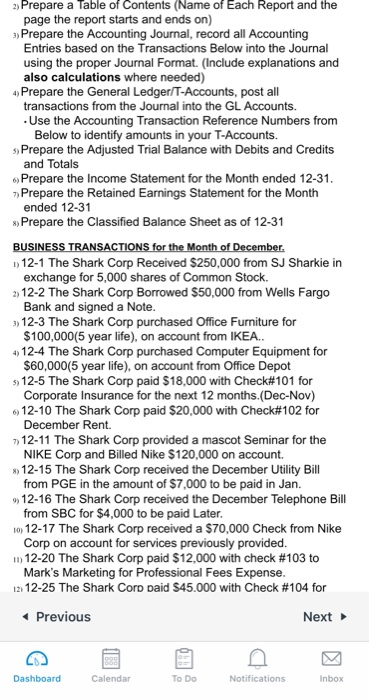

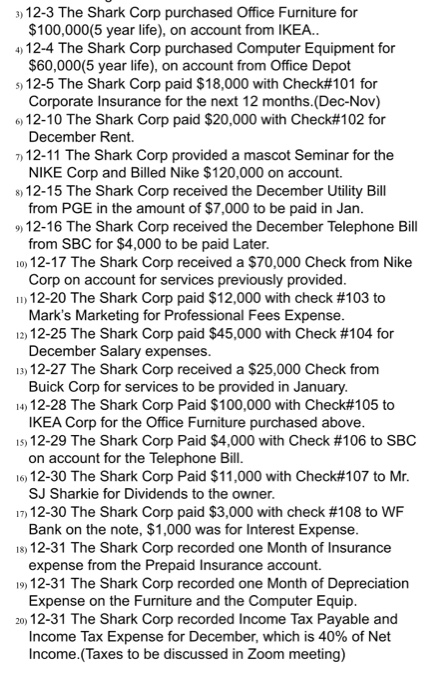

8) 2) Prepare a Table of Contents (Name of Each Report and the page the report starts and ends on) 3) Prepare the Accounting Journal, record all Accounting Entries based on the Transactions Below into the Journal using the proper Journal Format. (Include explanations and also calculations where needed) 4. Prepare the General Ledger/T-Accounts, post all transactions from the Journal into the GL Accounts. Use the Accounting Transaction Reference Numbers from Below to identify amounts in your T-Accounts. Prepare the Adjusted Trial Balance with Debits and Credits and Totals Prepare the Income Statement for the Month ended 12-31. Prepare the Retained Earnings Statement for the Month ended 12-31 Prepare the Classified Balance Sheet as of 12-31 BUSINESS TRANSACTIONS for the Month of December. 1) 12-1 The Shark Corp Received $250,000 from SJ Sharkie in exchange for 5,000 shares of Common Stock. 2) 12-2 The Shark Corp Borrowed $50,000 from Wells Fargo Bank and signed a Note. 3) 12-3 The Shark Corp purchased Office Furniture for $100,000(5 year life), on account from IKEA.. 12-4 The Shark Corp purchased Computer Equipment for $60,000(5 year life), on account from Office Depot 5, 12-5 The Shark Corp paid $18,000 with Check#101 for Corporate Insurance for the next 12 months.(Dec-Nov) 12-10 The Shark Corp paid $20,000 with Check#102 for December Rent , 12-11 The Shark Corp provided a mascot Seminar for the NIKE Corp and Billed Nike $120,000 on account. >) 12-15 The Shark Corp received the December Utility Bill from PGE in the amount of $7,000 to be paid in Jan. 12-16 The Shark Corp received the December Telephone Bill from SBC for $4,000 to be paid Later. 10, 12-17 The Shark Corp received a $70,000 Check from Nike Corp on account for services previously provided. 11) 12-20 The Shark Corp paid $12,000 with check #103 to Mark's Marketing for Professional Fees Expense. 121 12-25 The Shark Coro paid $45.000 with Check #104 for ) 12-15 The Shark Corp received the December Utility Bill from PGE in the amount of $7,000 to be paid in Jan. 12-16 The Shark Corp received the December Telephone Bill from SBC for $4,000 to be paid Later. 10, 12-17 The Shark Corp received a $70,000 Check from Nike Corp on account for services previously provided. 11) 12-20 The Shark Corp paid $12,000 with check #103 to Mark's Marketing for Professional Fees Expense. 121 12-25 The Shark Coro paid $45.000 with Check #104 for