Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8 6 pts You are considering a project to construct an factory in a foreign country at a cost of $20m now. after which there's

8

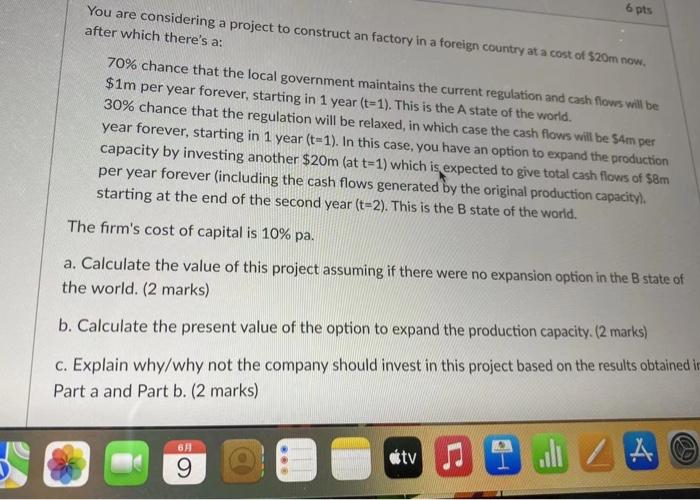

6 pts You are considering a project to construct an factory in a foreign country at a cost of $20m now. after which there's a: 70% chance that the local government maintains the current regulation and cash flows will be $1m per year forever, starting in 1 year (t-1). This is the A state of the world. 30% chance that the regulation will be relaxed, in which case the cash flows will be $4m per year forever, starting in 1 year (t-1). In this case, you have an option to expand the production capacity by investing another $20m (at t=1) which is expected to give total cash flows of $8m per year forever (including the cash flows generated by the original production capacity). starting at the end of the second year (t-2). This is the B state of the world. The firm's cost of capital is 10% pa. a. Calculate the value of this project assuming if there were no expansion option in the B state of the world. (2 marks) b. Calculate the present value of the option to expand the production capacity. (2 marks) c. Explain why/why not the company should invest in this project based on the results obtained in Part a and Part b. (2 marks) 68 tv all ZA 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started