Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7B help me undserstand numbers 1-5 with steps included so i can learn and understand the questions 1) 2) 3) 1-3 parts (a-c questions are

7B help me undserstand numbers 1-5 with steps included so i can learn and understand the questions

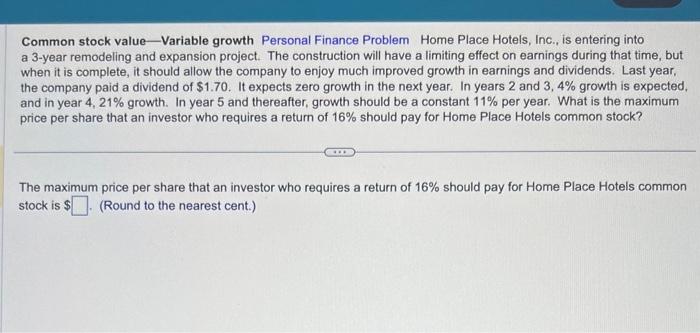

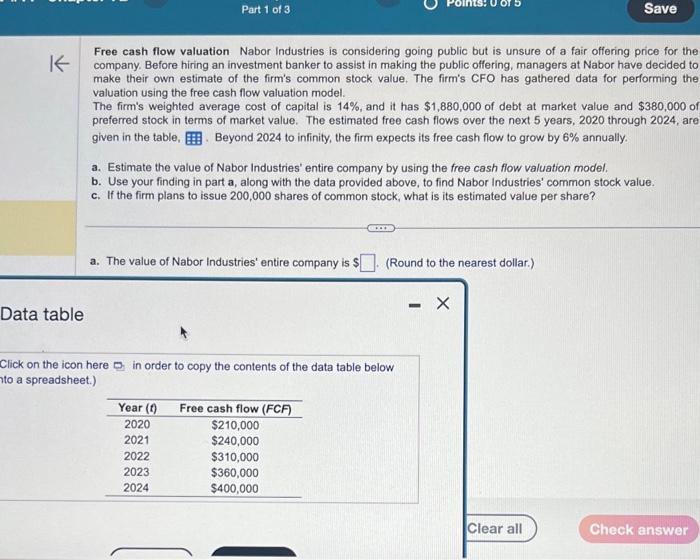

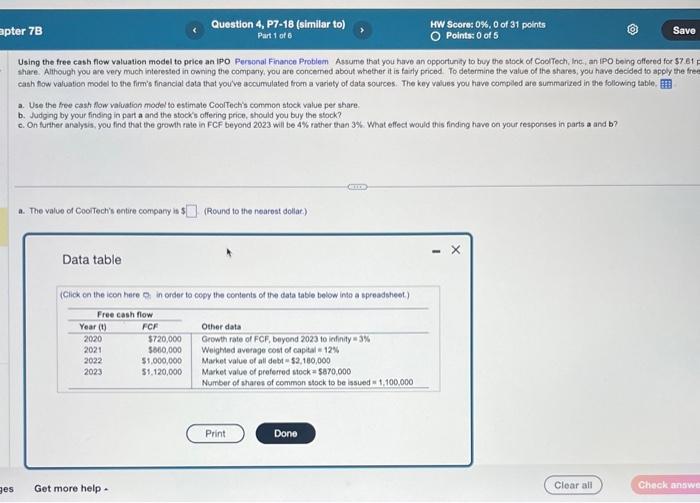

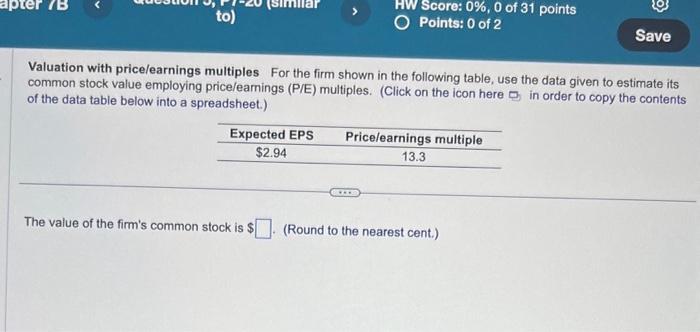

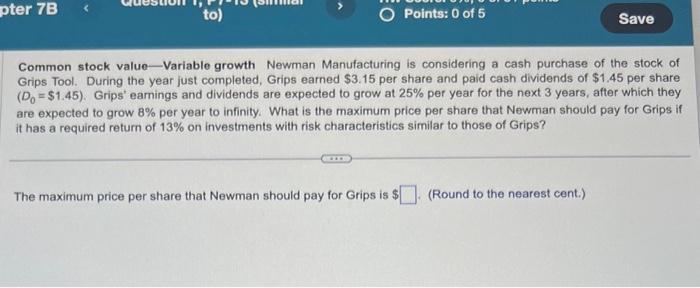

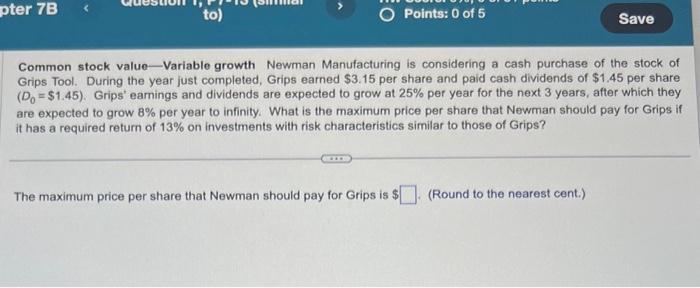

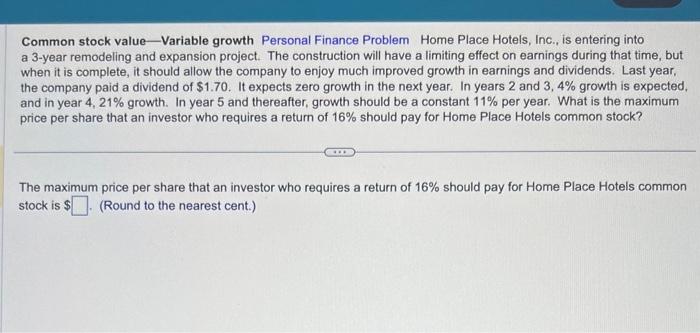

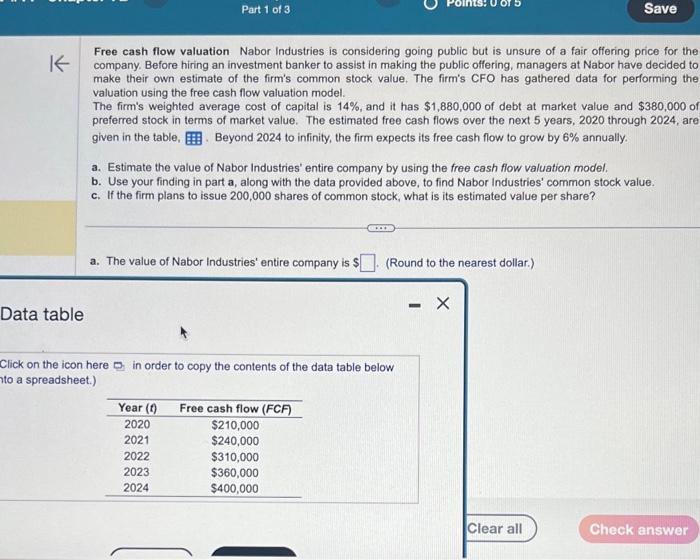

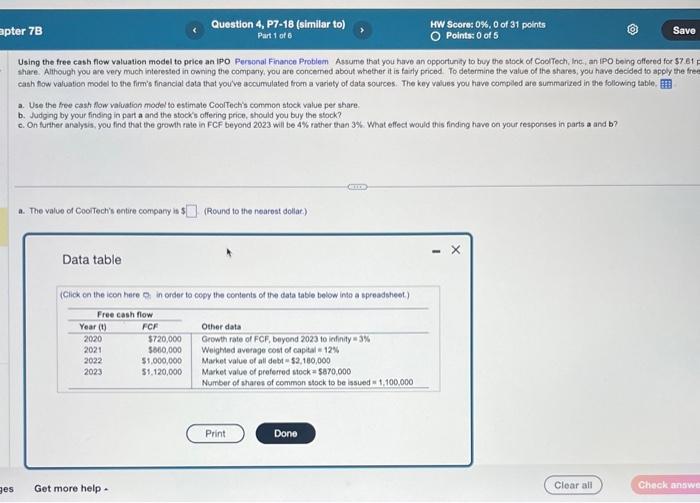

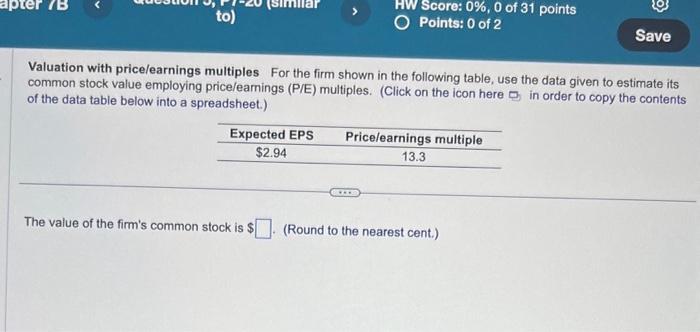

Common stock value-Variable growth Newman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year just completed, Grips earned $3.15 per share and paid cash dividends of $1.45 per share (D0=$1.45). Grips' earnings and dividends are expected to grow at 25% per year for the next 3 years, after which they are expected to grow 8% per year to infinity. What is the maximum price per share that Newman should pay for Grips if it has a required retum of 13% on investments with risk characteristics similar to those of Grips? The maximum price per share that Newman should pay for Grips is $ (Round to the nearest cent.) Common stock value - Variable growth Personal Finance Problem Home Place Hotels, Inc., is entering into a 3-year remodeling and expansion project. The construction will have a limiting effect on earnings during that time, but when it is complete, it should allow the company to enjoy much improved growth in earnings and dividends. Last year, the company paid a dividend of $1.70. It expects zero growth in the next year. In years 2 and 3,4% growth is expected, and in year 4,21% growth. In year 5 and thereafter, growth should be a constant 11% per year. What is the maximum price per share that an investor who requires a retum of 16% should pay for Home Place Hotels common stock? The maximum price per share that an investor who requires a return of 16% should pay for Home Place Hotels common stock is $ (Round to the nearest cent.) Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for th company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided t make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing th valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 14%, and it has $1,880,000 of debt at market value and $380,000c preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, ar given in the table, Beyond 2024 to infinity, the firm expects its free cash flow to grow by 6% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock, what is its estimated value per share? a. The value of Nabor Industries' entire company is $ (Round to the nearest dollar.) Data table Click on the icon here D in order to copy the contents of the data table below to a spreadsheet.) Using the free cash flow valuation model to price an IPO Personal Finance Problem Assiume that you have an opportunity to buy the stock of Coolfech, inc, an iPO being offered for $7.61 share. Although you are very much interested in oaning the company. you are concemed about whether it is faitly priced. To determine the value of the shares, you have decided to apply the fre caah how valuation model to the firm's financial dota that youve accumulated trom a variety of data sources. The key values you have compilod are summarized in the following table. a. Use the free cash flow valuation model to estimate Cooltechis common stock value per share b. Judging by your finding in part a and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growh rale in FCF beyond 2023 will be 4% rather than 3%. What effect would this finding have on your tesponses in parts a and b? a. The value of Coortechis entire company is 1 (Round to the nearest dollat) Data table (Cick on the icon here 0 . in order to copy the contents of the data table bedow into a spreadsheot) Valuation with price/earnings multiples For the firm shown in the following table, use the data given to estimate its common stock value employing price/eamings (P/E) multiples. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) The value of the firm's common stock is $ (Round to the nearest cent.) 1)

2)

3) 1-3 parts (a-c questions are listed)

4) a-c questions and table listed

5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started