Question

7.Suppose your portfolio consists of stocks A and B only, what is the minimum variance portfolio based on past data? (i.e. what are the weights

7.Suppose your portfolio consists of stocks A and B only, what is the minimum variance portfolio based on past data? (i.e. what are the weights on A and B?)

8. Work out the value of Beta () for stock A and B and comment on the differences.

9.Assume the risk free rate is 4.5%; market return is proxied by the average return of the past 12 months based on table 1. What does the market expect the rate of return for stock A and B to be, using the CAPM model?

10.Based on questions 8 and 9, draw a graph showing how the expected return varies with Beta (using the CAPM model). Label the axes and key points correctly and discuss what it means if a stock did not lie on the security market line.

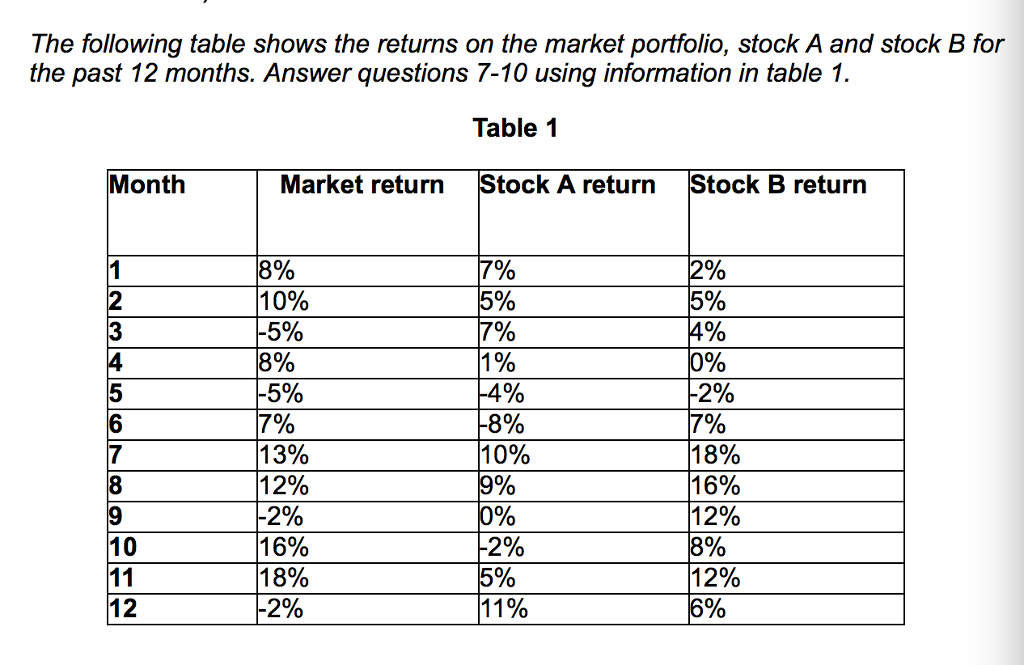

The following table shows the returns on the market portfolio, stock A and stock B for the past 12 months. Answer questions 7-10 using information in table 1. Table 1 Month Market return tock A return Stock B return 1 8% 70% 20% 2 100% 50% 5% 3 5% 10% 4 3% 1% 0% 5 15% 12% 6 70% 8% 7% 13% 10% 18% 12% 90% 16% 9 12% 00% 12% 16% 3% -2% 10 11 18% 15% 12% 22% 6% 11% 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started