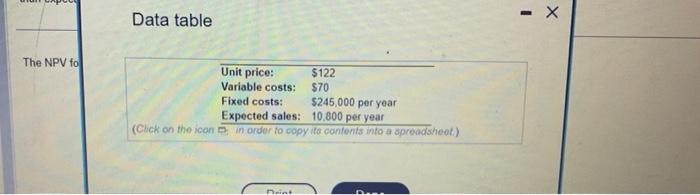

(Related to Checkpolint 13.3) (Scenario analysis) Family Security is considering introducing tiny GPS trackers that can be inserted in tho sole of a childs shoe, which would then alow for the tracking of that child if he or she was ever lost or abductod. The estimates, that might be off by 11 percent (either atove or below). associated with this new product are shown here: Since this is a new product line, you are not confldent in your estimates and would tike to know how woll you will fare if your estimates on the items listed above are 11 percent higher or 11 percent lower than expected. Assume that this new product line will require an initial outlay of $1.03 million. with no working captal investment, and will last for 10 years, being doprociated down to zero using straight-line depreciatlan. In addition, the firm's required rate of retum or cost of capital is 10.1 percent, and the firm's marginal tax rate is 34 percent. Calcilate the projecrs NPV under the Zest-case scenario" (that is, use the high estimates. - anit "price 11 percent above expected, variable costs 11 percent less than expected, fred costs 11 percent less than expected, and expected sales 11 percent more than expected) Calculate the projecrs NPV under the "worst-case scenario * The NPV for the beat-case scenario will be f (Round to the nearest dollar.) Data table (Related to Checkpolint 13.3) (Scenario analysis) Family Security is considering introducing tiny GPS trackers that can be inserted in tho sole of a childs shoe, which would then alow for the tracking of that child if he or she was ever lost or abductod. The estimates, that might be off by 11 percent (either atove or below). associated with this new product are shown here: Since this is a new product line, you are not confldent in your estimates and would tike to know how woll you will fare if your estimates on the items listed above are 11 percent higher or 11 percent lower than expected. Assume that this new product line will require an initial outlay of $1.03 million. with no working captal investment, and will last for 10 years, being doprociated down to zero using straight-line depreciatlan. In addition, the firm's required rate of retum or cost of capital is 10.1 percent, and the firm's marginal tax rate is 34 percent. Calcilate the projecrs NPV under the Zest-case scenario" (that is, use the high estimates. - anit "price 11 percent above expected, variable costs 11 percent less than expected, fred costs 11 percent less than expected, and expected sales 11 percent more than expected) Calculate the projecrs NPV under the "worst-case scenario * The NPV for the beat-case scenario will be f (Round to the nearest dollar.) Data table