7))Hello brother, please help me. Answer all the questions. I do not have many chance. and my money is finish I will not forget your favor. Please write question number and answer code.

intermediate Accounting1

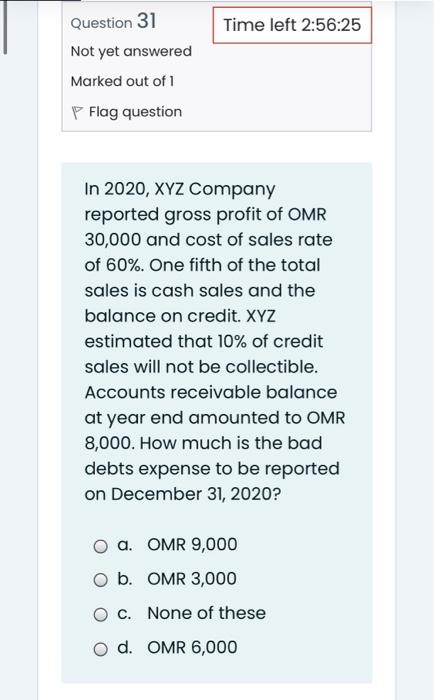

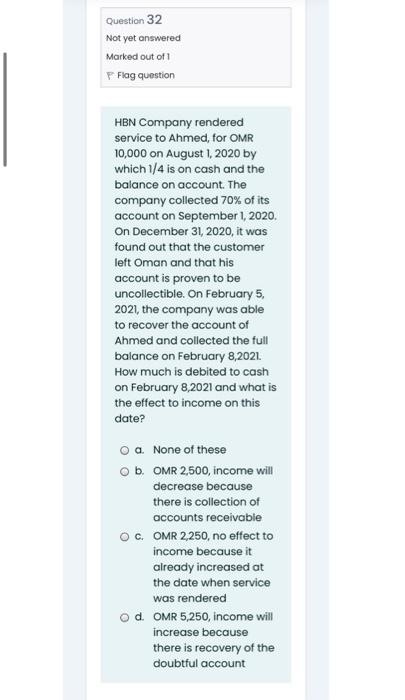

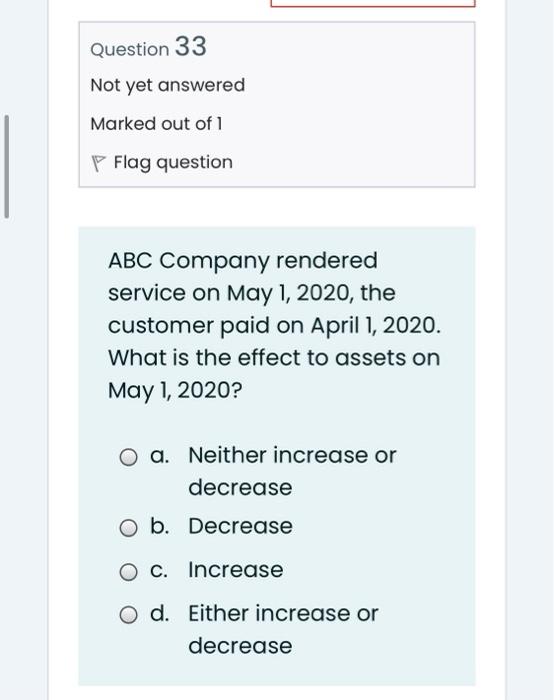

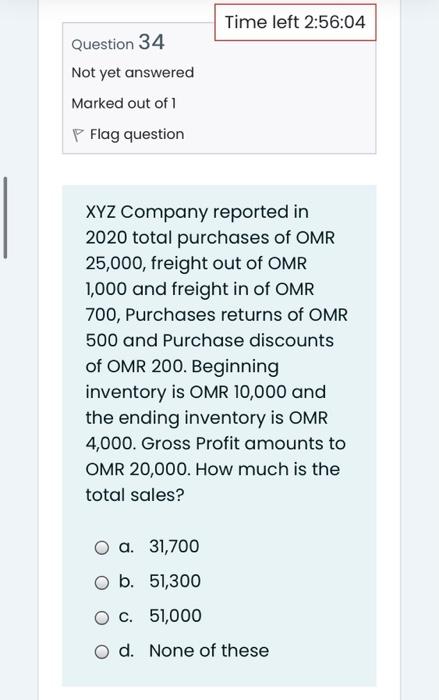

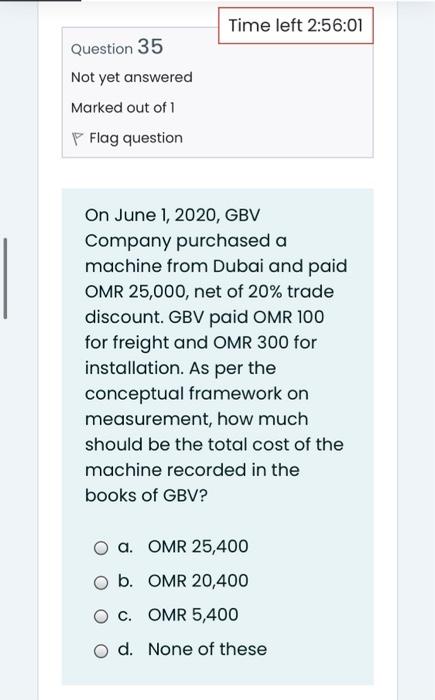

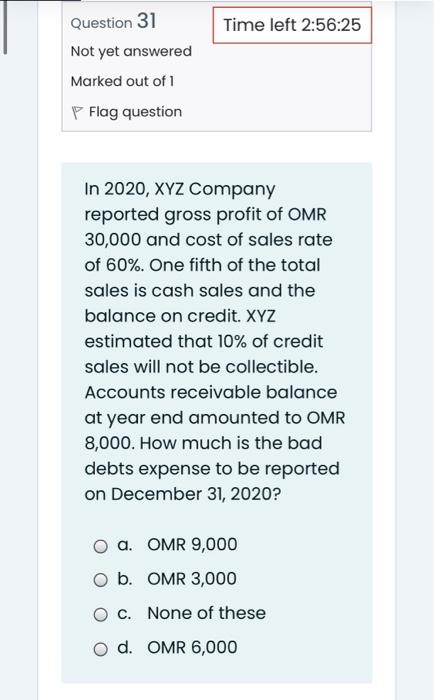

Time left 2:56:25 Question 31 Not yet answered Marked out of 1 P Flag question In 2020, XYZ Company reported gross profit of OMR 30,000 and cost of sales rate of 60%. One fifth of the total sales is cash sales and the balance on credit. XYZ estimated that 10% of credit sales will not be collectible. Accounts receivable balance at year end amounted to OMR 8,000. How much is the bad debts expense to be reported on December 31, 2020? o a. OMR 9,000 O b. OMR 3,000 O c. None of these Od. OMR 6,000 Question 32 Not yet answered Marked out of 1 Flag question HBN Company rendered service to Ahmed, for OMR 10,000 on August 1, 2020 by which 1/4 is on cash and the balance on account. The company collected 70% of its account on September 1, 2020. On December 31, 2020, it was found out that the customer left Oman and that his account is proven to be uncollectible. On February 5, 2021, the company was able to recover the account of Ahmed and collected the full balance on February 8,2021 How much is debited to cash on February 8,2021 and what is the effect to income on this date? O a. None of these ob. OMR 2,500, income will decrease because there is collection of accounts receivable OC OMR 2,250, no effect to income because it already increased at the date when service was rendered od OMR 5,250, income will increase because there is recovery of the doubtful account Question 33 Not yet answered Marked out of 1 P Flag question ABC Company rendered service on May 1, 2020, the customer paid on April 1, 2020. What is the effect to assets on May 1, 2020? O a. Neither increase or decrease b. Decrease O C. Increase O d. Either increase or decrease Time left 2:56:04 Question 34 Not yet answered Marked out of 1 P Flag question XYZ Company reported in 2020 total purchases of OMR 25,000, freight out of OMR 1,000 and freight in of OMR 700, Purchases returns of OMR 500 and Purchase discounts of OMR 200. Beginning inventory is OMR 10,000 and the ending inventory is OMR 4,000. Gross Profit amounts to OMR 20,000. How much is the total sales? O a. 31,700 O b. 51,300 O c. 51,000 d. None of these Time left 2:56:01 Question 35 Not yet answered Marked out of 1 Flag question On June 1, 2020, GBV Company purchased a machine from Dubai and paid OMR 25,000, net of 20% trade discount. GBV paid OMR 100 for freight and OMR 300 for installation. As per the conceptual framework on measurement, how much should be the total cost of the machine recorded in the books of GBV? a. OMR 25,400 b. OMR 20,400 O c. OMR 5,400 d. None of these