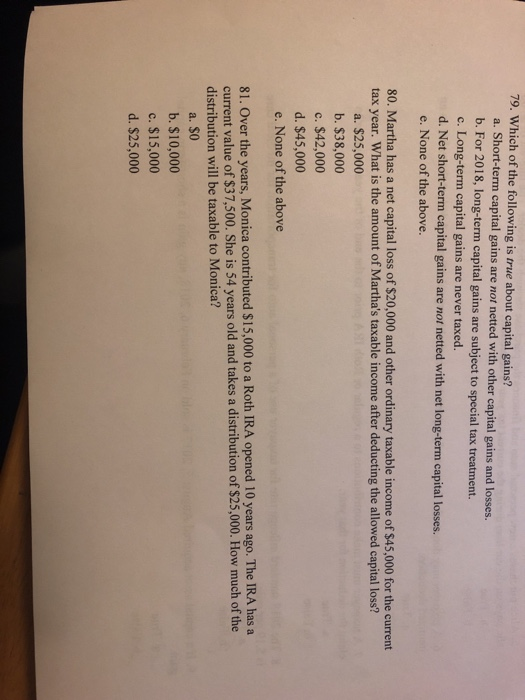

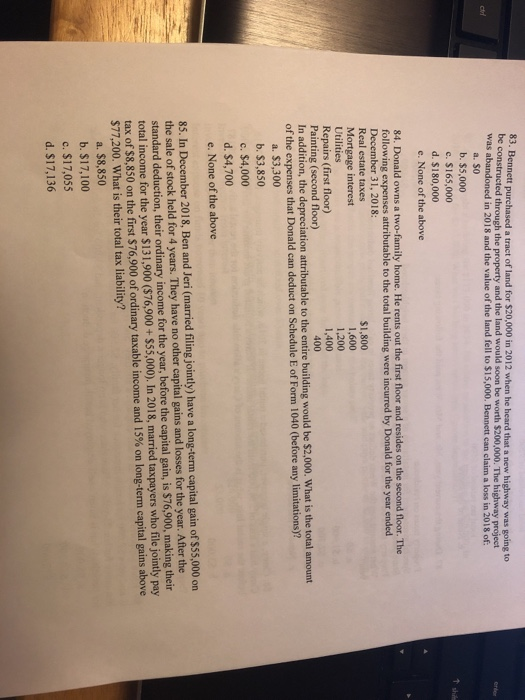

79. Which of the following is true about capital gains? a. Short-term capital gains are not netted with other capital gains and losses. b. For 2018, long-term capital gains are subject to special tax treatment. c. Long-term capital gains are never taxed. d. Net short-term capital gains are not netted with net long-term capital losses. e. None of the above. 80. Martha has a net capital loss of $20,000 and other ordinary taxable income of $45,000 for the current tax year. What is the amount of Martha's taxable income after deducting the allowed capital loss? a. $25,000 b. $38,000 c. $42,000 d. $45,000 e. None of the above 81. Over the years, Monica contributed $15,000 to a Roth IRA opened 10 years ago. The IRA has a current value of $37,500. She is 54 years old and takes a distribution of $25,000. How much of the distribution will be taxable to Monica? a. $O b. $10,000 c. $15,000 d. $25,000 83. Bennett purchased a tract of land for $20,000 in 2012 when he heard that a new highway was going to be constructed through the property and the land would soon be worth $200,000. The highway project was abandoned in 2018 and the value of the land fell to $15,000, Bennett can claim a loss in 2018 of a. $0 b. $5,000 c. $165,000 d. $180,000 e. None of the above 84. Donald owns a two-family home. He rents out the first floor and resides on the second floor. The following expenses attributable to the total building were incurred by Donald for the year ended December 31, 2018: Real estate taxes Mortgage interest Utilities Repairs (first floor) Painting (second floor) In addition, the depreciation attributable to the entire building would be $2,000. What is the total amount $1,800 1,600 1,200 1,400 of the expenses that Donald can deduct on Schedule E of Form 1040 (before any limitations)? a. $3,300 b. $3,850 c. $4,000 d. $4,700 e. None of the above 85. In December 2018, Ben and Jeri (married filing jointly) have a long-term capital gain of $5,000 on the sale of stock held for 4 years. They have no other capital gains and losses for the year. After the standard deduction, their ordinary income for the year, before the capital gain, is $76,900, making their total income for the year $131,900 ($76,900+ $55,000). In 2018, married taxpayers who file jointly pay tax of $8,850 on the first $76,900 of ordinary taxable income and 15% on long-term capital gains above $77,200. What is their total tax liability? a. $8,850 b. $17,100 c. $17,055 d. $17,136