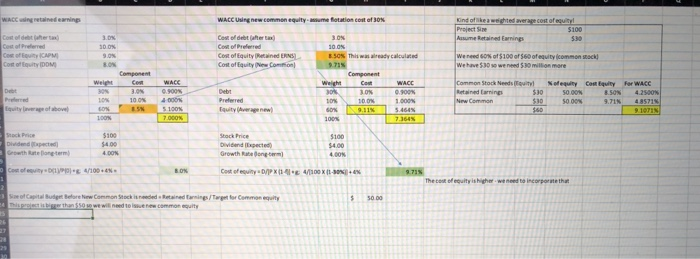

7.(a) Assuming that ABC will have $7.5 million of new retained earnings during the coming year and that all capital is raised in accordance with the target capital structure, how large could the capital budget be before the firm is required to sell new common stock to finance the capital budget? (b) What would the WACC be for a $20 million project? Use the DCF approach for your new cost of equity. Weight your cost of equity between retained earnings and new stock issuance and use that to calculate your new WACC WACCusing retained earning WACC Using new common equity-as me flotation cost of 30% Ond ofskeaweghted average cost of equty sume Retained Earning we need 60% of S 100 gr S60ofequty(common stacks Cont of Equity letained ENS We have 530 so we need $30 million mare Common Stock NeedsEquityl Nof equity Cost Equity For WACC 30% $30 50.00% 8.50% 10% 100% 4000% Preferred Eauity (Average new) Equity nveage of above 100 400 100 4.00 Dividend Expected Growth Rabe onm) Growth Rate long-term Capital Budget Blore New Common Stock is needed Retained Tannings/Target for Common equity 50.00 wewitl need tessue nw common equity 7.(a) Assuming that ABC will have $7.5 million of new retained earnings during the coming year and that all capital is raised in accordance with the target capital structure, how large could the capital budget be before the firm is required to sell new common stock to finance the capital budget? (b) What would the WACC be for a $20 million project? Use the DCF approach for your new cost of equity. Weight your cost of equity between retained earnings and new stock issuance and use that to calculate your new WACC WACCusing retained earning WACC Using new common equity-as me flotation cost of 30% Ond ofskeaweghted average cost of equty sume Retained Earning we need 60% of S 100 gr S60ofequty(common stacks Cont of Equity letained ENS We have 530 so we need $30 million mare Common Stock NeedsEquityl Nof equity Cost Equity For WACC 30% $30 50.00% 8.50% 10% 100% 4000% Preferred Eauity (Average new) Equity nveage of above 100 400 100 4.00 Dividend Expected Growth Rabe onm) Growth Rate long-term Capital Budget Blore New Common Stock is needed Retained Tannings/Target for Common equity 50.00 wewitl need tessue nw common equity