Question

7-54 CHAPTER 7 The Role of Financial Information in Valuation and Credit Risk Assessment 2. As of the end of 20x3,307 million common shares were

7-54\ CHAPTER 7 The Role of Financial Information in Valuation and Credit Risk Assessment\ 2. As of the end of

20x3,307million common shares were outstanding. Corvet your estimate in requirement 1 to a per share estimate. Do you expect that the actual market price would be similar to, above, or below the value you estimated?\ 3. Now assume the company will maintain a

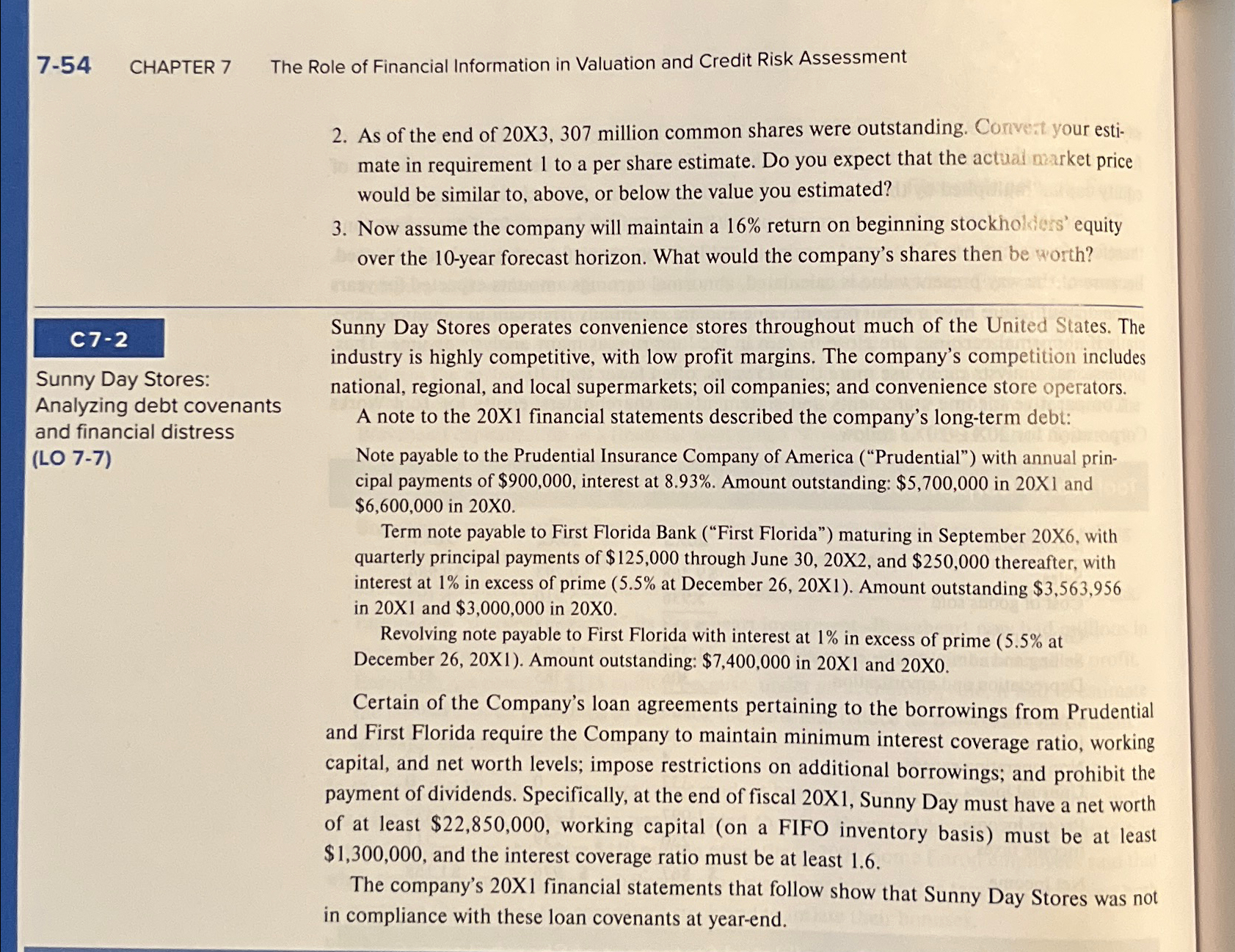

16%return on beginning stockholders' equity over the 10-year forecast horizon. What would the company's shares then be worth?\ C7-2\ Sunny Day Stores: Analyzing debt covenants and financial distress (LO 7-7)\ Sunny Day Stores operates convenience stores throughout much of the United States. The industry is highly competitive, with low profit margins. The company's competition includes national, regional, and local supermarkets; oil companies; and convenience store operators.\ A note to the 20X1 financial statements described the company's long-term debt:\ Note payable to the Prudential Insurance Company of America ("Prudential") with annual principal payments of

$900,000, interest at

8.93%. Amount outstanding:

$5,700,000in

(20)/(x)I and

$6,600,000in

20x0.\ Term note payable to First Florida Bank ("First Florida") maturing in September 20X6, with quarterly principal payments of

$125,000through June

30,20x2, and

$250,000thereafter, with interest at

1%in excess of prime (

5.5%at December

26,20x1). Amount outstanding

$3,563,956in

20x1and

$3,000,000in

20x0.\ Revolving note payable to First Florida with interest at

1%in excess of prime (

5.5%at December 26, 20X1). Amount outstanding: $7,400,000 in 20X1 and 20X0.\ Certain of the Company's loan agreements pertaining to the borrowings from Prudential and First Florida require the Company to maintain minimum interest coverage ratio, working capital, and net worth levels; impose restrictions on additional borrowings; and prohibit the payment of dividends. Specifically, at the end of fiscal 20X1, Sunny Day must have a net worth of at least

$22,850,000, working capital (on a FIFO inventory basis) must be at least

$1,300,000, and the interest coverage ratio must be at least 1.6 .\ The company's 20X1 financial statements that follow show that Sunny Day Stores was not in compliance with these loan covenants at year-end.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started