Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7.84 A&B&C Please Do; A & B and C Some lenders charge an up-front fee on a loan, which is subtracted from what the borrower

7.84

A&B&C

Please Do; A & B and C

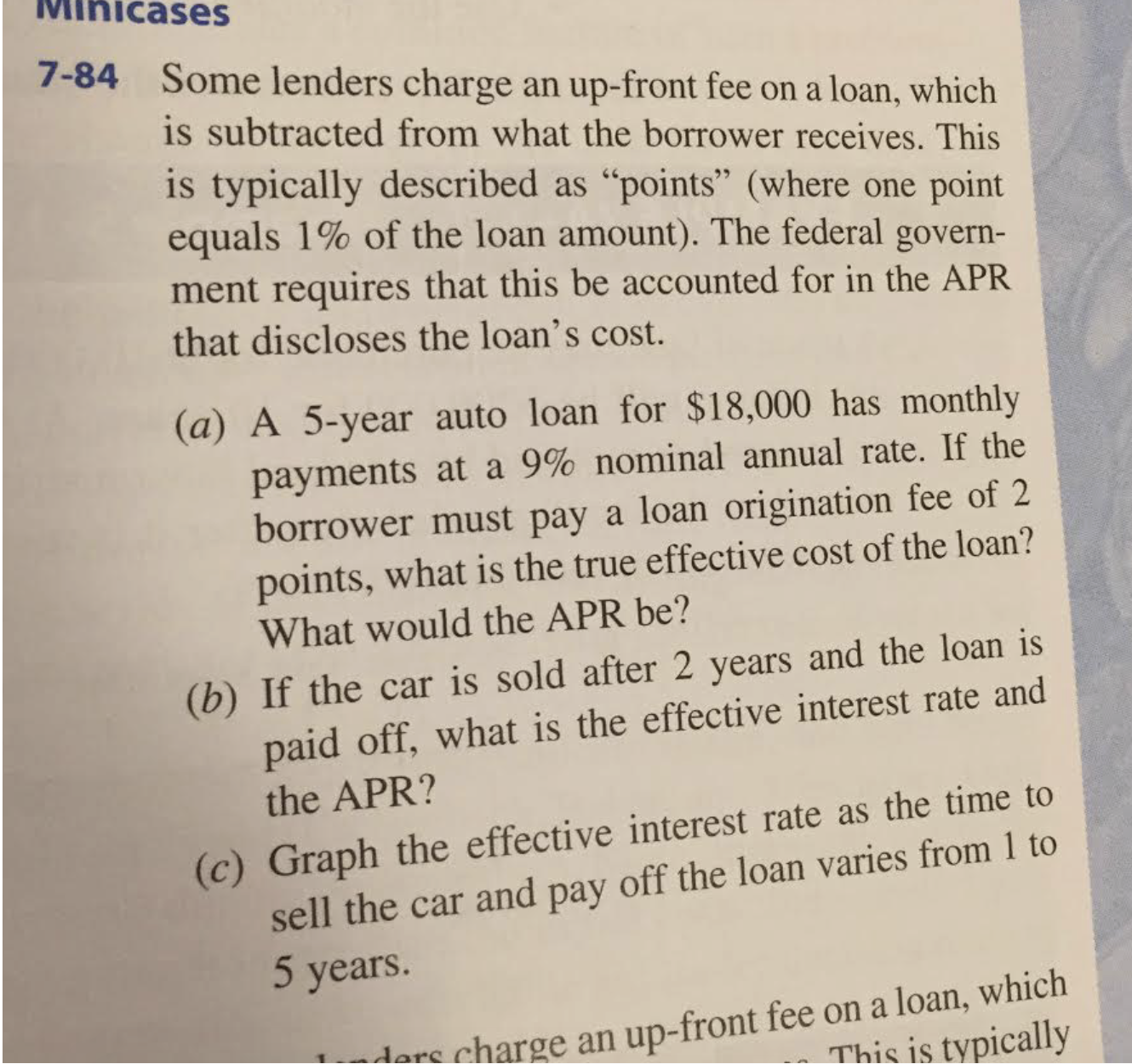

Some lenders charge an up-front fee on a loan, which is subtracted from what the borrower receives. This is typically described as "points" (where one point equals 1% of the loan amount). The federal government requires that this be accounted for in the APR that disclosed the loan's cost. A 5-Year auto loan for $18,000 has monthly payments at a 9% nominal annual rate. If the borrower must pay a loan origination fee or 2 points, what is the true effective cost of the loan? What would the APR be? If the car is sold after 2 years and the loan is paid off, what is the effective interest rate and the APR? Graph the effective interest rate as the time to sell the car and pay off the loan varies from 1 to 5 years. Some lenders charge an up-front fee on a loan, which is subtracted from what the borrower receives. This is typically described as "points" (where one point equals 1% of the loan amount). The federal government requires that this be accounted for in the APR that disclosed the loan's cost. A 5-Year auto loan for $18,000 has monthly payments at a 9% nominal annual rate. If the borrower must pay a loan origination fee or 2 points, what is the true effective cost of the loan? What would the APR be? If the car is sold after 2 years and the loan is paid off, what is the effective interest rate and the APR? Graph the effective interest rate as the time to sell the car and pay off the loan varies from 1 to 5 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started