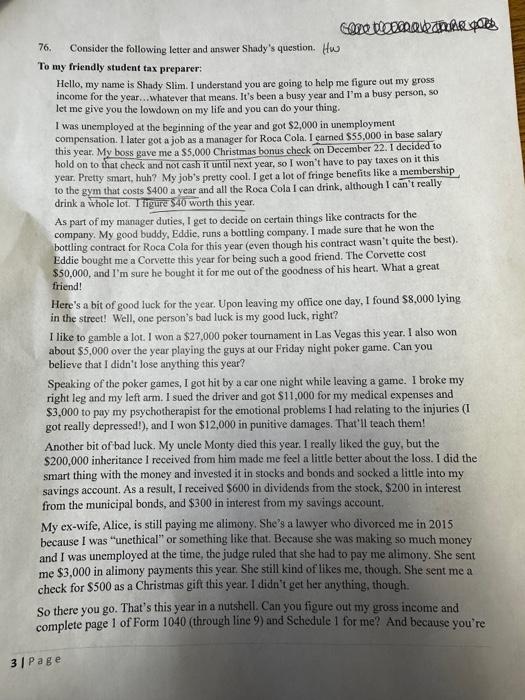

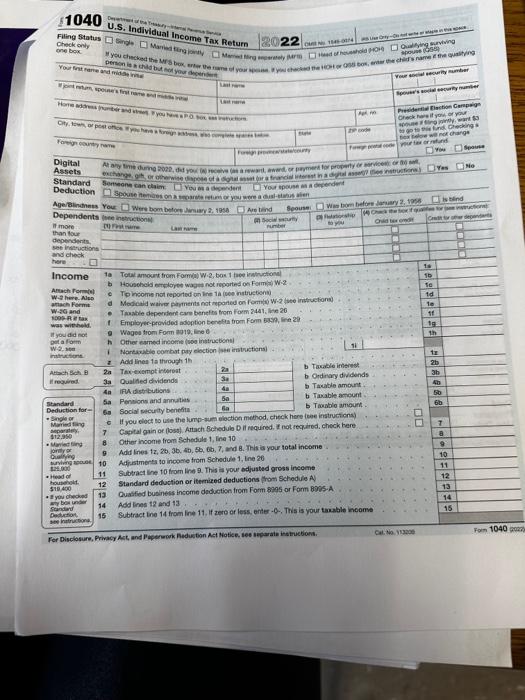

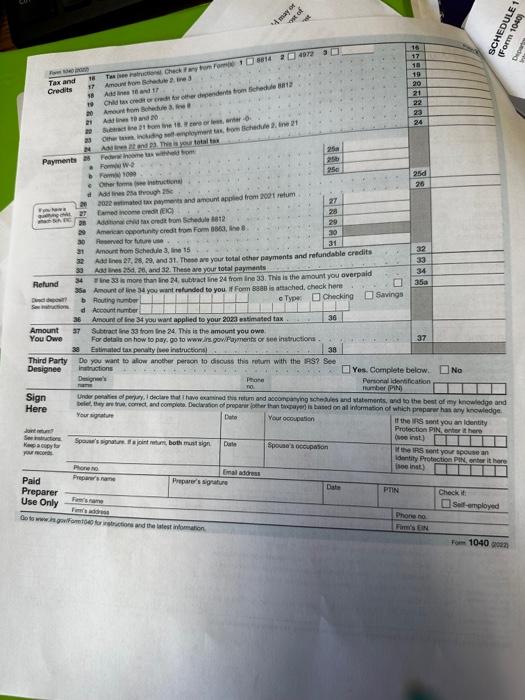

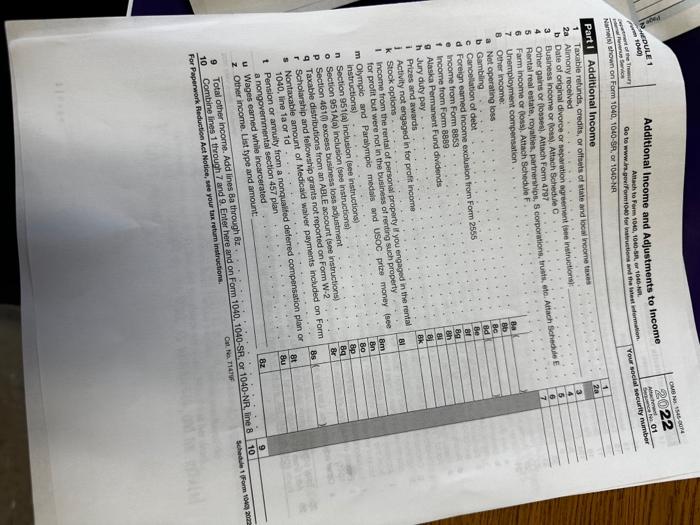

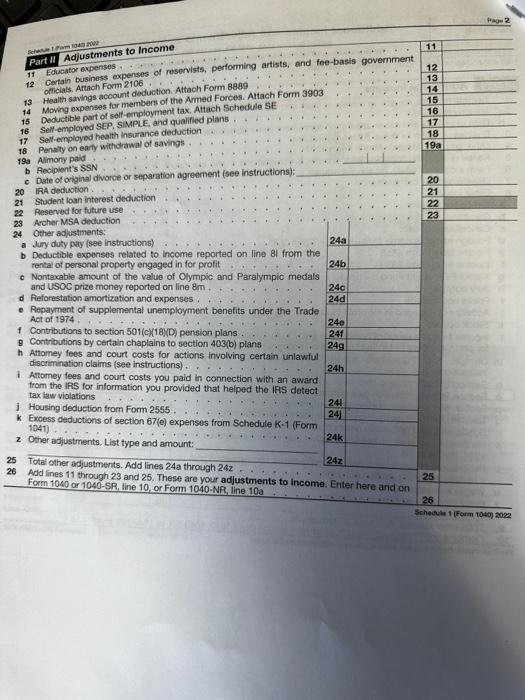

76. Consider the following letter and answer Shady's question. Hw To my friendly student tax preparer: Hello, my name is Shady Slim. I understand you are going to help me figure out my gross income for the year... whatever that means. It's been a busy year and I' m a busy person, so let me give you the lowdown on my life and you can do your thing. I was unemployed at the beginning of the year and got $2,000 in unemployment compensation. 1 later got a job as a manager for Roca Cola. 1 earned $55,000 in base salary this year. My boss gave me a $5,000 Christmas bonus check on December 22.1 decided to hold on to that check and not cash it until next year, so I won't have to pay taxes on it this year. Pretty smart, huh? My job's pretty cool. I get a lot of fringe benefits like a membership to the gym that costs $400 a year and all the Roca Cola I can drink, although I can't really drink a whole lot, Ifigure $40 worth this year. As part of my munager duties, I get to decide on certain things like contracts for the company. My good buddy, Eddie, runs a bottling company. I made sure that he won the bottling contract for Roca Cola for this year (even though his contract wasn't quite the best). Eddie bought me a Corvette this year for being such a good friend. The Corvette cost $50,000, and I'm sure he bought it for me out of the goodness of his heart. What a great friend! Here's a bit of good luck for the year. Upon leaving my office one day, I found $8,000 lying in the street! Well, one person's bad luck is my good luck, right? I like to gamble a lot. I won a $27,000 poker toumament in Las Vegas this year. I also won about \$5,000 over the year playing the guys at our Friday night poker game. Can you believe that I didn't lose anything this year? Speaking of the poker games, I got hit by a car one night while leaving a game. I broke my right leg and my left arm. I sued the driver and got $11,000 for my medical expenses and $3,000 to pay my psychotherapist for the emotional problems I had relating to the injuries (I got really depressed!), and I won $12,000 in punitive damages. That'll teach them! Another bit of bad luck. My unele Monty died this year. I really liked the guy, but the $200,000 inheritance I received from him made me feel a little better about the loss. I did the smart thing with the money and invested it in stocks and bonds and socked a little into my savings account. As a result, I received $600 in dividends from the stock, $200 in interest from the municipal bonds, and $300 in interest from my savings account. My ex-wife, Alice, is still paying me alimony. She's a lawyer who divoreed me in 2015 because I was "unethical" or something like that. Because she was making so much money and I was unemployed at the time, the judge ruled that she had to pay me alimony. She sent me $3,000 in alimony payments this year. She still kind of likes me, though. She sent me a check for $500 as a Christmas gift this year. I didn't get her anything, though. So there you go. That's this year in a nutshell. Can you figure out my gross income and complete page 1 of Form 1040 (through line 9) and Schedule 1 for me? And because you're ge cot.tion 1000 Fon 1040 ene Hags 2 Part II Adjustments to Income if Educator expenses 12 Cortain business expenses of reservists, performing artists, and foe-basis government 13 Moalth savings account deduction. Attach forpenses for members of the Amed Forces. Attach Form 3903 15. Deductible part of self-employment tax. Attach Schedule SE 16 Sell-employed SEP, SIMPL.E, and qualified plans 17 Selt-employed health insurance deduction 18 Penalty on earty withdrawal of savings 19a Almony paid. b Aeciplent's SSN c Date of ariginal divorce or separation agreement (see instructions): 20 IRA deduction. 21 Student loan interest deduction 22 Reserved lor future use 23 Avcher MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line at from the rental of personal property engaged in for profit c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m. d Reforestation amortization and expenses . - Repayment of supplemental unemployment benefits under the Trade Act of 1974 f Contributions to section 501 (c)(18)(D) pension plans . g. Contributions by certain chaplains to section 403(b) plans h Attomey fees and court costs for actions involving certain unlawful discrimination claims (see instructions). i Attomey fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IFS detect tax law violations i. Housing deduction from Form 2555 k Exoess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount: 25 Total other adjustments. Add lines 24a through 24z 26 Add lines 11 through 23 and 25 . These are your adjustments to income. Enter here and on Form 1040 or 1040 -SR, line 10, or Form 1040-NR, line 10a Schectule 1 (Form 1040) 2022 a student, this is free, right? Thanks. I owe you one! Let me know if I can get you a sixpack of Roca Cola or something. (is, gPULE 1 Additional Income and Adjustments to Income Anach to form 1040, 1040-58. or 1046-kh. it of the Timentr Anach to Fons 1040, 1040-59h, or 1946-kh. Your social socurity curmber Part 1 Additional Income 1 Taxable refunds, credis, or olfeds of state and local hoorne taxes 23 Alimorvy recelved 3 Business income or (coss). Attach Schedula C 5 Rerkal real estate, royalties. partnerarige, 8 dy 6 Farm income or (0osis). Attach Scto 7 Unemployment a. Not operating loss b Gambling c Cancellution of debt d Foreign eamed income exclusion from form 2555 - income trom Form 8853 . 1 income from Form 8889 g. Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards i. Activity not engaged in for profit income K Stock options i income trom the rental of persondi property if you engaged in the rent. for profit but were not in the business al rend USOC prize money m Olympic and Paralympic medais instructions) n Section 951(a) inclusion (see instructions) - Section 951 A(a) inclusion (3ese insuructidjustrvent p. Section 461 (1) exceess business a Taxable distributions from an Aate accoum not repod on Form W-2 r. Scholarship and fellowship grants not repon payments included on For s Nontaxable amount of Medicasd.................. compensation plan or t Pension or annuity from a nonqualited a nongovernmental section 45 inced u. Wages earned whise type and amount: z Other income. Ust sype and a through Bz. 10 Combine lines 1 theough 7 and 9 . Ene restum instructions. 76. Consider the following letter and answer Shady's question. Hw To my friendly student tax preparer: Hello, my name is Shady Slim. I understand you are going to help me figure out my gross income for the year... whatever that means. It's been a busy year and I' m a busy person, so let me give you the lowdown on my life and you can do your thing. I was unemployed at the beginning of the year and got $2,000 in unemployment compensation. 1 later got a job as a manager for Roca Cola. 1 earned $55,000 in base salary this year. My boss gave me a $5,000 Christmas bonus check on December 22.1 decided to hold on to that check and not cash it until next year, so I won't have to pay taxes on it this year. Pretty smart, huh? My job's pretty cool. I get a lot of fringe benefits like a membership to the gym that costs $400 a year and all the Roca Cola I can drink, although I can't really drink a whole lot, Ifigure $40 worth this year. As part of my munager duties, I get to decide on certain things like contracts for the company. My good buddy, Eddie, runs a bottling company. I made sure that he won the bottling contract for Roca Cola for this year (even though his contract wasn't quite the best). Eddie bought me a Corvette this year for being such a good friend. The Corvette cost $50,000, and I'm sure he bought it for me out of the goodness of his heart. What a great friend! Here's a bit of good luck for the year. Upon leaving my office one day, I found $8,000 lying in the street! Well, one person's bad luck is my good luck, right? I like to gamble a lot. I won a $27,000 poker toumament in Las Vegas this year. I also won about \$5,000 over the year playing the guys at our Friday night poker game. Can you believe that I didn't lose anything this year? Speaking of the poker games, I got hit by a car one night while leaving a game. I broke my right leg and my left arm. I sued the driver and got $11,000 for my medical expenses and $3,000 to pay my psychotherapist for the emotional problems I had relating to the injuries (I got really depressed!), and I won $12,000 in punitive damages. That'll teach them! Another bit of bad luck. My unele Monty died this year. I really liked the guy, but the $200,000 inheritance I received from him made me feel a little better about the loss. I did the smart thing with the money and invested it in stocks and bonds and socked a little into my savings account. As a result, I received $600 in dividends from the stock, $200 in interest from the municipal bonds, and $300 in interest from my savings account. My ex-wife, Alice, is still paying me alimony. She's a lawyer who divoreed me in 2015 because I was "unethical" or something like that. Because she was making so much money and I was unemployed at the time, the judge ruled that she had to pay me alimony. She sent me $3,000 in alimony payments this year. She still kind of likes me, though. She sent me a check for $500 as a Christmas gift this year. I didn't get her anything, though. So there you go. That's this year in a nutshell. Can you figure out my gross income and complete page 1 of Form 1040 (through line 9) and Schedule 1 for me? And because you're ge cot.tion 1000 Fon 1040 ene Hags 2 Part II Adjustments to Income if Educator expenses 12 Cortain business expenses of reservists, performing artists, and foe-basis government 13 Moalth savings account deduction. Attach forpenses for members of the Amed Forces. Attach Form 3903 15. Deductible part of self-employment tax. Attach Schedule SE 16 Sell-employed SEP, SIMPL.E, and qualified plans 17 Selt-employed health insurance deduction 18 Penalty on earty withdrawal of savings 19a Almony paid. b Aeciplent's SSN c Date of ariginal divorce or separation agreement (see instructions): 20 IRA deduction. 21 Student loan interest deduction 22 Reserved lor future use 23 Avcher MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line at from the rental of personal property engaged in for profit c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m. d Reforestation amortization and expenses . - Repayment of supplemental unemployment benefits under the Trade Act of 1974 f Contributions to section 501 (c)(18)(D) pension plans . g. Contributions by certain chaplains to section 403(b) plans h Attomey fees and court costs for actions involving certain unlawful discrimination claims (see instructions). i Attomey fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IFS detect tax law violations i. Housing deduction from Form 2555 k Exoess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount: 25 Total other adjustments. Add lines 24a through 24z 26 Add lines 11 through 23 and 25 . These are your adjustments to income. Enter here and on Form 1040 or 1040 -SR, line 10, or Form 1040-NR, line 10a Schectule 1 (Form 1040) 2022 a student, this is free, right? Thanks. I owe you one! Let me know if I can get you a sixpack of Roca Cola or something. (is, gPULE 1 Additional Income and Adjustments to Income Anach to form 1040, 1040-58. or 1046-kh. it of the Timentr Anach to Fons 1040, 1040-59h, or 1946-kh. Your social socurity curmber Part 1 Additional Income 1 Taxable refunds, credis, or olfeds of state and local hoorne taxes 23 Alimorvy recelved 3 Business income or (coss). Attach Schedula C 5 Rerkal real estate, royalties. partnerarige, 8 dy 6 Farm income or (0osis). Attach Scto 7 Unemployment a. Not operating loss b Gambling c Cancellution of debt d Foreign eamed income exclusion from form 2555 - income trom Form 8853 . 1 income from Form 8889 g. Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards i. Activity not engaged in for profit income K Stock options i income trom the rental of persondi property if you engaged in the rent. for profit but were not in the business al rend USOC prize money m Olympic and Paralympic medais instructions) n Section 951(a) inclusion (see instructions) - Section 951 A(a) inclusion (3ese insuructidjustrvent p. Section 461 (1) exceess business a Taxable distributions from an Aate accoum not repod on Form W-2 r. Scholarship and fellowship grants not repon payments included on For s Nontaxable amount of Medicasd.................. compensation plan or t Pension or annuity from a nonqualited a nongovernmental section 45 inced u. Wages earned whise type and amount: z Other income. Ust sype and a through Bz. 10 Combine lines 1 theough 7 and 9 . Ene restum instructions