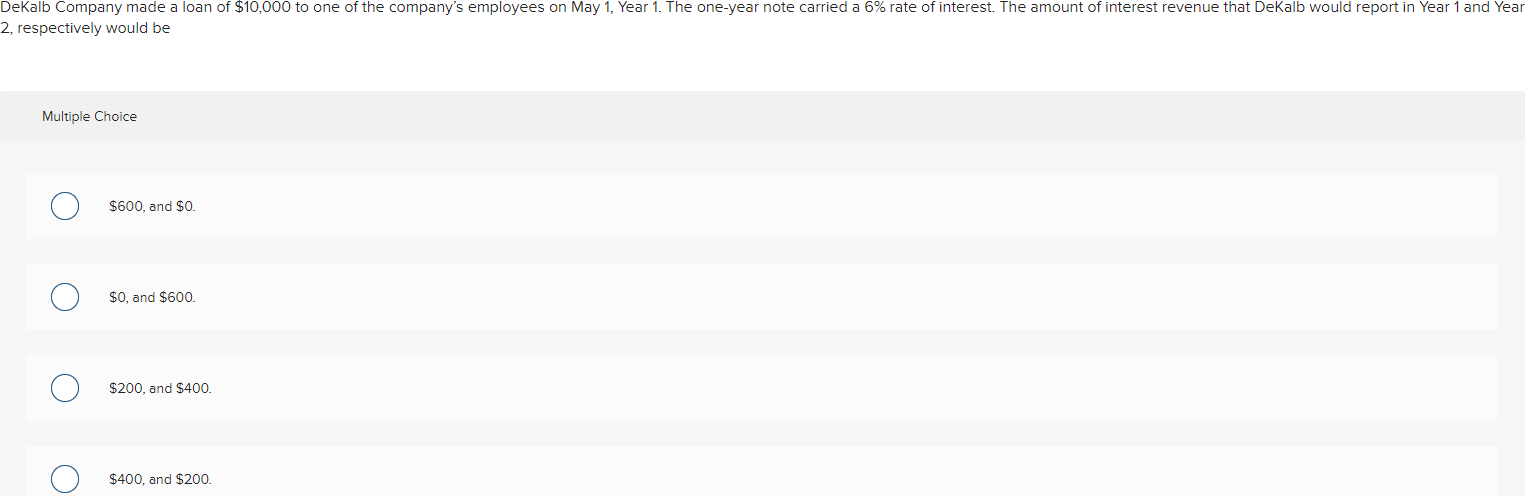

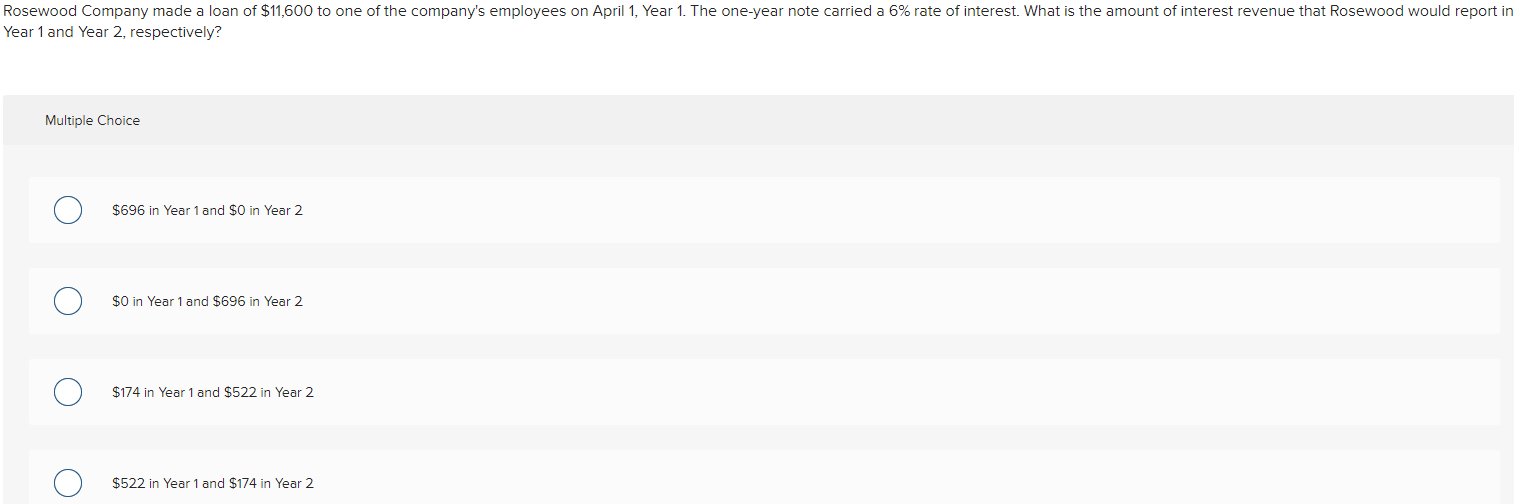

'ear 1 and Year 2, respectively? Multiple Choice $960 in Year 1 and $0 in Year 2 $0 in Year 1 and $960 in Year 2 $240 in Year 1 and \$720 in Year 2 $720 in Year 1 and $240 in Year 2 Indicate whether each of the following statements is true or false. a) Loaning cash to another company is considered a financing activity on the statement of cash flows. b) The major difference between treating the extension of credit to a customer as accounts receivable and treating it as notes receivable is the existence of interest. c) In a promissory note, the payee issues the note to the maker. d) Interest rates are always stated on an annual basis, regardless of the length of the note. e) Accruing interest on a note receivable is considered an asset use transaction. Year 1 and Year 2, respectively? Multiple Choice $696 in Year 1 and \$0 in Year 2 $0 in Year 1 and $696 in Year 2 $174 in Year 1 and \$522 in Year 2 $522 in Year 1 and $174 in Year 2 , respectively would be Multiple Choice $600, and \$0. $0, and $600. $200, and $400. $400, and $200. low from operating activities shown on Western's Year 2 financial statements would be: Multiple Choice $1,600 interest revenue and $2,400 cash inflow from operating activities. $800 interest revenue and zero cash inflow from operating activities. $1,600 interest revenue and zero cash inflow from operating activities. $800 interest revenue and $2,400 cash inflow from operating activities

'ear 1 and Year 2, respectively? Multiple Choice $960 in Year 1 and $0 in Year 2 $0 in Year 1 and $960 in Year 2 $240 in Year 1 and \$720 in Year 2 $720 in Year 1 and $240 in Year 2 Indicate whether each of the following statements is true or false. a) Loaning cash to another company is considered a financing activity on the statement of cash flows. b) The major difference between treating the extension of credit to a customer as accounts receivable and treating it as notes receivable is the existence of interest. c) In a promissory note, the payee issues the note to the maker. d) Interest rates are always stated on an annual basis, regardless of the length of the note. e) Accruing interest on a note receivable is considered an asset use transaction. Year 1 and Year 2, respectively? Multiple Choice $696 in Year 1 and \$0 in Year 2 $0 in Year 1 and $696 in Year 2 $174 in Year 1 and \$522 in Year 2 $522 in Year 1 and $174 in Year 2 , respectively would be Multiple Choice $600, and \$0. $0, and $600. $200, and $400. $400, and $200. low from operating activities shown on Western's Year 2 financial statements would be: Multiple Choice $1,600 interest revenue and $2,400 cash inflow from operating activities. $800 interest revenue and zero cash inflow from operating activities. $1,600 interest revenue and zero cash inflow from operating activities. $800 interest revenue and $2,400 cash inflow from operating activities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started