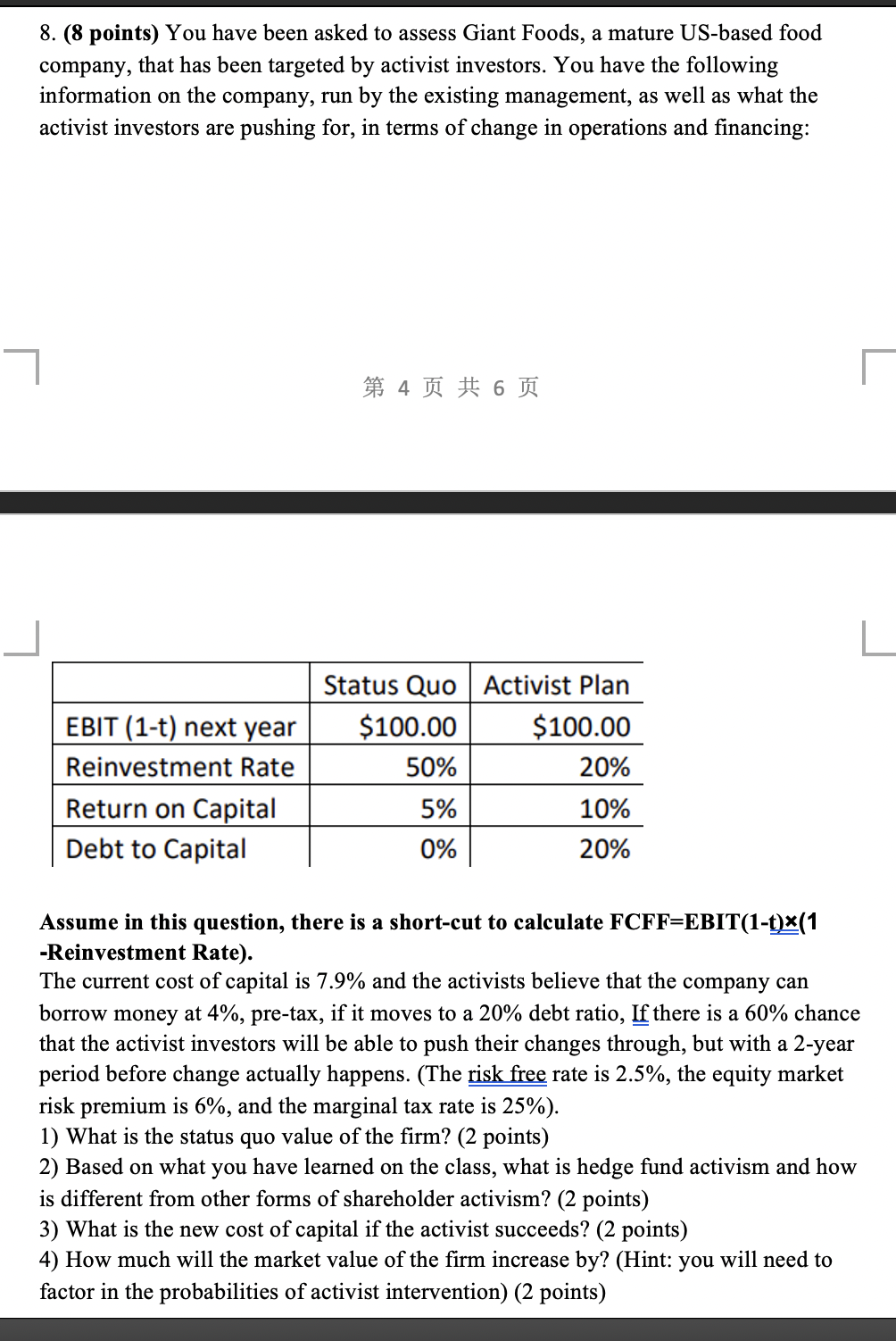

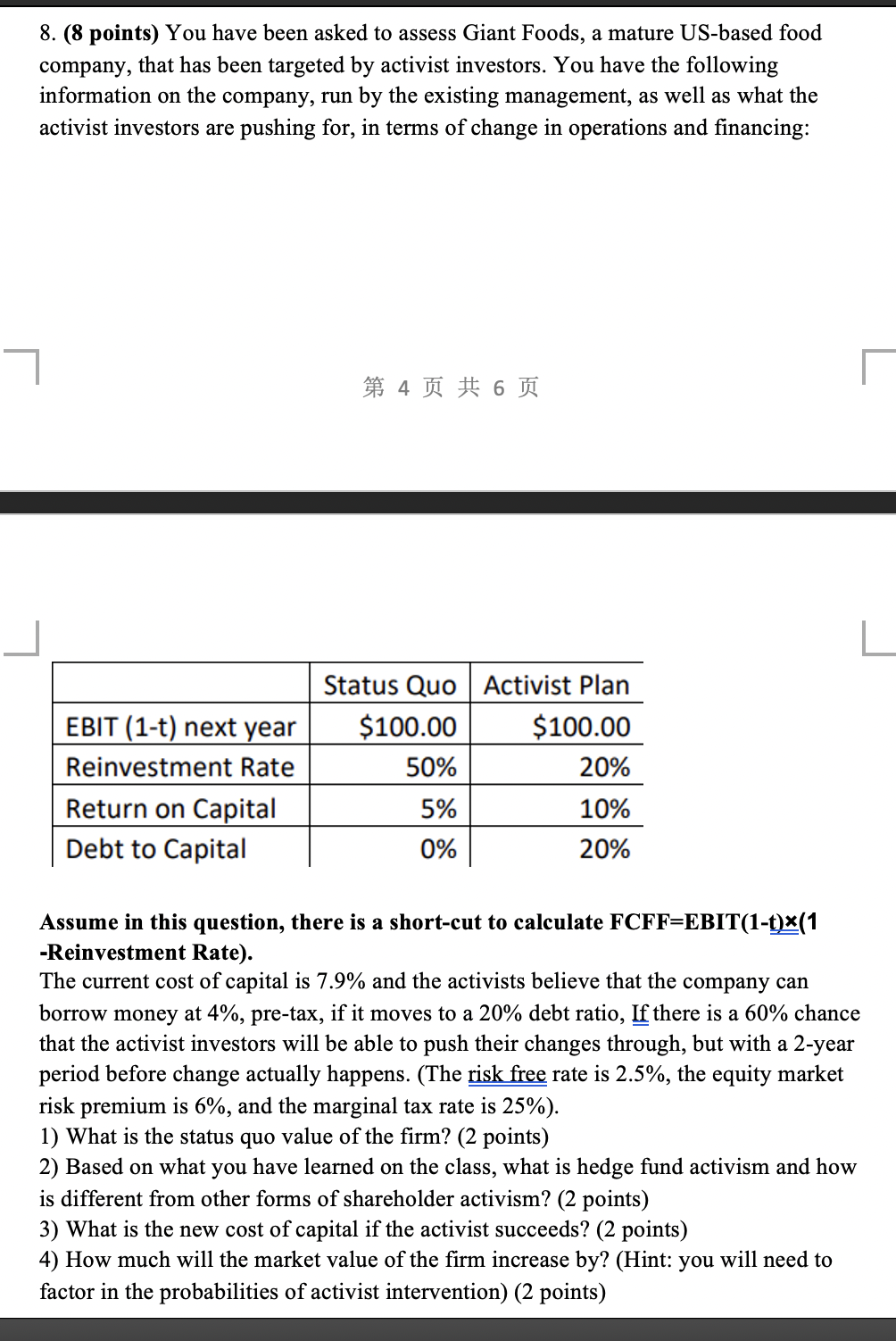

8. (8 points) You have been asked to assess Giant Foods, a mature US-based food company, that has been targeted by activist investors. You have the following information on the company, run by the existing management, as well as what the activist investors are pushing for, in terms of change in operations and financing: 46 EBIT (1-t) next year Reinvestment Rate Return on Capital Debt to Capital Status Quo Activist Plan $100.00 $100.00 50% 20% 5% 10% 0% 20% a Assume in this question, there is a short-cut to calculate FCFF=EBIT(1-t)x(1 -Reinvestment Rate). The current cost of capital is 7.9% and the activists believe that the company can borrow money at 4%, pre-tax, if it moves to a 20% debt ratio, If there is a 60% chance that the activist investors will be able to push their changes through, but with a 2-year period before change actually happens. (The risk free rate is 2.5%, the equity market risk premium is 6%, and the marginal tax rate is 25%). 1) What is the status quo value of the firm? (2 points) 2) Based on what you have learned on the class, what is hedge fund activism and how is different from other forms of shareholder activism? (2 points) 3) What is the new cost of capital if the activist succeeds? (2 points) 4) How much will the market value of the firm increase by? (Hint: you will need to factor in the probabilities of activist intervention) (2 points) 8. (8 points) You have been asked to assess Giant Foods, a mature US-based food company, that has been targeted by activist investors. You have the following information on the company, run by the existing management, as well as what the activist investors are pushing for, in terms of change in operations and financing: 46 EBIT (1-t) next year Reinvestment Rate Return on Capital Debt to Capital Status Quo Activist Plan $100.00 $100.00 50% 20% 5% 10% 0% 20% a Assume in this question, there is a short-cut to calculate FCFF=EBIT(1-t)x(1 -Reinvestment Rate). The current cost of capital is 7.9% and the activists believe that the company can borrow money at 4%, pre-tax, if it moves to a 20% debt ratio, If there is a 60% chance that the activist investors will be able to push their changes through, but with a 2-year period before change actually happens. (The risk free rate is 2.5%, the equity market risk premium is 6%, and the marginal tax rate is 25%). 1) What is the status quo value of the firm? (2 points) 2) Based on what you have learned on the class, what is hedge fund activism and how is different from other forms of shareholder activism? (2 points) 3) What is the new cost of capital if the activist succeeds? (2 points) 4) How much will the market value of the firm increase by? (Hint: you will need to factor in the probabilities of activist intervention) (2 points)