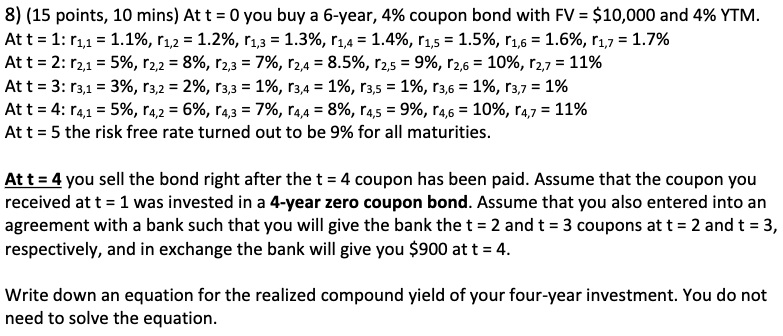

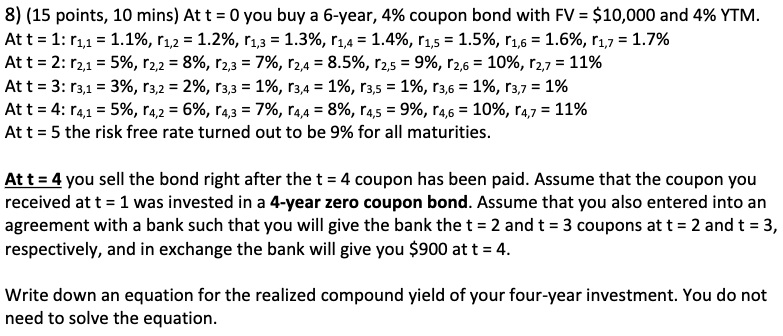

8) (15 points, 10 mins) At t = 0 you buy a 6-year, 4% coupon bond with FV = $10,000 and 4% YTM. At t = 1:11,1 = 1.1%, (1,2 = 1.2%, r1,3 = 1.3%, (1,4 = 1.4%, r1,5 = 1.5%, r1,6 = 1.6%, (1,7 = 1.7% At t = 2:12,1 = 5%, r2,2 = 8%, r2,3 = 7%, r2,4 = 8.5%, r2,5 = 9%, (2,6 = 10%, r2,7 = 11% At t = 3: 13,1 = 3%, r3,2 = 2%, r3,3 = 1%, 13,4 = 1%, r3,5 = 1%, 13,6 = 1%, r3,7 = 1% At t = 4:14,1 = 5%, 14,2 = 6%, r4,3 = 7%, 14,4 = 8%, 14,5 = 9%, 14,6 = 10%, 14,7 = 11% At t = 5 the risk free rate turned out to be 9% for all maturities. At t = 4 you sell the bond right after the t = 4 coupon has been paid. Assume that the coupon you received at t = 1 was invested in a 4-year zero coupon bond. Assume that you also entered into an agreement with a bank such that you will give the bank the t = 2 and t = 3 coupons at t = 2 and t = 3, respectively, and in exchange the bank will give you $900 at t = 4. Write down an equation for the realized compound yield of your four-year investment. You do not need to solve the equation. 8) (15 points, 10 mins) At t = 0 you buy a 6-year, 4% coupon bond with FV = $10,000 and 4% YTM. At t = 1:11,1 = 1.1%, (1,2 = 1.2%, r1,3 = 1.3%, (1,4 = 1.4%, r1,5 = 1.5%, r1,6 = 1.6%, (1,7 = 1.7% At t = 2:12,1 = 5%, r2,2 = 8%, r2,3 = 7%, r2,4 = 8.5%, r2,5 = 9%, (2,6 = 10%, r2,7 = 11% At t = 3: 13,1 = 3%, r3,2 = 2%, r3,3 = 1%, 13,4 = 1%, r3,5 = 1%, 13,6 = 1%, r3,7 = 1% At t = 4:14,1 = 5%, 14,2 = 6%, r4,3 = 7%, 14,4 = 8%, 14,5 = 9%, 14,6 = 10%, 14,7 = 11% At t = 5 the risk free rate turned out to be 9% for all maturities. At t = 4 you sell the bond right after the t = 4 coupon has been paid. Assume that the coupon you received at t = 1 was invested in a 4-year zero coupon bond. Assume that you also entered into an agreement with a bank such that you will give the bank the t = 2 and t = 3 coupons at t = 2 and t = 3, respectively, and in exchange the bank will give you $900 at t = 4. Write down an equation for the realized compound yield of your four-year investment. You do not need to solve the equation