Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7,8, and 9 with work/explanation When you retire, you want to have a monthly income of $6,000. Your current salary is $75,008-and your employer offers

7,8, and 9 with work/explanation

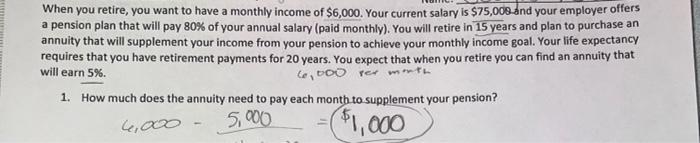

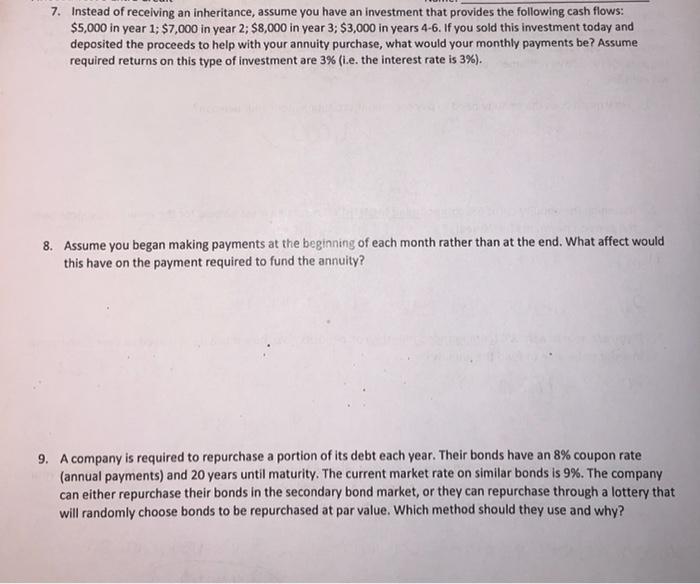

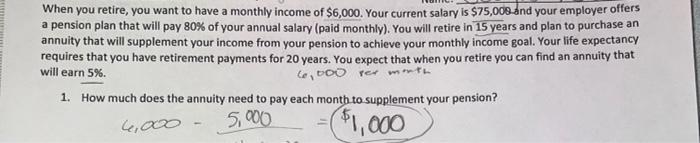

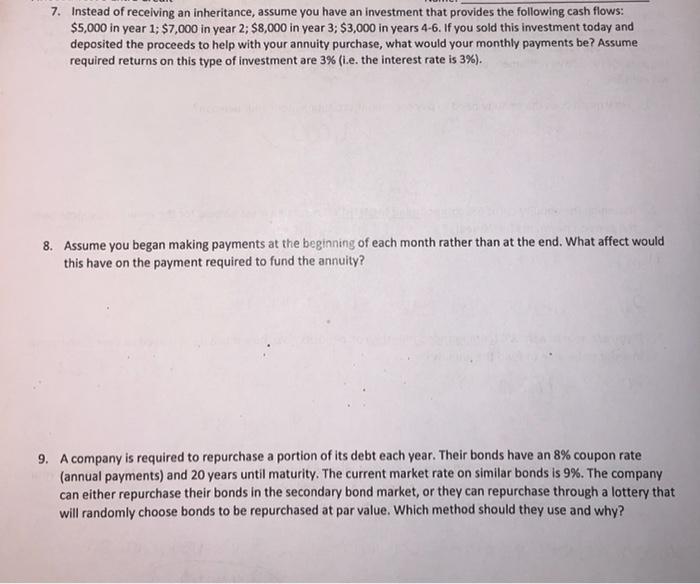

When you retire, you want to have a monthly income of $6,000. Your current salary is $75,008-and your employer offers a pension plan that will pay 80% of your annual salary (paid monthly). You will retire in 15 years and plan to purchase an annuity that will supplement your income from your pension to achieve your monthly income goal. Your life expectancy requires that you have retirement payments for 20 years. You expect that when you retire you can find an annuity that will earn 5%. 6, Doo rer month 1. How much does the annuity need to pay each month to supplement your pension? 6,000 5.000 =($1,000 7. Instead of receiving an inheritance, assume you have an investment that provides the following cash flows: $5,000 in year 1; $7,000 in year 2; $8,000 in year 3; $3,000 in years 4-6. If you sold this investment today and deposited the proceeds to help with your annuity purchase, what would your monthly payments be? Assume required returns on this type of investment are 3% (Le. the interest rate is 3%). 8. Assume you began making payments at the beginning of each month rather than at the end. What affect would this have on the payment required to fund the annuity? 9. A company is required to repurchase a portion of its debt each year. Their bonds have an 8% coupon rate (annual payments) and 20 years until maturity. The current market rate on similar bonds is 9%. The company can either repurchase their bonds in the secondary bond market, or they can repurchase through a lottery that will randomly choose bonds to be repurchased at par value. Which method should they use and why? When you retire, you want to have a monthly income of $6,000. Your current salary is $75,008-and your employer offers a pension plan that will pay 80% of your annual salary (paid monthly). You will retire in 15 years and plan to purchase an annuity that will supplement your income from your pension to achieve your monthly income goal. Your life expectancy requires that you have retirement payments for 20 years. You expect that when you retire you can find an annuity that will earn 5%. 6, Doo rer month 1. How much does the annuity need to pay each month to supplement your pension? 6,000 5.000 =($1,000 7. Instead of receiving an inheritance, assume you have an investment that provides the following cash flows: $5,000 in year 1; $7,000 in year 2; $8,000 in year 3; $3,000 in years 4-6. If you sold this investment today and deposited the proceeds to help with your annuity purchase, what would your monthly payments be? Assume required returns on this type of investment are 3% (Le. the interest rate is 3%). 8. Assume you began making payments at the beginning of each month rather than at the end. What affect would this have on the payment required to fund the annuity? 9. A company is required to repurchase a portion of its debt each year. Their bonds have an 8% coupon rate (annual payments) and 20 years until maturity. The current market rate on similar bonds is 9%. The company can either repurchase their bonds in the secondary bond market, or they can repurchase through a lottery that will randomly choose bonds to be repurchased at par value. Which method should they use and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started