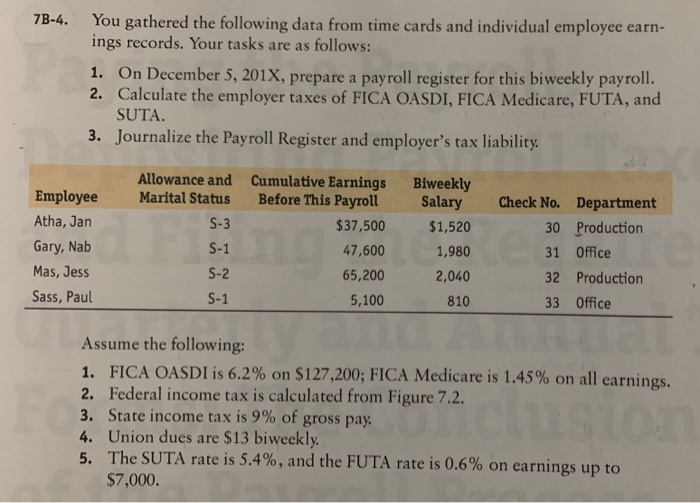

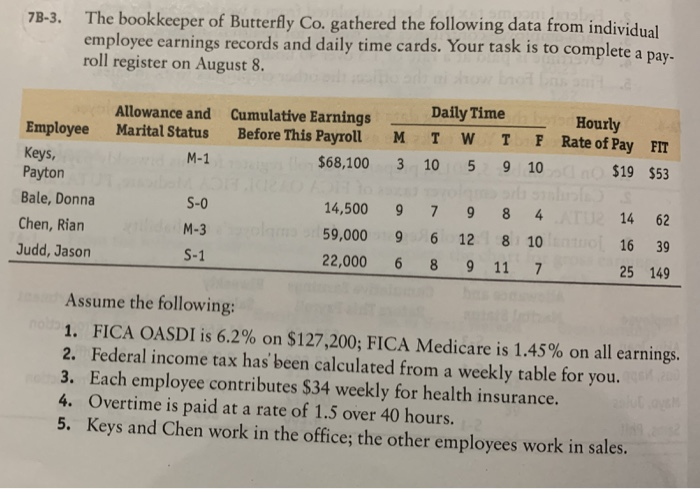

7B-4. You gathered the following data from time cards and individual employee earn- ings records. Your tasks are as follows: 1. On December 5, 201X, prepare a payroll register for this biweekly payroll. 2. Calculate the employer taxes of FICA OASDI, FICA Medicare, FUTA. and SUTA. 3. Journalize the Payroll Register and employer's tax liability. Employee Atha, Jan Gary, Nab Mas, Jess Sass, Paul Allowance and Marital Status S-3 S-1 Cumulative Earnings Before This Payroll $37,500 47,600 65,200 5,100 Biweekly Salary $1,520 1,980 2,040 810 Check No. Department 30 Production 31 Office 32 Production 33 Office S-2 S-1 Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated from Figure 7.2. 3. State income tax is 9% of gross pay. 4. Union dues are $13 biweekly. 5. The SUTA rate is 5.4%, and the FUTA rate is 0.6% on earnings up to $7,000. 7B-3. The bookkeeper of Butterfly Co. gathered the following data from individual employee earnings records and daily time cards. Your task is to complete a pay- roll register on August 8. Allowance and Marital Status M-1 Cumulative Earnings Before This Payroll $68,100 M 3 Daily Time T W T 10 5 9 F 10 Honey Rate of Pay FIT $19 $53 Employee Keys, Payton Bale, Donna Chen, Rian Judd, Jason S-0 3 M- 5 14,500 9,000 22,000 9 9 6 7 6 8 9 8 12 8 9 11 4 10 7 S-1 14 16 25 62 39 149 Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax has been calculated from a weekly table for you. 3. Each employee contributes $34 weekly for health insurance. 4. Overtime is paid at a rate of 1.5 over 40 hours. 5. Keys and Chen work in the office; the other employees work in sales. 7B-4. You gathered the following data from time cards and individual employee earn- ings records. Your tasks are as follows: 1. On December 5, 201X, prepare a payroll register for this biweekly payroll. 2. Calculate the employer taxes of FICA OASDI, FICA Medicare, FUTA. and SUTA. 3. Journalize the Payroll Register and employer's tax liability. Employee Atha, Jan Gary, Nab Mas, Jess Sass, Paul Allowance and Marital Status S-3 S-1 Cumulative Earnings Before This Payroll $37,500 47,600 65,200 5,100 Biweekly Salary $1,520 1,980 2,040 810 Check No. Department 30 Production 31 Office 32 Production 33 Office S-2 S-1 Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated from Figure 7.2. 3. State income tax is 9% of gross pay. 4. Union dues are $13 biweekly. 5. The SUTA rate is 5.4%, and the FUTA rate is 0.6% on earnings up to $7,000. 7B-3. The bookkeeper of Butterfly Co. gathered the following data from individual employee earnings records and daily time cards. Your task is to complete a pay- roll register on August 8. Allowance and Marital Status M-1 Cumulative Earnings Before This Payroll $68,100 M 3 Daily Time T W T 10 5 9 F 10 Honey Rate of Pay FIT $19 $53 Employee Keys, Payton Bale, Donna Chen, Rian Judd, Jason S-0 3 M- 5 14,500 9,000 22,000 9 9 6 7 6 8 9 8 12 8 9 11 4 10 7 S-1 14 16 25 62 39 149 Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax has been calculated from a weekly table for you. 3. Each employee contributes $34 weekly for health insurance. 4. Overtime is paid at a rate of 1.5 over 40 hours. 5. Keys and Chen work in the office; the other employees work in sales