Answered step by step

Verified Expert Solution

Question

1 Approved Answer

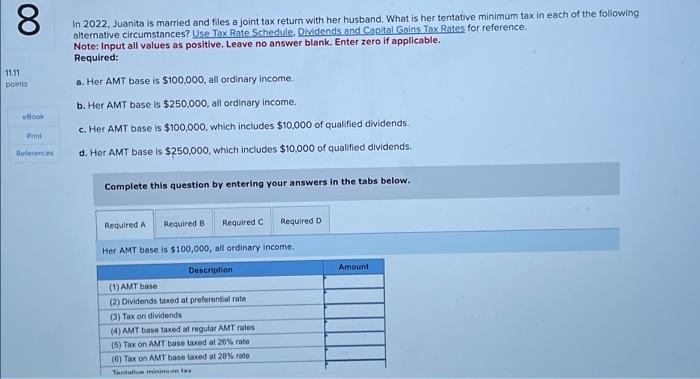

8 11.11 points eBook Print References In 2022, Juanita is married and files a joint tax return with her husband. What is her tentative minimum

8 11.11 points eBook Print References In 2022, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. Required: a. Her AMT base is $100,000, all ordinary income. b. Her AMT base is $250,000, all ordinary income. c. Her AMT base is $100,000, which includes $10,000 of qualified dividends. d. Her AMT base is $250,000, which includes $10,000 of qualified dividends. Complete this question by entering your answers in the tabs below. Required A Required B Required C Her AMT base is $100,000, all ordinary income. Description Required D (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started