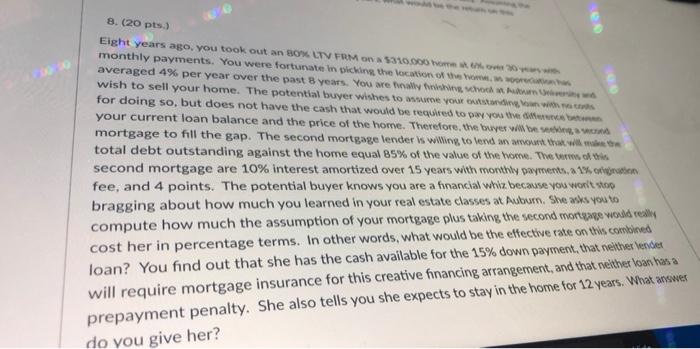

8. (20 pts) Eight years ago, you took out an 80% LTV FRM O 5310000 monthly payments. You were fortunate in picking the location of the averaged 4% per year over the past 8 years. You meally is, hoch woh wish to sell your home. The potential buyer wishes to www Youth for doing so, but does not have the cash that would be required to Day you the your current loan balance and the price of the home. Therefore, the buyer will be mortgage to fill the gap. The second mortgage lender is willing to lend and that will total debt outstanding against the home equal 85% of the value of the vowe. The mos second mortgage are 10% interest amortized over 15 years with monthly payments, ac fee, and 4 points. The potential buyer knows you are a financial wiviz because you want to bragging about how much you learned in your real estate classes at Akun. She asks you to compute how much the assumption of your mortgage plus taking the second mortage would really cost her in percentage terms. In other words, what would be the effective rate on this combined loan? You find out that she has the cash available for the 15% down payment, that neither vendet will require mortgage insurance for this creative financing arrangement, and that weither voan has a prepayment penalty. She also tells you she expects to stay in the home for 12 years. What answer do you give her? 8. (20 pts) Eight years ago, you took out an 80% LTV FRM O 5310000 monthly payments. You were fortunate in picking the location of the averaged 4% per year over the past 8 years. You meally is, hoch woh wish to sell your home. The potential buyer wishes to www Youth for doing so, but does not have the cash that would be required to Day you the your current loan balance and the price of the home. Therefore, the buyer will be mortgage to fill the gap. The second mortgage lender is willing to lend and that will total debt outstanding against the home equal 85% of the value of the vowe. The mos second mortgage are 10% interest amortized over 15 years with monthly payments, ac fee, and 4 points. The potential buyer knows you are a financial wiviz because you want to bragging about how much you learned in your real estate classes at Akun. She asks you to compute how much the assumption of your mortgage plus taking the second mortage would really cost her in percentage terms. In other words, what would be the effective rate on this combined loan? You find out that she has the cash available for the 15% down payment, that neither vendet will require mortgage insurance for this creative financing arrangement, and that weither voan has a prepayment penalty. She also tells you she expects to stay in the home for 12 years. What answer do you give her