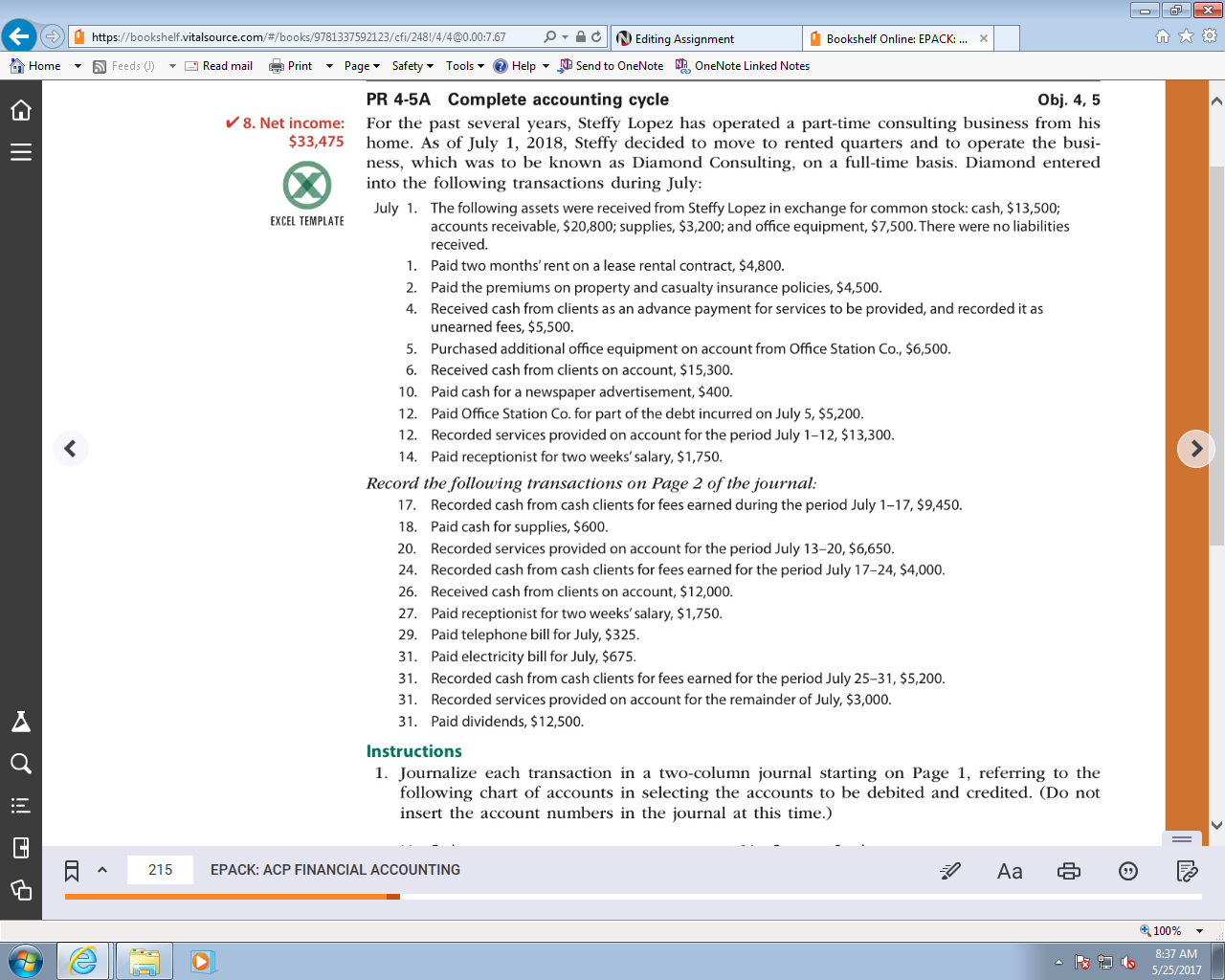

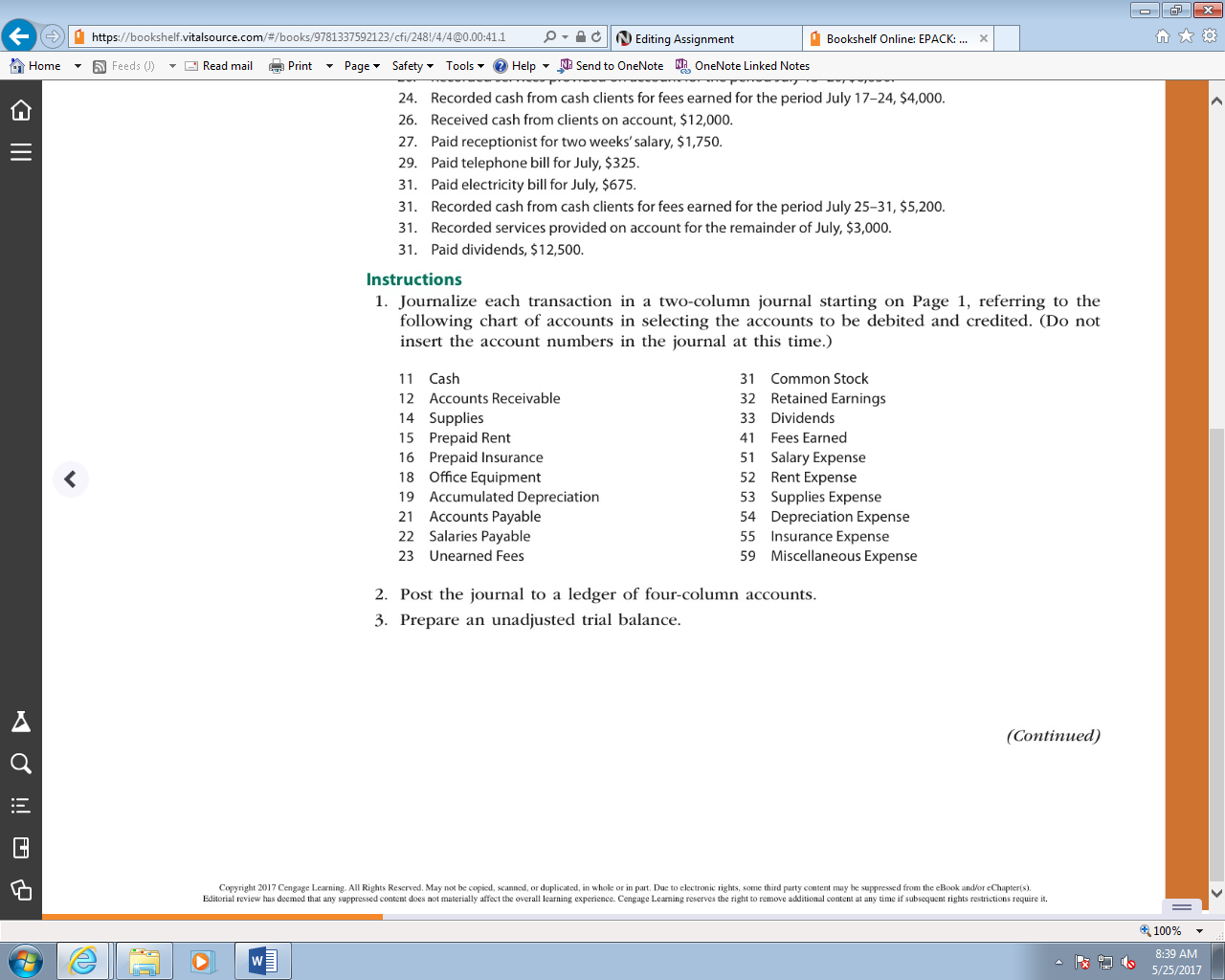

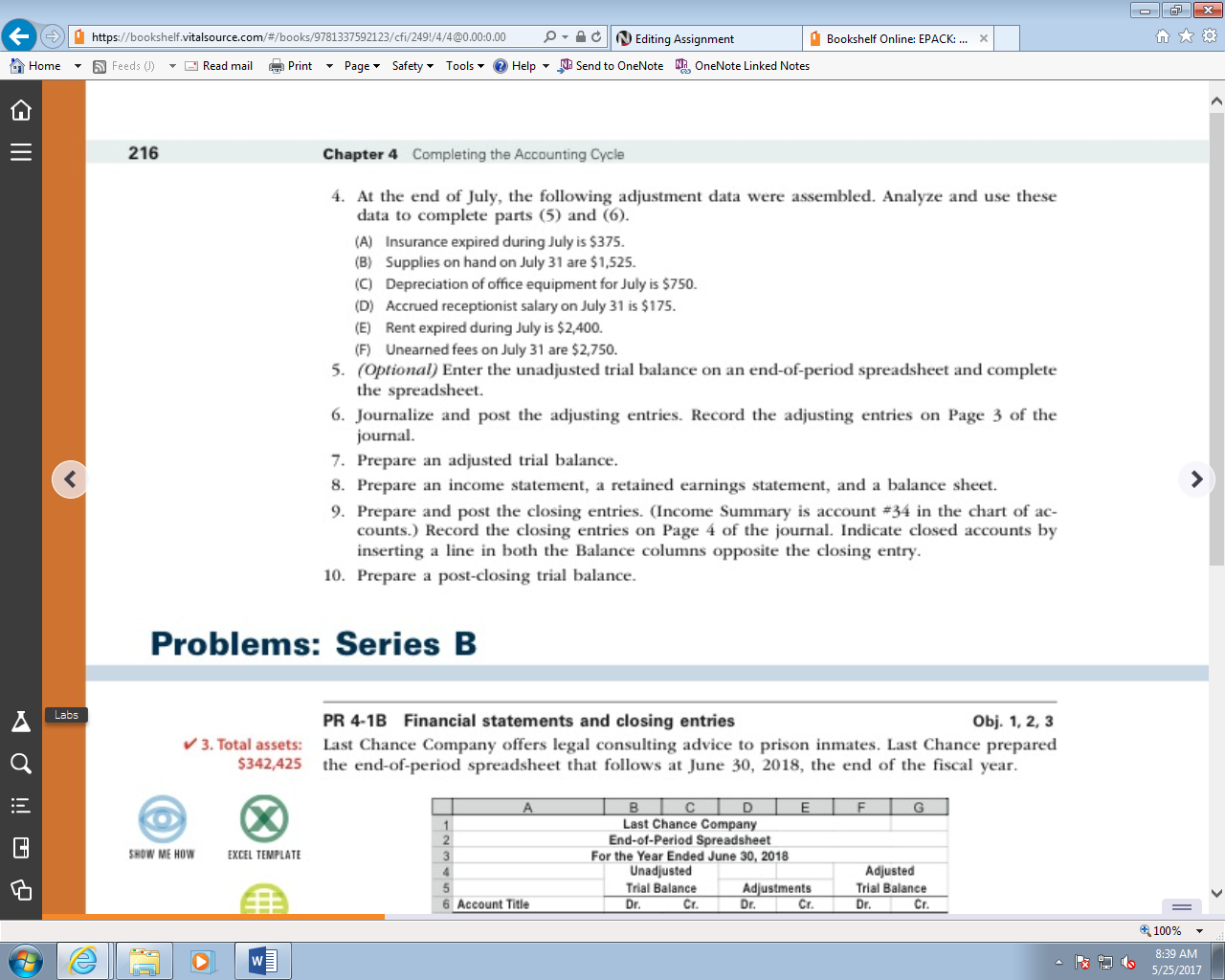

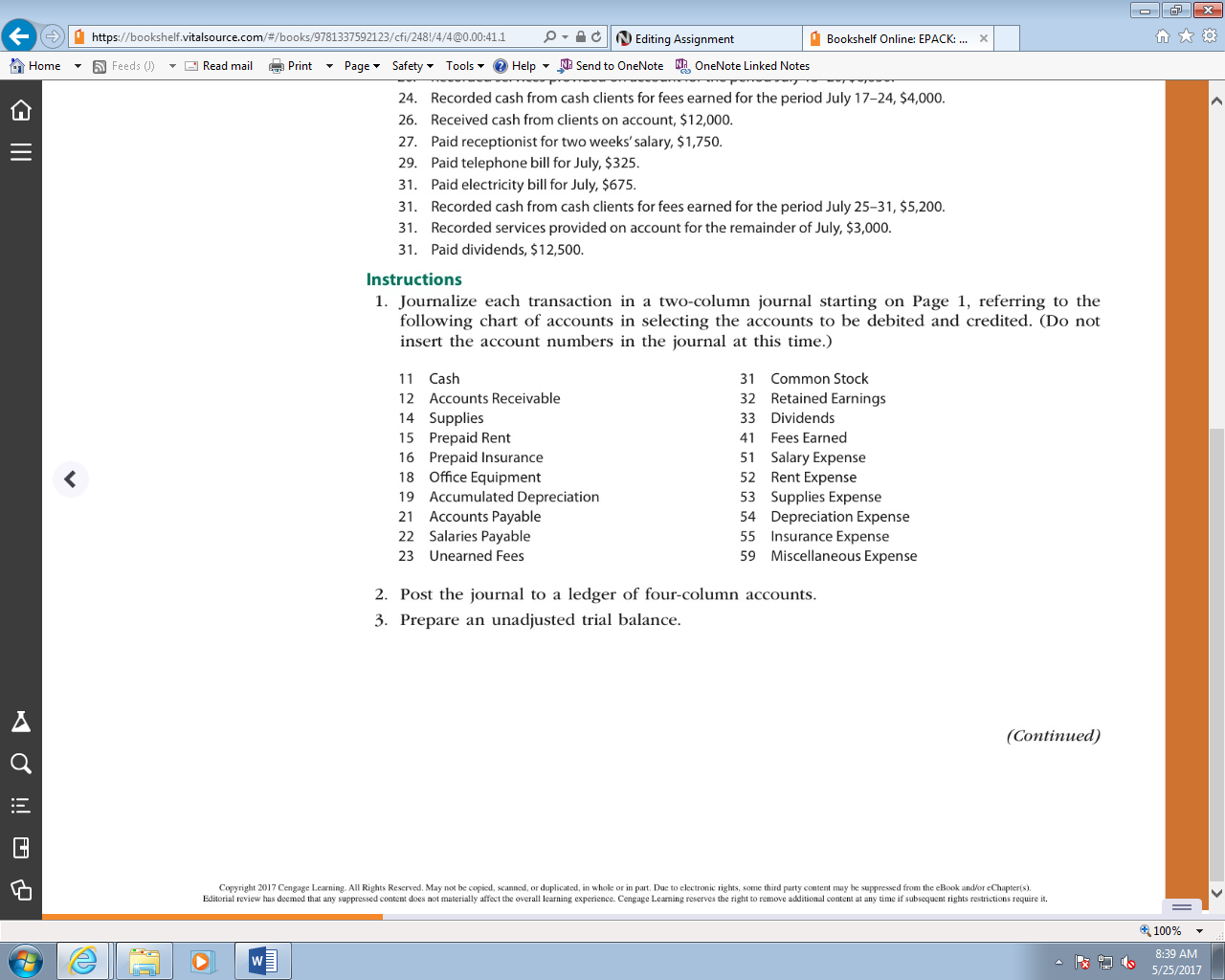

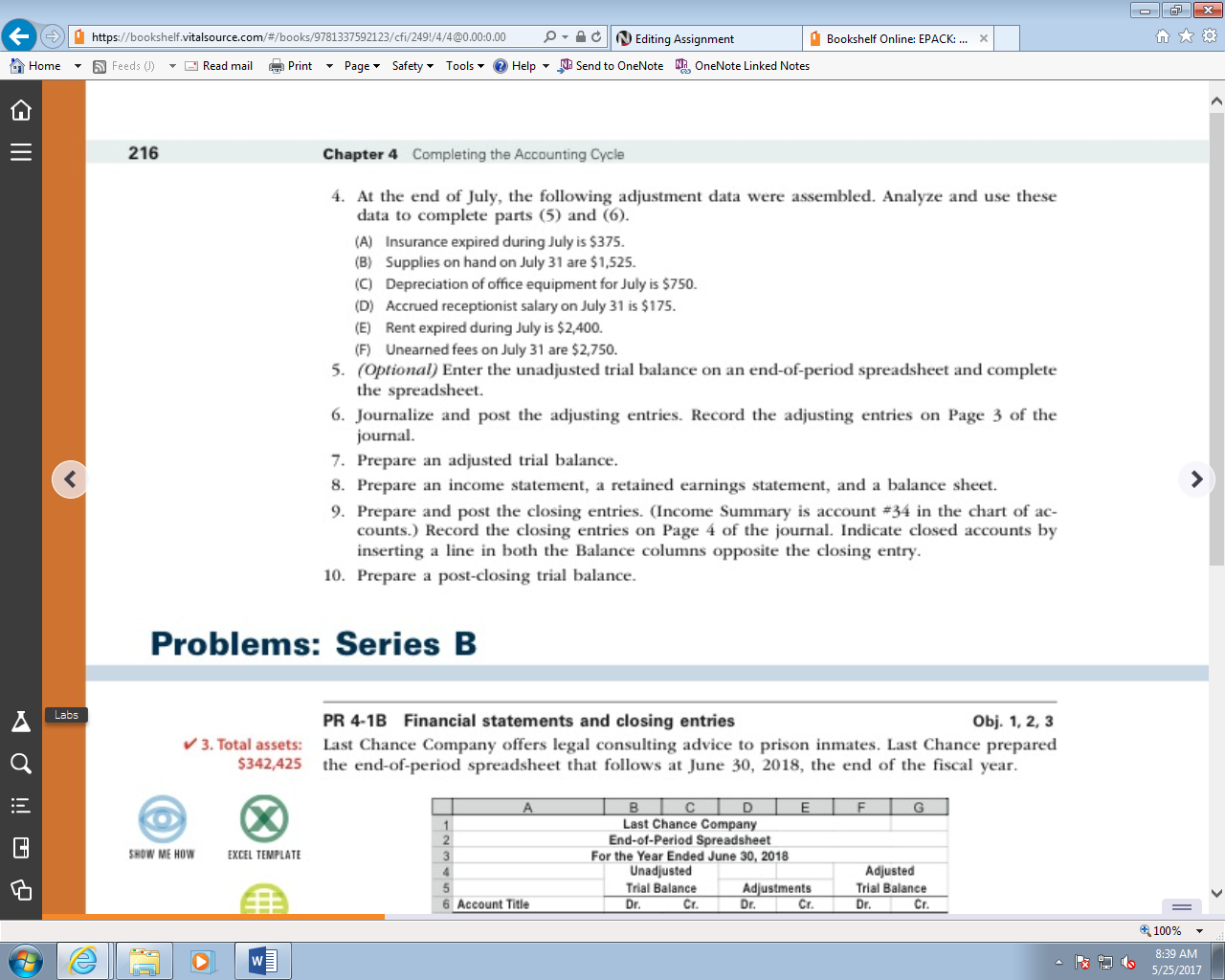

7.67 C Editing Assignment Bookshelf online: EPACK italsource.com/ Read mail Print Pag Safety Tools Help NB Send to OneNote NR, OneNote Linked Notes PR 4-5A Complete accounting cycle Obi. 4, 5 8. Net income For the past several years, Steffy Lopez has operated a part-time consulting business from his $33,475 home. As of July 1, 2018, Steffy decided to move to rented quarters and to operate the busi- ness, which was to be known as Diamond Consulting, on a full-time basis. Diamond entered into the following transactions during July: July 1. The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,500; EXCEL TEMPLATE accounts receivable, $20,800; supplies, $3,200; and office equipment, $7,500. There were no liabilities received 1. Paid two months' rent on a lease rental contract, $4,800 2. Paid the premiums on property and casualty insurance policies, $4500. 4. Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,500 5. Purchased additional office equipment on account from Office Station Co., $6,500 6. Received cash from clients on account, $15,300 10. Paid cash for a newspaper advertisement, $400 2. Paid Office Station Co. for part of the debt incurred on July 5, $5,200 12. Recorded services provided on account for the period July 1-12, $13,300 14. Paid receptionist for two weeks' salary, $1,750 Record the following transactions on Page 2 of the journal Recorded cash from cash clients for fees earned during the period July 7, $9,450. 17 18. Paid cash for supplies, $600 20. Recorded services provided on account for the period July 13-20, $6,650 24. Recorded cash from cash clients for fees earned for the period July 17-24, $4,000 26. Received cash from clients on account, $12,000 27. Paid receptionist for two weeks' salary, $1,750 29. Paid telephone bill for July, $325 31. Paid electricity bill for July, $675 31. Recorded cash from cash clients for fees earned for the period July 25-31, $5,200 31. Recorded services provided on account for the remainder of July, $3,000 31. Paid dividends, $12,500 Instructions 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) EPACK: ACP FINANCIAL ACCOUNTING Aa 215 100% 8:37 AM 5/25/2017