Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(7-A1) Prepare Master Budget 1. You are the new manager of the Rapidbuy Electronics store in the Mall of America. Top management of Rapidbuy Electronics

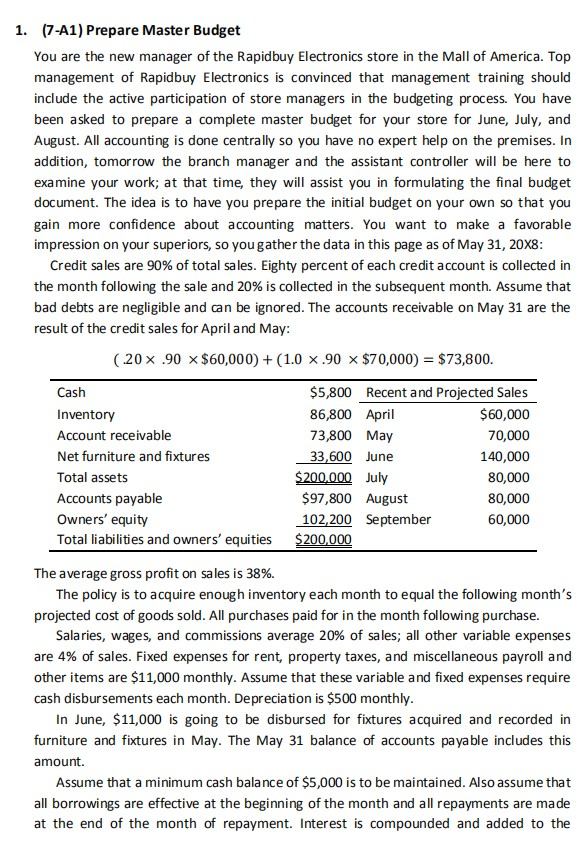

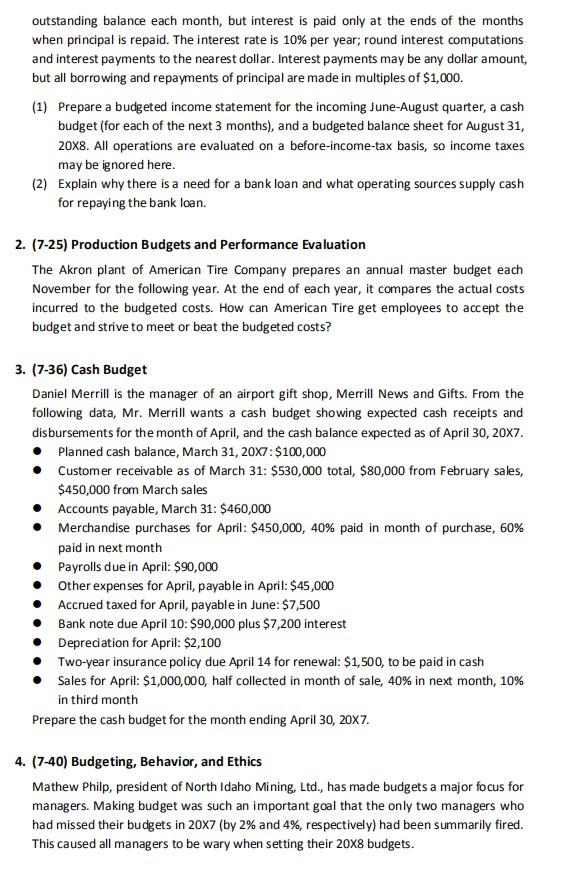

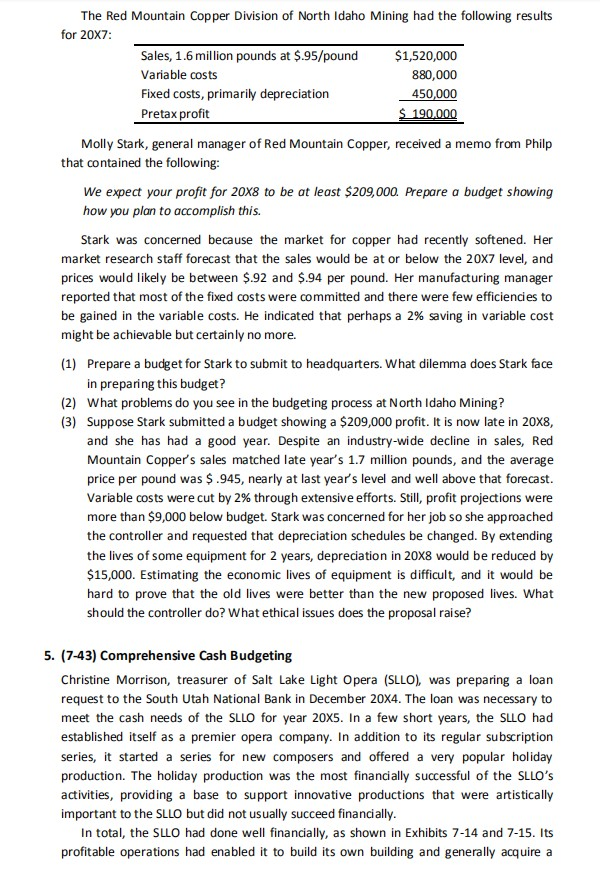

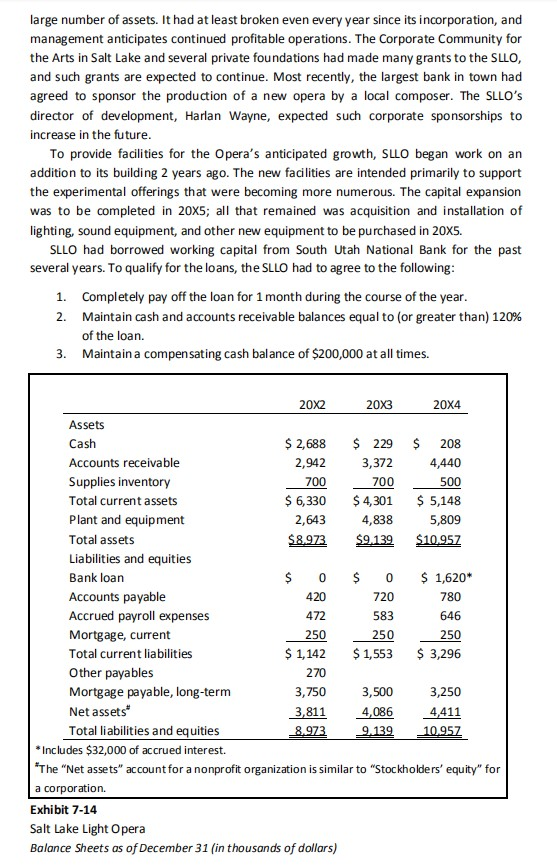

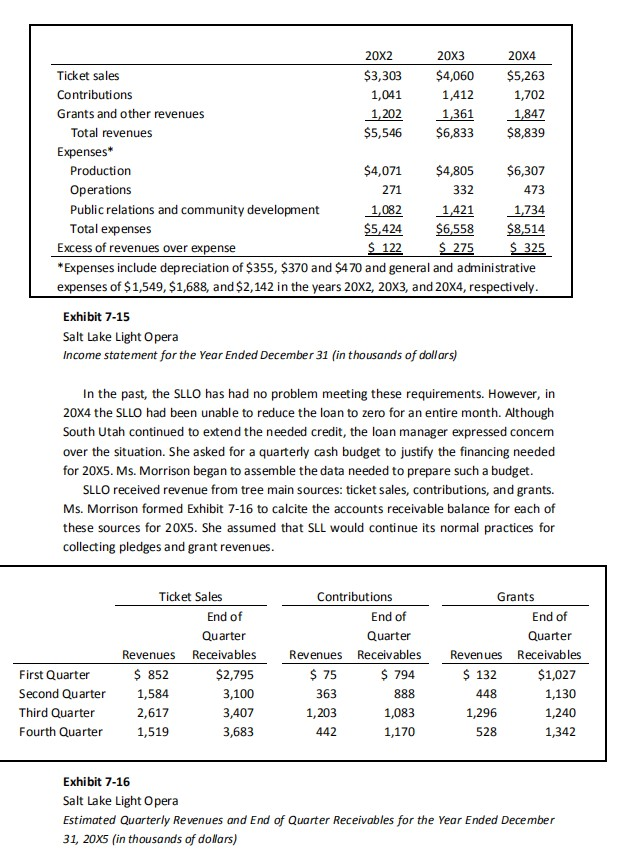

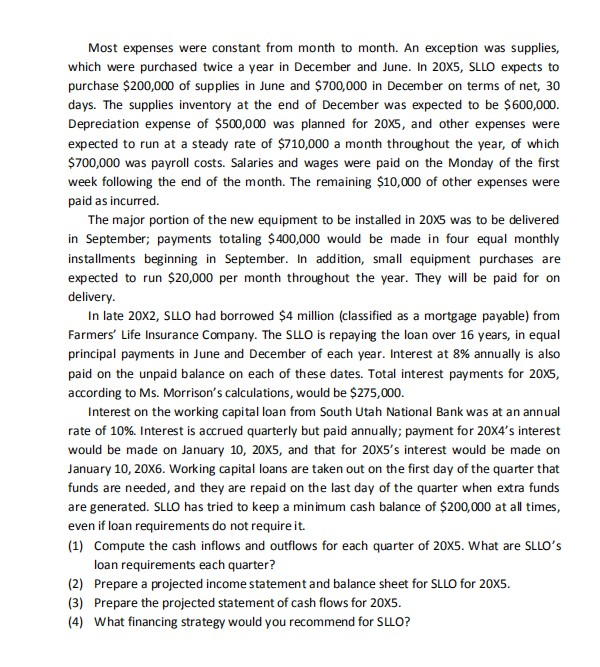

(7-A1) Prepare Master Budget 1. You are the new manager of the Rapidbuy Electronics store in the Mall of America. Top management of Rapidbuy Electronics is convinced that management training should include the active participation of store managers in the budgeting process. You have been asked to prepare a complete master budget for your store for June, July, and August. All accounting is done centrally so you have no expert help on the premises. In addition, tomorrow the branch manager and the assistant controller willI be here to examine your work; at that time, they will assist you in formulating the final budget document. The idea is to have you prepare the initial budget on your own so that you gain more confidence about accounting matters. You want to make a favorable impression on your superiors, so you gather the data in this page as of May 31, 20X8: Credit sales are 90% of total sales. Eighty percent of each credit account is collected in the month following the sale and 20% is collected in the subsequent month. Assume that bad debts are negligible and can be ignored. The accounts receivable on May 31 are the result of the credit sales for April and May: ( 20 x .90 x $60,000) + (1.0 x .90 x $70,000) = $73,800. $5,800 Cash Recent and Projected Sales 86,800 April $60,000 Inventory Account receivable 73,800 May 70,000 Net furniture and fixtures 33,600 June 140,000 $200,000 July Total assets 80,000 $97,800 August Accounts payable 80,000 Owners' equity 102,200 September $200,000 60,000 Total liabilities and owners' equities The average gross profit on sales is 38%. The policy is to acquire enough inventory each month to equal the following month's projected cost of goods sold. All purchases paid for in the month following purchase. Salaries, wages, and commissions average 20% of sales; all other variable expenses are 4% of sales. Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $11,000 monthly. Assume that these variable and fixed expenses require cash disbursements each month. Depreciation is $500 monthly. In June, $11,000 is going to be disbursed for fixtures acquired and recorded in furniture and fixtures in May. The May 31 balance of accounts payable includes this amount. Assume that a minimum cash balance of $5,000 is to be maintained. Also assume that all borrowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Interest is compounded and added to the outstanding balance each month, but interest is paid only at the ends of the months when principal is repaid. The interest rate is 10% per year; round interest computations and interest payments to the nearest dollar. Interest payments may be any dollar amount, but all borrowing and repayments of principal are made in multiples of $1,000. (1) Prepare a budgeted income statement for the incoming June-August quarter, a cash budget (for each of the next 3 months), and a budgeted balance sheet for August 31, 20x8. All operations are evaluated on a before-income-tax basis, so income taxes may be ignored here. (2) Explain why there is a need for a bank loan and what operating sources supply cash for repaying the bank loan. 2. (7-25) Production Budgets and Performance Evaluation The Akron plant of American Tire Company prepares an annual master budget each November for the following year. At the end of each year, it compares the actual costs incurred to the budgeted costs. How can American Tire get employees to accept the budget and strive to meet or beat the budgeted costs? 3. (7-36) Cash Budget Daniel Merrill is the manager of an airport gift shop, Merill News and Gifts. From the following data, Mr. Merrill wants a cash budget showing expected cash receipts and disbursements for the month of April, and the cash balance expected as of April 30, 20X7. Planned cash balance, March 31, 20X7:$100,000 Customer receivable as of March 31: $530,000 total, $80,000 from February sales, $450,000 from March sales Accounts payable, March 31: $460,000 Merchandise purchases for April: $450,000, 40% paid in month of purchase, 60% paid in next month Payrolls due in April: $90,000 Other expenses for April, payable in April: $45,000 Accrued taxed for April, payable in June: $7,500 Bank note due April 10: $90,000 plus $7,200 interest Depreciation for April: $2,100 Two-year insurance policy due April 14 for renewal: $1,500, to be paid in cash Sales for April: $1,000,000, half collected in month of sale, 40% in next month, 10% in third month Prepare the cash budget for the month ending April 30, 20X7. 4. (7-40) Budgeting, Behavior, and Ethics Mathew Philp, president of North Idaho Mining, Ltd., has made budgets a major focus for managers. Making budget was such an important goal that the only two managers who had missed their budgets in 20X7 (by 2% and 4%, respectively) had been summarily fired. This caused all managers to be wary when setting their 20X8 budgets. The Red Mountain Copper Division of North Idaho Mining had the following results for 20X7: Sales, 1.6 million pounds at $.95/pound $1,520,000 Variable costs 880,000 Fixed costs, primarily depreciation 450,000 Pretax profit $ 190,000 Molly Stark, general manager of Red Mountain Copper, received a memo from Philp that contained the following: We expect your profit for 20X8 to be at least $209,000. Prepare a budget showing how you plan to accomplish this. Stark was concerned because the market for copper had recently softened. Her market research staff forecast that the sales would be at or below the 20X7 level, and prices would likely be between $.92 and $.94 per pound. Her manufacturing manager reported that most of the fixed costs were committed and there were few efficiencies to be gained in the variable costs. He indicated that perhaps a 2% saving in variable cost might be achievable but certainly no more. (1) Prepare a budget for Stark to submit to headquarters. What dilemma does Stark face in preparing this budget? (2) What problems do you see in the budgeting process at North Idaho Mining? (3) Suppose Stark submitted a budget showing a $209,000 profit. It is now late in 20X8, and she has had a good year. Despite an industry-wide decline in sales, Red Mountain Copper's sales matched late year's 1.7 million pounds, and the average price per pound was $ .945, nearly at last year's level and well above that forecast. Variable costs were cut by 2% through extensive efforts. Still, profit projections were more than $9,000 below budget. Stark was concerned for her job so she approached the controller and requested that depreciation schedules be changed. By extending the lives of some equipment for 2 years, depreciation in 20x8 would be reduced by $15,000. Estimating the economic lives of equipment is difficult, and it would be hard to prove that the old lives were better than the new proposed lives. What should the controller do? What ethical issues does the proposal raise? 5. (7-43) Comprehensive Cash Budgeting Christine Morrison, treasurer of Salt Lake Light Opera (SLLO), was preparing a loan request to the South Utah National Bank in December 20x4. The loan was necessary to meet the cash needs of the SLLO for year 20X5. In a few short years, the SLLOo had established itself as a premier opera company. In addition to its regular subscription series, it started a series for new composers and offered a very popular holiday production. The holiday production was the most financially successful of the SLLO's activities, providing a base to support innovative productions that were artistically important to the SLLO but did not usually succeed financially. In total, the SLLO had done well financially, as shown in Exhibits 7-14 and 7-15. Its profitable operations had enabled it to build its own building and generally acquire a large number of assets. It had at least broken even every year since its incorporation, and management anticipates continued profitable operations. The Corporate Community for the Arts in Salt Lake and several private foundations had made many grants to the SLLO, and such grants are expected to continue. Most recently, the largest bank in town had agreed to sponsor the production of a new opera by a local composer. The SLLO'S director of development, Harlan Wayne, expected such corporate sponsorships to increase in the future. To provide facilities for the Opera's anticipated growth, SLLO began work on an addition to its building 2 years ago. The new facilities are intended primarily to support the experimental offerings that were becoming more numerous. The capital expansion was to be completed in 20X5; all that remained was acquisition and installation of lighting, sound equipment, and other new equipment to be purchased in 20X5. SLLO had borrowed working capital from South Utah National Bank for the past several years. To qualify for the loans, the SLLO had to agree to the following: Completely pay off the loan for 1 month during the course of the year. 1. 2. Maintain cash and accounts receivable balances equal to (or greater than) 120% of the loan. Maintain a compensating cash balance of $200,000 at all times. 3. 20X2 20X3 20X4 Assets $ 2,688 $ 229 Cash 208 2,942 Accounts receivable 3,372 4,440 Supplies inventory 700 700 500 $ 4,301 $ 5,148 $ 6,330 Total current assets Plant and equipment 2,643 4,838 5,809 $10.957 $8.973 $9.139 Total assets Liabilities and equities $ 1,620* Bank loan 780 Accounts payable Accrued payroll expenses 420 720 472 583 646 Mortgage, current 250 250 250 $ 1,142 $ 1,553 $ 3,296 Total current liabilities Other payables 270 Mortgage payable, long-term Net assets" 3,750 3,500 3,250 4,411 3,811 4,086 Total liabilities and equities 8,973 9.139 10.957 * Includes $32,000 of accrued interest. *The "Net assets" account for a nonprofit organization is similar to "Stockholders' equity" for a corporation. Exhibit 7-14 Salt Lake Light Opera Balance Sheets as of December 31 (in thousands of dollars) 20X2 20X3 20X4 Ticket sales $3,303 $4,060 $5,263 Contributions 1,041 1,412 1,702 1,361 $6,833 Grants and other revenues 1,202 1,847 $5,546 $8,839 Total revenues Expenses* $4,071 $4,805 $6,307 Production Operations 271 332 473 Public relations and community development 1,734 $8,514 $ 325 1,082 1,421 $5,424 $6,558 $ 275 Total expenses Excess of revenues over expense $ 122 *Expenses include depreciation of $355, $370 and $470 and general and administrative expenses of $1,549, $1,688, and $2,142 in the years 20X2, 20X3, and 20X4, respectively. Exhibit 7-15 Salt Lake Light Opera Income statement for the Year Ended December 31 (in thousands of dollars) In the past, the SLLO has had no problem meeting these requirements. However, in 20X4 the SLLO had been unable to reduce the loan to zero for an entire month. Although South Utah continued to extend the needed credit, the loan manager expressed concem over the situation. She asked for a quarterly cash budget to justify the financing needed for 20X5. Ms. Morrison began to assemble the data needed to prepare such a budget. SLLO received revenue from tree main sources: ticket sales, contributions, and grants. Ms. Morrison formed Exhibit 7-16 to calcite the accounts receivable balance for each of these sources for 20X5. She assumed that SLL would continue its normal practices for collecting pledges and grant revenues. Ticket Sales Contributions Grants End of End of End of Quarter Quarter Quarter Revenues Receivables Revenues Receivables Revenues Receivables $ 75 $ 794 $ 852 $ 132 First Quarter $2,795 $1,027 Second Quarter 1,584 3,100 448 1,130 363 888 Third Quarter 1,296 2,617 3,407 1,203 1,083 1,240 Fourth Quarter 1,342 1,519 3,683 442 1,170 528 Exhibit 7-16 Salt Lake Light Opera Estimated Quarterly Revenues and End of Quarter Receivables for the Year Ended December 31, 20X5 (in thousands of dollars) Most expenses were constant from month to month. An exception was supplies, which were purchased twice a year in December and June. In 20X5, SLLO expects to purchase $200,000 of supplies in June and $700,000 in December on terms of net, 30 days. The supplies inventory at the end of December was expected to be $600,000. Depreciation expense of $500,000 was planned for 20X5, and other expenses were expected to run at a steady rate of $710,000 a month throughout the year, of which $700,000 was payroll costs. Salaries and wages were paid on the Monday of the first week following the end of the month. The remaining $10,000 of other expenses were paid as incurred. The major portion of the new equipment to be installed in 20X5 was to be delivered in September; payments totaling $400,000 would be made in four equal monthly installments beginning in September. In addition, small equipment purchases are expected to run $20,000 per month throughout the year. They will be paid for on delivery. In late 20X2, SLO had borrowed $4 million (classified as a mortgage payable) from Farmers' Life Insurance Company. The SLLO is repaying the loan over 16 years, in equal principal payments in June and December of each year. Interest at 8% annually is also paid on the unpaid balance on each of these dates. Total interest payments for 20X5, according to Ms. Morrison's calculations, would be $275,000. Interest on the working capital loan from South Utah National Bank was at an annual rate of 10%. Interest is accrued quarterly but paid annually; payment for 20X4's interest would be made on January 10, 20X5, and that for 20X5's interest would be made on January 10, 20X6. Working capital loans are taken out on the first day of the quarter that funds are needed, and they are repaid on the last day of the quarter when extra funds are generated. SLLO has tried to keep a minimum cash balance of $200,000 at all times, even if loan requirements do not require it. (1) Compute the cash inflows and outflows for each quarter of 20X5. What are SLLO's loan requirements each quarter? (2) Prepare a projected income statement and balance sheet for SLLO for 20X5. (3) Prepare the projected statement of cash flows for 20X5. (4) What financing strategy would you recommend for SLLO? (7-A1) Prepare Master Budget 1. You are the new manager of the Rapidbuy Electronics store in the Mall of America. Top management of Rapidbuy Electronics is convinced that management training should include the active participation of store managers in the budgeting process. You have been asked to prepare a complete master budget for your store for June, July, and August. All accounting is done centrally so you have no expert help on the premises. In addition, tomorrow the branch manager and the assistant controller willI be here to examine your work; at that time, they will assist you in formulating the final budget document. The idea is to have you prepare the initial budget on your own so that you gain more confidence about accounting matters. You want to make a favorable impression on your superiors, so you gather the data in this page as of May 31, 20X8: Credit sales are 90% of total sales. Eighty percent of each credit account is collected in the month following the sale and 20% is collected in the subsequent month. Assume that bad debts are negligible and can be ignored. The accounts receivable on May 31 are the result of the credit sales for April and May: ( 20 x .90 x $60,000) + (1.0 x .90 x $70,000) = $73,800. $5,800 Cash Recent and Projected Sales 86,800 April $60,000 Inventory Account receivable 73,800 May 70,000 Net furniture and fixtures 33,600 June 140,000 $200,000 July Total assets 80,000 $97,800 August Accounts payable 80,000 Owners' equity 102,200 September $200,000 60,000 Total liabilities and owners' equities The average gross profit on sales is 38%. The policy is to acquire enough inventory each month to equal the following month's projected cost of goods sold. All purchases paid for in the month following purchase. Salaries, wages, and commissions average 20% of sales; all other variable expenses are 4% of sales. Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $11,000 monthly. Assume that these variable and fixed expenses require cash disbursements each month. Depreciation is $500 monthly. In June, $11,000 is going to be disbursed for fixtures acquired and recorded in furniture and fixtures in May. The May 31 balance of accounts payable includes this amount. Assume that a minimum cash balance of $5,000 is to be maintained. Also assume that all borrowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Interest is compounded and added to the outstanding balance each month, but interest is paid only at the ends of the months when principal is repaid. The interest rate is 10% per year; round interest computations and interest payments to the nearest dollar. Interest payments may be any dollar amount, but all borrowing and repayments of principal are made in multiples of $1,000. (1) Prepare a budgeted income statement for the incoming June-August quarter, a cash budget (for each of the next 3 months), and a budgeted balance sheet for August 31, 20x8. All operations are evaluated on a before-income-tax basis, so income taxes may be ignored here. (2) Explain why there is a need for a bank loan and what operating sources supply cash for repaying the bank loan. 2. (7-25) Production Budgets and Performance Evaluation The Akron plant of American Tire Company prepares an annual master budget each November for the following year. At the end of each year, it compares the actual costs incurred to the budgeted costs. How can American Tire get employees to accept the budget and strive to meet or beat the budgeted costs? 3. (7-36) Cash Budget Daniel Merrill is the manager of an airport gift shop, Merill News and Gifts. From the following data, Mr. Merrill wants a cash budget showing expected cash receipts and disbursements for the month of April, and the cash balance expected as of April 30, 20X7. Planned cash balance, March 31, 20X7:$100,000 Customer receivable as of March 31: $530,000 total, $80,000 from February sales, $450,000 from March sales Accounts payable, March 31: $460,000 Merchandise purchases for April: $450,000, 40% paid in month of purchase, 60% paid in next month Payrolls due in April: $90,000 Other expenses for April, payable in April: $45,000 Accrued taxed for April, payable in June: $7,500 Bank note due April 10: $90,000 plus $7,200 interest Depreciation for April: $2,100 Two-year insurance policy due April 14 for renewal: $1,500, to be paid in cash Sales for April: $1,000,000, half collected in month of sale, 40% in next month, 10% in third month Prepare the cash budget for the month ending April 30, 20X7. 4. (7-40) Budgeting, Behavior, and Ethics Mathew Philp, president of North Idaho Mining, Ltd., has made budgets a major focus for managers. Making budget was such an important goal that the only two managers who had missed their budgets in 20X7 (by 2% and 4%, respectively) had been summarily fired. This caused all managers to be wary when setting their 20X8 budgets. The Red Mountain Copper Division of North Idaho Mining had the following results for 20X7: Sales, 1.6 million pounds at $.95/pound $1,520,000 Variable costs 880,000 Fixed costs, primarily depreciation 450,000 Pretax profit $ 190,000 Molly Stark, general manager of Red Mountain Copper, received a memo from Philp that contained the following: We expect your profit for 20X8 to be at least $209,000. Prepare a budget showing how you plan to accomplish this. Stark was concerned because the market for copper had recently softened. Her market research staff forecast that the sales would be at or below the 20X7 level, and prices would likely be between $.92 and $.94 per pound. Her manufacturing manager reported that most of the fixed costs were committed and there were few efficiencies to be gained in the variable costs. He indicated that perhaps a 2% saving in variable cost might be achievable but certainly no more. (1) Prepare a budget for Stark to submit to headquarters. What dilemma does Stark face in preparing this budget? (2) What problems do you see in the budgeting process at North Idaho Mining? (3) Suppose Stark submitted a budget showing a $209,000 profit. It is now late in 20X8, and she has had a good year. Despite an industry-wide decline in sales, Red Mountain Copper's sales matched late year's 1.7 million pounds, and the average price per pound was $ .945, nearly at last year's level and well above that forecast. Variable costs were cut by 2% through extensive efforts. Still, profit projections were more than $9,000 below budget. Stark was concerned for her job so she approached the controller and requested that depreciation schedules be changed. By extending the lives of some equipment for 2 years, depreciation in 20x8 would be reduced by $15,000. Estimating the economic lives of equipment is difficult, and it would be hard to prove that the old lives were better than the new proposed lives. What should the controller do? What ethical issues does the proposal raise? 5. (7-43) Comprehensive Cash Budgeting Christine Morrison, treasurer of Salt Lake Light Opera (SLLO), was preparing a loan request to the South Utah National Bank in December 20x4. The loan was necessary to meet the cash needs of the SLLO for year 20X5. In a few short years, the SLLOo had established itself as a premier opera company. In addition to its regular subscription series, it started a series for new composers and offered a very popular holiday production. The holiday production was the most financially successful of the SLLO's activities, providing a base to support innovative productions that were artistically important to the SLLO but did not usually succeed financially. In total, the SLLO had done well financially, as shown in Exhibits 7-14 and 7-15. Its profitable operations had enabled it to build its own building and generally acquire a large number of assets. It had at least broken even every year since its incorporation, and management anticipates continued profitable operations. The Corporate Community for the Arts in Salt Lake and several private foundations had made many grants to the SLLO, and such grants are expected to continue. Most recently, the largest bank in town had agreed to sponsor the production of a new opera by a local composer. The SLLO'S director of development, Harlan Wayne, expected such corporate sponsorships to increase in the future. To provide facilities for the Opera's anticipated growth, SLLO began work on an addition to its building 2 years ago. The new facilities are intended primarily to support the experimental offerings that were becoming more numerous. The capital expansion was to be completed in 20X5; all that remained was acquisition and installation of lighting, sound equipment, and other new equipment to be purchased in 20X5. SLLO had borrowed working capital from South Utah National Bank for the past several years. To qualify for the loans, the SLLO had to agree to the following: Completely pay off the loan for 1 month during the course of the year. 1. 2. Maintain cash and accounts receivable balances equal to (or greater than) 120% of the loan. Maintain a compensating cash balance of $200,000 at all times. 3. 20X2 20X3 20X4 Assets $ 2,688 $ 229 Cash 208 2,942 Accounts receivable 3,372 4,440 Supplies inventory 700 700 500 $ 4,301 $ 5,148 $ 6,330 Total current assets Plant and equipment 2,643 4,838 5,809 $10.957 $8.973 $9.139 Total assets Liabilities and equities $ 1,620* Bank loan 780 Accounts payable Accrued payroll expenses 420 720 472 583 646 Mortgage, current 250 250 250 $ 1,142 $ 1,553 $ 3,296 Total current liabilities Other payables 270 Mortgage payable, long-term Net assets" 3,750 3,500 3,250 4,411 3,811 4,086 Total liabilities and equities 8,973 9.139 10.957 * Includes $32,000 of accrued interest. *The "Net assets" account for a nonprofit organization is similar to "Stockholders' equity" for a corporation. Exhibit 7-14 Salt Lake Light Opera Balance Sheets as of December 31 (in thousands of dollars) 20X2 20X3 20X4 Ticket sales $3,303 $4,060 $5,263 Contributions 1,041 1,412 1,702 1,361 $6,833 Grants and other revenues 1,202 1,847 $5,546 $8,839 Total revenues Expenses* $4,071 $4,805 $6,307 Production Operations 271 332 473 Public relations and community development 1,734 $8,514 $ 325 1,082 1,421 $5,424 $6,558 $ 275 Total expenses Excess of revenues over expense $ 122 *Expenses include depreciation of $355, $370 and $470 and general and administrative expenses of $1,549, $1,688, and $2,142 in the years 20X2, 20X3, and 20X4, respectively. Exhibit 7-15 Salt Lake Light Opera Income statement for the Year Ended December 31 (in thousands of dollars) In the past, the SLLO has had no problem meeting these requirements. However, in 20X4 the SLLO had been unable to reduce the loan to zero for an entire month. Although South Utah continued to extend the needed credit, the loan manager expressed concem over the situation. She asked for a quarterly cash budget to justify the financing needed for 20X5. Ms. Morrison began to assemble the data needed to prepare such a budget. SLLO received revenue from tree main sources: ticket sales, contributions, and grants. Ms. Morrison formed Exhibit 7-16 to calcite the accounts receivable balance for each of these sources for 20X5. She assumed that SLL would continue its normal practices for collecting pledges and grant revenues. Ticket Sales Contributions Grants End of End of End of Quarter Quarter Quarter Revenues Receivables Revenues Receivables Revenues Receivables $ 75 $ 794 $ 852 $ 132 First Quarter $2,795 $1,027 Second Quarter 1,584 3,100 448 1,130 363 888 Third Quarter 1,296 2,617 3,407 1,203 1,083 1,240 Fourth Quarter 1,342 1,519 3,683 442 1,170 528 Exhibit 7-16 Salt Lake Light Opera Estimated Quarterly Revenues and End of Quarter Receivables for the Year Ended December 31, 20X5 (in thousands of dollars) Most expenses were constant from month to month. An exception was supplies, which were purchased twice a year in December and June. In 20X5, SLLO expects to purchase $200,000 of supplies in June and $700,000 in December on terms of net, 30 days. The supplies inventory at the end of December was expected to be $600,000. Depreciation expense of $500,000 was planned for 20X5, and other expenses were expected to run at a steady rate of $710,000 a month throughout the year, of which $700,000 was payroll costs. Salaries and wages were paid on the Monday of the first week following the end of the month. The remaining $10,000 of other expenses were paid as incurred. The major portion of the new equipment to be installed in 20X5 was to be delivered in September; payments totaling $400,000 would be made in four equal monthly installments beginning in September. In addition, small equipment purchases are expected to run $20,000 per month throughout the year. They will be paid for on delivery. In late 20X2, SLO had borrowed $4 million (classified as a mortgage payable) from Farmers' Life Insurance Company. The SLLO is repaying the loan over 16 years, in equal principal payments in June and December of each year. Interest at 8% annually is also paid on the unpaid balance on each of these dates. Total interest payments for 20X5, according to Ms. Morrison's calculations, would be $275,000. Interest on the working capital loan from South Utah National Bank was at an annual rate of 10%. Interest is accrued quarterly but paid annually; payment for 20X4's interest would be made on January 10, 20X5, and that for 20X5's interest would be made on January 10, 20X6. Working capital loans are taken out on the first day of the quarter that funds are needed, and they are repaid on the last day of the quarter when extra funds are generated. SLLO has tried to keep a minimum cash balance of $200,000 at all times, even if loan requirements do not require it. (1) Compute the cash inflows and outflows for each quarter of 20X5. What are SLLO's loan requirements each quarter? (2) Prepare a projected income statement and balance sheet for SLLO for 20X5. (3) Prepare the projected statement of cash flows for 20X5. (4) What financing strategy would you recommend for SLLO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started