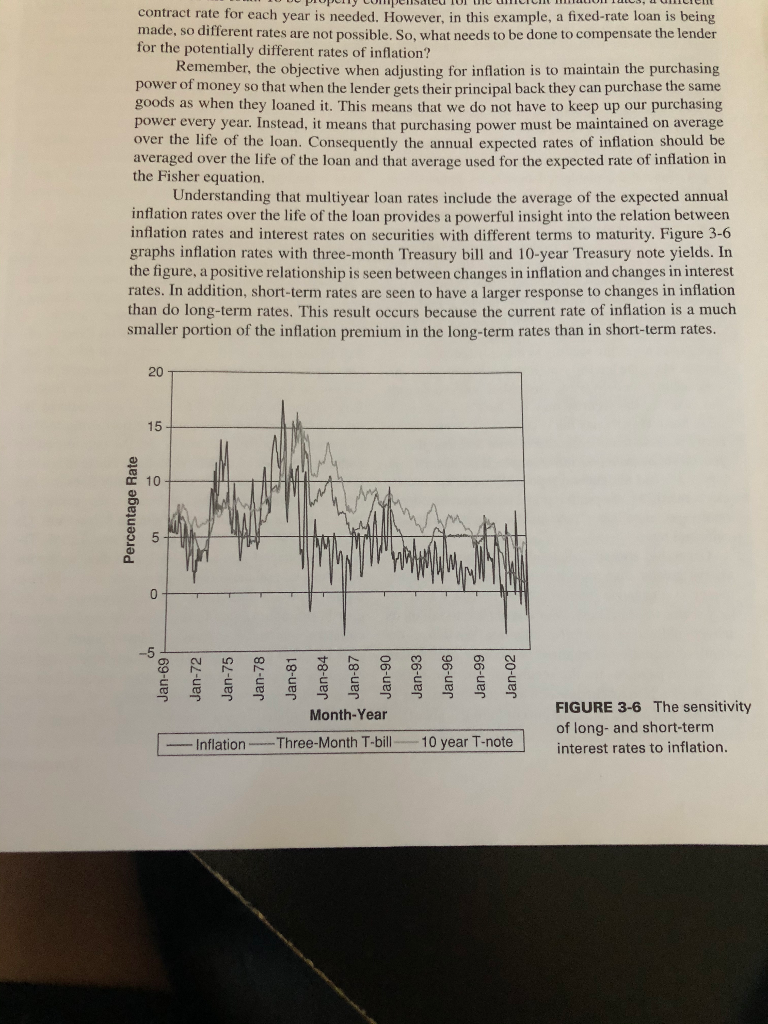

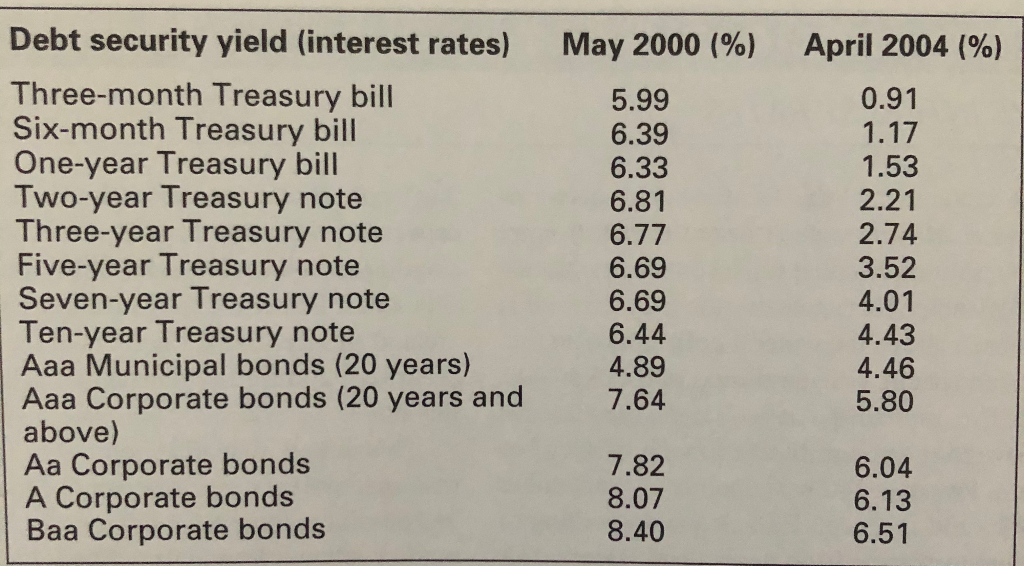

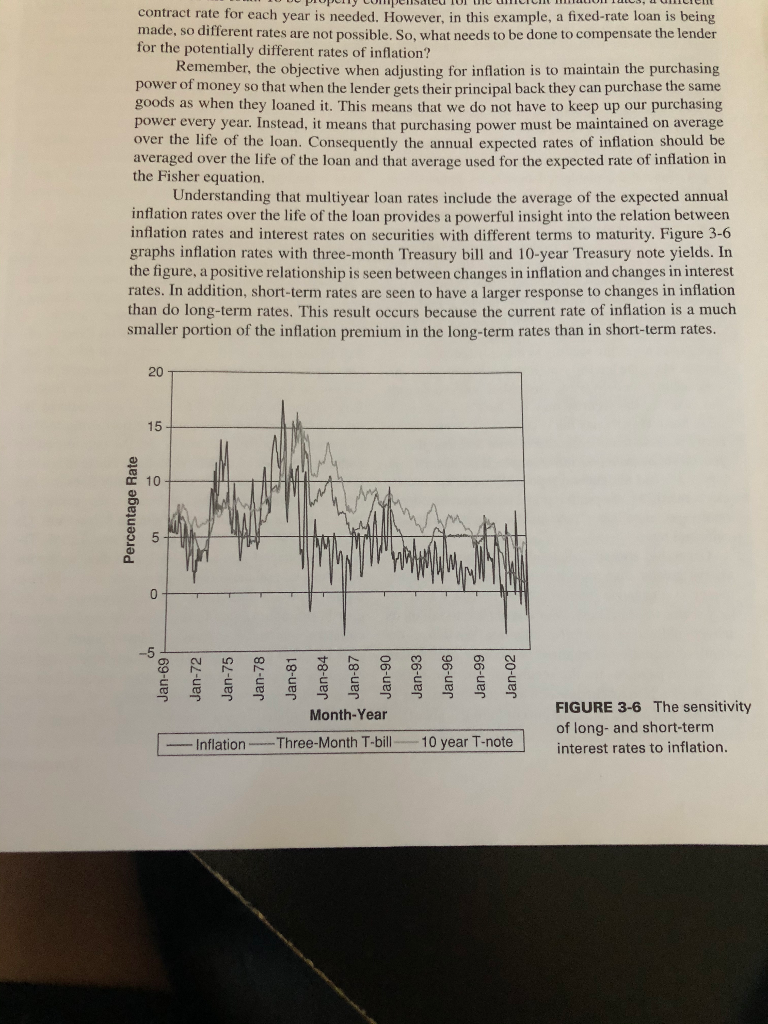

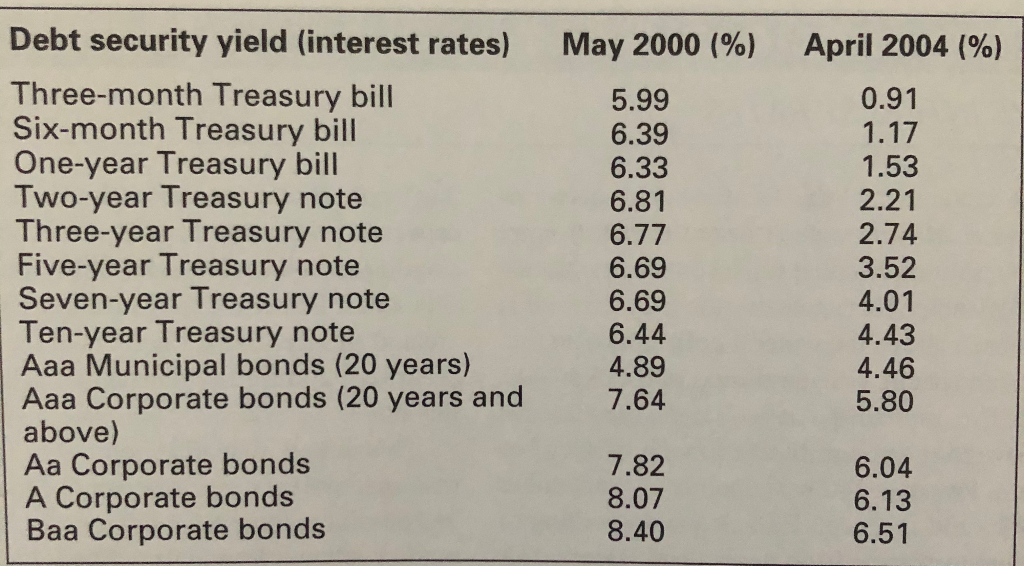

7)Using equation 3-6 and the data in figure 3-7 for May 2000, calculate the one-year interest rate expected for year three. 8)Using equation 3-6 and the data in figure 3-7 for April 2004. Calculate the one-year interest rate expected in year two. 9) Use the data in 3-7 for April 2004 to estimate future interest rates for a two-year security that starts three years in the future. TO U POPCY LUNCusacu IUI UL ULICITULUI IULLO, ULICUL contract rate for each year is needed. However, in this example, a fixed-rate loan is being made, so different rates are not possible. So, what needs to be done to compensate the lender for the potentially different rates of inflation? Remember, the objective when adjusting for inflation is to maintain the purchasing power of money so that when the lender gets their principal back they can purchase the same goods as when they loaned it. This means that we do not have to keep up our purchasing power every year. Instead, it means that purchasing power must be maintained on average over the life of the loan. Consequently the annual expected rates of inflation should be averaged over the life of the loan and that average used for the expected rate of inflation in the Fisher equation. Understanding that multiyear loan rates include the average of the expected annual inflation rates over the life of the loan provides a powerful insight into the relation between inflation rates and interest rates on securities with different terms to maturity. Figure 3-6 graphs inflation rates with three-month Treasury bill and 10-year Treasury note yields. In the figure, a positive relationship is seen between changes in inflation and changes in interest rates. In addition, short-term rates are seen to have a larger response to changes in ination than do long-term rates. This result occurs because the current rate of inflation is a much smaller portion of the inflation premium in the long-term rates than in short-term rates. Percentage Rate Jan-69 Jan-72 Jan-75 Jan-78 Jan-81 Jan-84 Jan-87 Jan-90 Jan-93 Jan-96 Jan-99 Jan-02 Month-Year --Inflation ---- Three-Month T-bill-10 year T-note FIGURE 3-6 The sensitivity of long and short-term interest rates to inflation. May 2000 (%) 5.99 6.39 6.33 6.81 6.77 6.69 6.69 6.44 4.89 7.64 April 2004 (%) 0.91 1.17 1.53 2.21 2.74 Debt security yield (interest rates) Three-month Treasury bill Six-month Treasury bill One-year Treasury bill Two-year Treasury note Three-year Treasury note Five-year Treasury note Seven-year Treasury note Ten-year Treasury note Aaa Municipal bonds (20 years) Aaa Corporate bonds (20 years and above) Aa Corporate bonds A Corporate bonds Baa Corporate bonds 3.52 4.01 4.43 4.46 5.80 7.82 8.07 8.40 6.04 6.13 6.51