Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8 2 1 ? 2 4 , 1 2 : 3 1 PM Training detail: Curriculum Test - Annual Federal Tax Refresher ( AFTR )

: PM

Training detail: Curriculum

Test Annual Federal Tax Refresher AFTR T

Time remaining

:

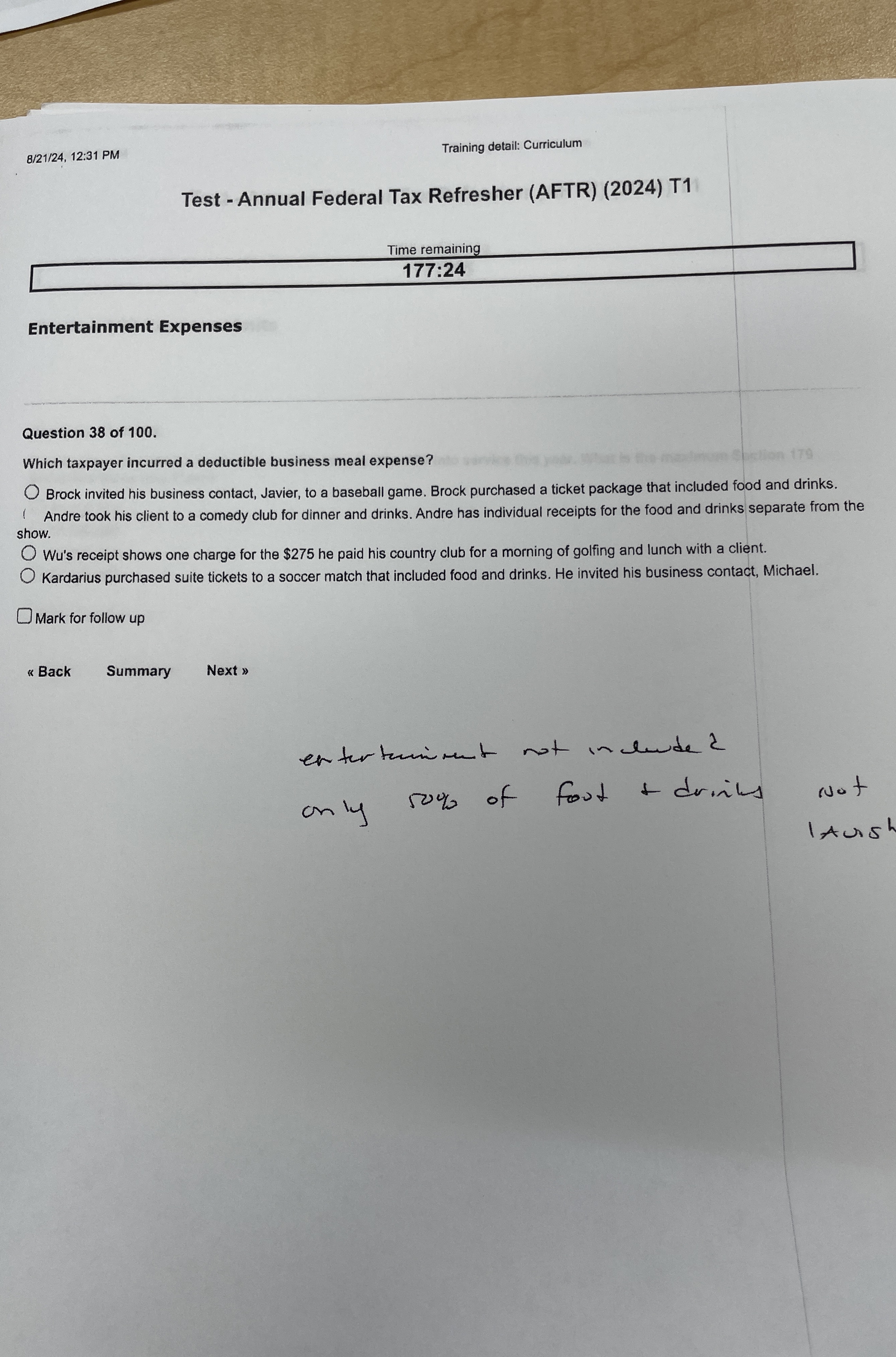

Entertainment Expenses

Question of

Which taxpayer incurred a deductible business meal expense?

Brock invited his business contact, Javier, to a baseball game. Brock purchased a ticket package that included food and drinks. Andre took his client to a comedy club for dinner and drinks. Andre has individual receipts for the food and drinks separate from the show.

Wu's receipt shows one charge for the $ he paid his country club for a morning of golfing and lunch with a client.

Kardarius purchased suite tickets to a soccer match that included food and drinks. He invited his business contact, Michael.

Mark for follow up

Back

Summary

Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started