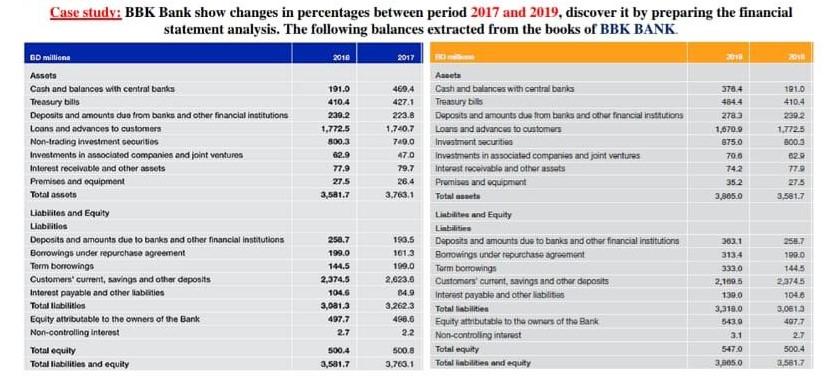

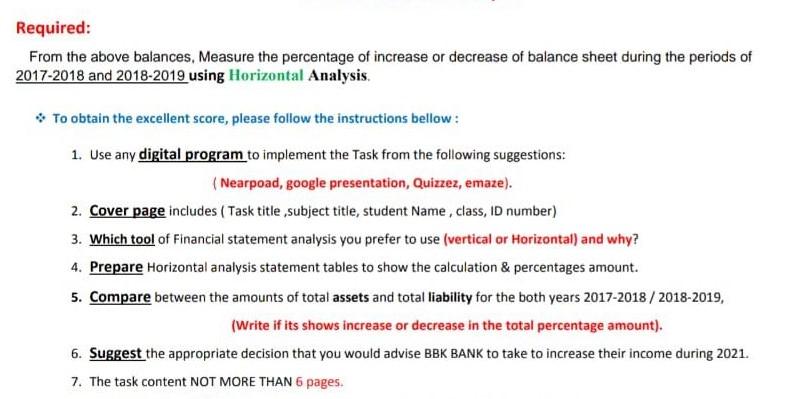

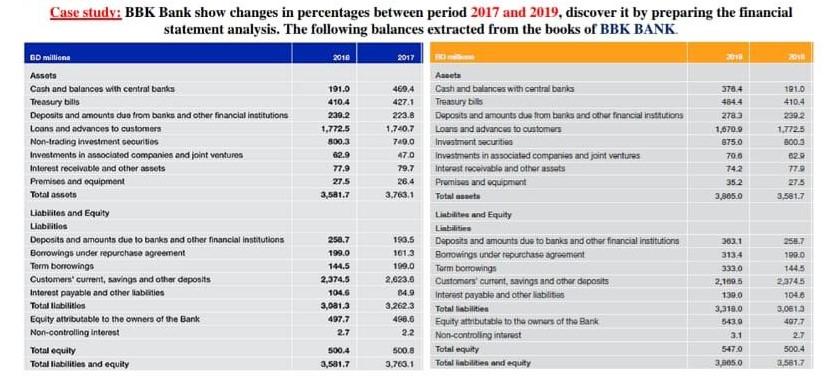

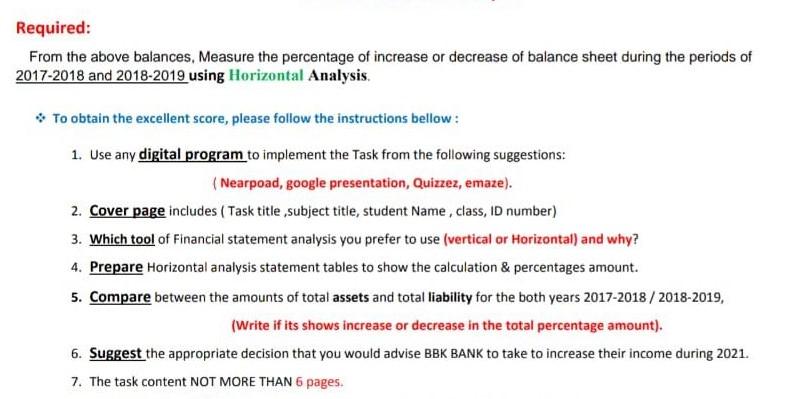

77.9 Case study: BBK Bank show changes in percentages between period 2017 and 2019, discover it by preparing the financial statement analysis. The following balances extracted from the books of BBK BANK. BD million 2010 2017 Assets Aneta Cash and balances with centrat banks 191.0 489.4 Cash and balances with central banks 3704 101.0 Treasury bilis 4104 4271 Treasury bits 454.4 410.4 Deposits and amounts duo from banks and other financial institutions 229.2 223.8 Deposits and amounts due from banks and other financial institions 2783 239.2 Loans and advances to customers 1.772.5 1.740.7 Loans and advances to customers 1,070 1.772.5 Non-trading investment securities 800.3 749.0 Investment securities 875.0 6003 Investments in associated companies and joint ventures 02.9 470 Investments in associated companies and joint ventures 700 829 Interest receivable and other assets 79.7 Interest receivable and other assets 742 779 Premises and equipment 27.5 Promises and equipment 35.2 27.5 Total assots 3,581.7 3,763,1 Total met 3,805.0 3,5817 Lioblites and Equity Liabilis and Equity Liabilities Libilities Deposits and amounts due to banks and other financial institutions 25.7 199,5 Deposits and amounts due to bunis and other financial institutions 3031 2587 Borrowings under repurchase agreement 199.0 161.3 Bonowings under repurchase agreement 3134 100D Term borrowings 144.5 199.0 Torm bomowings 3330 1445 Customers current, savings and other deposits 2,374.5 2,623.6 Customers current, savings and other deposits 2,1995 2.3745 Interest payable and other liabities 104.6 14.9 Interest payable and other liabilities 139.0 1046 Total liabilities 3,081.3 3.2623 Total abilities 3,310.0 3,0613 Equity attributable to the owners of the Bank 497.7 498,6 Equity attributable to the owners of the Bank 543.0 4077 Non-controlling interest 2.7 2.2 Non-controling interest 3.1 2.7 Total equity 500.4 500.8 Total equity 5470 500.4 Total liabilities and equity 3.501.7 3.760.1 Total liabilities and equity 3.005.0 3.581.7 Required: From the above balances, Measure the percentage of increase or decrease of balance sheet during the periods of 2017-2018 and 2018-2019 using Horizontal Analysis, To obtain the excellent score, please follow the instructions below: 1. Use any digital program to implement the Task from the following suggestions: (Nearpoad, google presentation, Quizzez, emaze). 2. Cover page includes (Task title ,subject title, student Name, class, ID number) 3. Which tool of Financial statement analysis you prefer to use (vertical or Horizontal) and why? 4. Prepare Horizontal analysis statement tables to show the calculation & percentages amount. 5. Compare between the amounts of total assets and total liability for the both years 2017-2018 / 2018-2019, (Write if its shows increase or decrease in the total percentage amount). 6. Suggest the appropriate decision that you would advise BBK BANK to take to increase their income during 2021. 7. The task content NOT MORE THAN 6 pages. 77.9 Case study: BBK Bank show changes in percentages between period 2017 and 2019, discover it by preparing the financial statement analysis. The following balances extracted from the books of BBK BANK. BD million 2010 2017 Assets Aneta Cash and balances with centrat banks 191.0 489.4 Cash and balances with central banks 3704 101.0 Treasury bilis 4104 4271 Treasury bits 454.4 410.4 Deposits and amounts duo from banks and other financial institutions 229.2 223.8 Deposits and amounts due from banks and other financial institions 2783 239.2 Loans and advances to customers 1.772.5 1.740.7 Loans and advances to customers 1,070 1.772.5 Non-trading investment securities 800.3 749.0 Investment securities 875.0 6003 Investments in associated companies and joint ventures 02.9 470 Investments in associated companies and joint ventures 700 829 Interest receivable and other assets 79.7 Interest receivable and other assets 742 779 Premises and equipment 27.5 Promises and equipment 35.2 27.5 Total assots 3,581.7 3,763,1 Total met 3,805.0 3,5817 Lioblites and Equity Liabilis and Equity Liabilities Libilities Deposits and amounts due to banks and other financial institutions 25.7 199,5 Deposits and amounts due to bunis and other financial institutions 3031 2587 Borrowings under repurchase agreement 199.0 161.3 Bonowings under repurchase agreement 3134 100D Term borrowings 144.5 199.0 Torm bomowings 3330 1445 Customers current, savings and other deposits 2,374.5 2,623.6 Customers current, savings and other deposits 2,1995 2.3745 Interest payable and other liabities 104.6 14.9 Interest payable and other liabilities 139.0 1046 Total liabilities 3,081.3 3.2623 Total abilities 3,310.0 3,0613 Equity attributable to the owners of the Bank 497.7 498,6 Equity attributable to the owners of the Bank 543.0 4077 Non-controlling interest 2.7 2.2 Non-controling interest 3.1 2.7 Total equity 500.4 500.8 Total equity 5470 500.4 Total liabilities and equity 3.501.7 3.760.1 Total liabilities and equity 3.005.0 3.581.7 Required: From the above balances, Measure the percentage of increase or decrease of balance sheet during the periods of 2017-2018 and 2018-2019 using Horizontal Analysis, To obtain the excellent score, please follow the instructions below: 1. Use any digital program to implement the Task from the following suggestions: (Nearpoad, google presentation, Quizzez, emaze). 2. Cover page includes (Task title ,subject title, student Name, class, ID number) 3. Which tool of Financial statement analysis you prefer to use (vertical or Horizontal) and why? 4. Prepare Horizontal analysis statement tables to show the calculation & percentages amount. 5. Compare between the amounts of total assets and total liability for the both years 2017-2018 / 2018-2019, (Write if its shows increase or decrease in the total percentage amount). 6. Suggest the appropriate decision that you would advise BBK BANK to take to increase their income during 2021. 7. The task content NOT MORE THAN 6 pages